Ford Motor (F) stock has been in a recovery mode through 2021. Over a 12-month period, the stock has trended higher by 83.9%.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Even after a big rally and subsequent drop, I am bullish on F stock. It seems likely that positive momentum will take hold in the medium-term. While there can be intermediate corrections, F stock is likely to set off on an uptrend that lasts throughout 2022.

The first point to note is that F stock trades at a forward price-to-earnings-ratio of 11.41. Even after a big rally, the valuations seem attractive relative to the broad markets. The S&P 500 index currently trades at a cyclically adjusted P/E ratio of 39.6.

From a business perspective, Ford is pursuing an aggressive portfolio transformation towards electric vehicles. This is likely to remain the key catalyst for stock upside in the coming quarters.

Balance Sheet Will Support Aggressive Investment Plans

Ford has ambitious investment plans for the next few years. The company’s balance sheet is strong and likely to support growth.

First, Ford reported cash and equivalents of $31.5 billion as of Q3 2021. Considering the undrawn credit facility, the company had a total liquidity buffer of $47.4 billion.

Furthermore, the company reported adjusted free cash flow of $7.7 billion as of Q3 2021. In the last 12-months, the adjusted free cash flow was $4.1 billion. Therefore, the FCF is likely to help in investments and deleveraging.

Another important point to note is that Ford holds 12% stake in Rivian Automotive (RIVN). Even after the downside post-listing, Rivian commands a market capitalization of $58 billion. Ford’s stake is therefore valued at $6.9 billion.

This investment can swell in value in the coming years. Additionally, Ford can sell stake in Rivian to build its own cash buffer.

Therefore, liquidity is unlikely to be a concern for Ford as it aggressively invests in the electric vehicle sector.

Growth Likely to Accelerate

Ford has planned investment of $30 billion in the EV sector in the next few years. The company plans to have 40% of its global volume all-electric by 2030. In Europe, the company plans to have all cars sold to be electric by 2030.

As a part of the plan, Ford and SK Innovations will invest $11.4 billion in its Tennessee and Kentucky plants. So far, these investments have been targeted towards growth in battery capacity and an increase in production of the F-150 Lightening.

Moreover, China is likely to remain the biggest EV market in the coming years. Ford is targeting market share growth there, through investment in electrification and new store openings.

As of 2021, the company has 25 stores in China, in metropolitan areas. The company plans to increase the number of stores to 100 by 2026. It’s worth noting that locally produced Mustang Mach-E is already being delivered to customers in China. Once revenue accelerates in China, the overall impact of growth will be significant.

It’s also worth noting that the EV industry is already intensely competitive. However, there are two factors that give Ford an edge over newer rivals.

First, the company has the financial flexibility to invest in innovation and growth. Further, the company’s iconic brands have a strong market presence. Once these brands are electrified, there will be demand without the need for significant marketing investments.

Wall Street’s Take

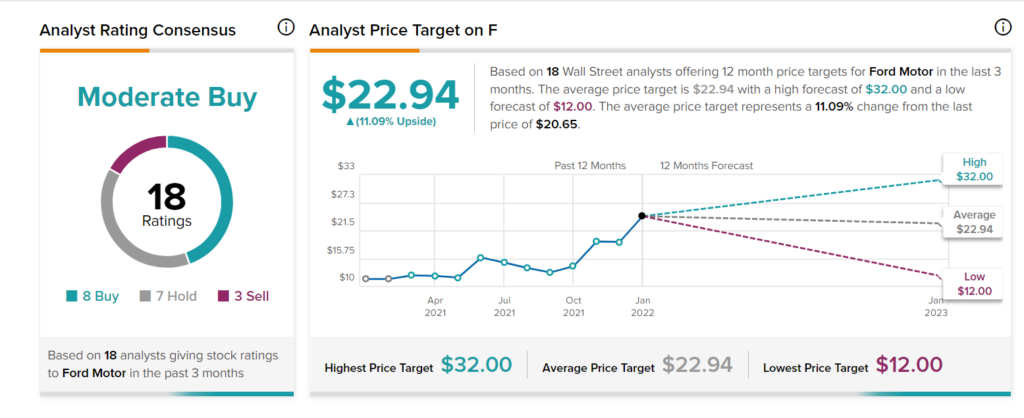

Turning to Wall Street, Ford has a Moderate Buy consensus rating, based on eight Buy, seven Hold, and three Sell ratings assigned in the past three months. The average Ford price target of $22.94 implies 11.09% downside potential.

Bottom Line

Ford stock remains attractive, with the company focusing on portfolio transformation.

Further, the company’s SUV sales have been robust in the United States. In Europe, the company already has a leading market position in the commercial vehicle segment.

China was a concern when it comes to growth. However, as the portfolio is electrified, it’s likely that growth will gain traction.

Considering these factors and the company’s healthy balance sheet, F stock could well be worth buying on corrections.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.