Major names in the lithium mining space posted gains yesterday after Elon Musk called on entrepreneurs to enter lithium refining during Tesla’s (TSLA) second-quarter earnings call this week.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

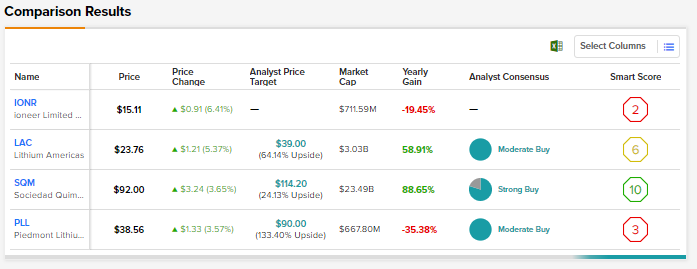

Concurrently, the Global X Lithium & Battery Tech ETF (LIT) rose nearly 2.7% yesterday. Let’s have a look at four major names in the space that rallied yesterday: Ioneer Limited, Lithium Americas, Sociedad Quimica, and Piedmont Lithium, and how they stack up.

Musk noted that lithium is one of the most common elements on the planet, but refining it into battery-grade lithium hydroxide and lithium carbonate and scaling the operations remains difficult.

Lithium prices have skyrocketed from $11 to around $80, and Tesla is entering lithium refining activity in Texas. Musk added, “There is like software margins in lithium processing right now. So, I would really like to encourage, once again, entrepreneurs to enter the lithium refining business. You can’t lose. It’s license to print money.”

Ioneer Limited (IONR)

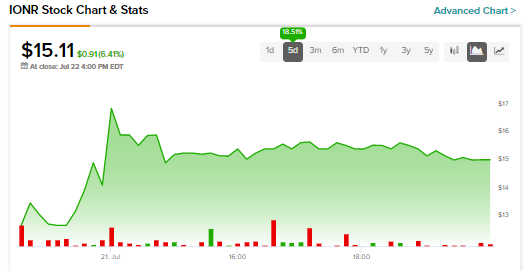

IONR shares closed 6.4% higher yesterday and rose a further 8.9% during the extended trading session. There are only two known deposits of lithium boron on the globe today, and IONR owns one of them in Nevada.

IONR completed the definitive feasibility study (DFS) for this project in 2020 and expects the Rhyolite Ridge project to be a long-life, low-cost operation. The project is expected to become operational in 2025.

Yesterday, IONR agreed to supply 7,000 tons per annum (TPA) of lithium carbonate to Ford (F) for a period of five years starting in 2025. Ford plans to use the supply to produce batteries for its electric vehicles.

Notably, IONR anticipates producing 20,600 TPA of lithium carbonate/hydroxide as well as 174,400 TPA of boric acid from the project over 26 years.

This provides long-term revenue visibility for the company, while the production of lithium as well as boric acid enables it to stay at the lower end of the cost curve.

Lithium Americas (LAC)

Despite the recent correction, LAC shares rose 5.4% yesterday and are still up 67.4% over the past 12 months. LAC owns an interest in three projects. Two of these are located in Argentina and one in Nevada.

On July 20, LAC inaugurated its lithium technical development center (LiTDC) in Nevada. The center is set up to demonstrate the chemical process designed for LAC’s Thacker Pass lithium project (Nevada).

Furthermore, for Thacker Pass, LAC is advancing a feasibility study with a target of 40,000 TPA initial production capacity of lithium carbonate and a phase 2 target of 80,000 TPA. Results from this study are anticipated in 2H 2022.

In Argentina, LAC is eyeing 20,000 TPA of lithium carbonate equivalent at Cauchari-Olaroz. In the meantime, the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating but sees a further 64.14% potential upside based on an average price target of $39.

Sociedad Quimica (SQM)

SQM rose a total of 4.7% yesterday and is up a massive 87.8% over the past 12 months. While IONR does not yet have analyst coverage and LAC is a Moderate Buy, SQM has a Strong Buy consensus rating alongside a $114.20 price target. This indicates a 24.13% potential upside.

Revenues have increased from $1.82 billion in 2020 to $2.86 billion in 2021. Simultaneously, SQM’s earnings have expanded from $0.79 per share in 2020 to $2.05 per share in 2021. These figures are further expected to rise to $8.6 billion and $10.2 per share, respectively, in 2023.

SQM has been benefiting from the rise in lithium prices and its long-term commercial strategy. The company has almost tripled its production in the past three years and remains a leader in lithium as well as potassium nitrate, iodine, and thermo solar salts.

Piedmont Lithium (PLL)

Although PLL shares rose nearly 4.3% yesterday, the stock is down 33% over the past 12 months. Nonetheless, of all the names on our list today, the Street sees the maximum upside in PLL at 133.4% based on an average price target of $90.

PLL is in the exploration phase and owns the lithium project in the Carolina tin-spodumene belt. It also has partnerships with Sayona Mining in Quebec and with Atlantic Lithium in Ghana.

The company expects operations at its North American Lithium (NAL) project in Quebec to commence in H1 2023 and aims to become revenue-generating in 2023.

This geographic resource diversification bodes well for the company and, impressively, it was added to the U.S. Russell 2000 index as well as the Russell Microcap index last month as well.

Closing Note

As the world weans away from fossil fuels and battery usage keeps rising, lithium will continue to play a pivotal role. Musk’s comments further underscore the massive potential in the lithium space, and the names on our list today stand to gain big.

Furthermore, the tectonic shifts in the geopolitical dynamics globally mean the U.S. and Europe are looking to reduce their dependence on China for battery-grade lithium and concentrates, and these companies with resources and focus on the U.S. should benefit in the long term.

Read the full Disclosure