In our “Expert Spotlight” piece today, the TipRanks Expert Center brings top picks from notable financial blogger, Zvi Bar. Zvi Bar provides advisory services to companies, trusts, and individuals, including consulting expert services regarding retirement and estate planning. Moreover, he is a practicing lawyer in the state of New York specializing in cash management, Bitcoin, and Trust Protector services.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Amid uncertain times for the capital markets, simplicity can be an effective tool to separate the wheat from the chaff. Financial bloggers are adept at this as they convey complex market movements in simple terms for investors. Zvi Bar is one such blogger who has been doing this with much success, as can be gauged from his track record.

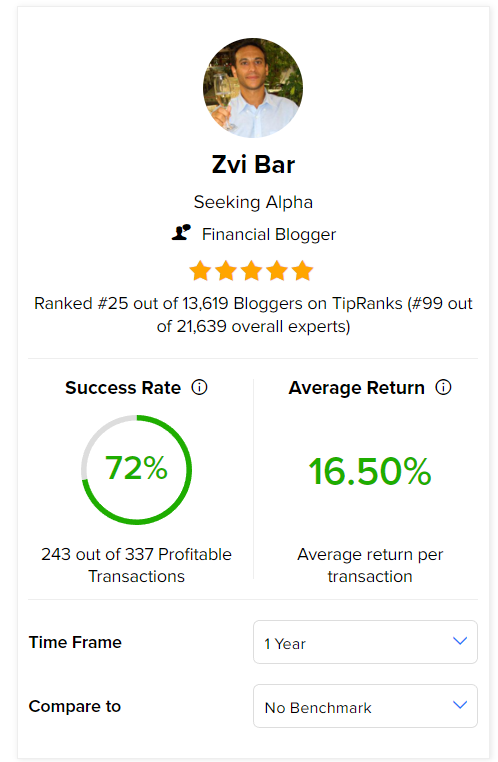

Bar’s Standing Among TipRanks Experts

According to the TipRanks Star Ranking System, Zvi Bar ranks #25 out of 13,619 bloggers in the TipRanks universe and #99 among 21,639 overall experts, including hedge fund managers, Wall Street analysts, corporate insiders, financial bloggers, and individual investors.

Bar’s success rate in picking stocks stands at 72%, whereas his average return per rating is an impressive 16.50%.

The analyst’s average returns relative to the S&P 500 and the benchmark sector stand at 4.50% and 3.90%, respectively.

Among Bar’s picks, 98.23% are Buys and 1.77% have a Sell rating.

Notably, according to TipRanks, Bar’s most profitable pick has been Riot Blockchain (RIOT) between November 9, 2020, to November 9, 2021, generating an impressive return of 490.2%.

Now, let’s look at a couple of his top picks.

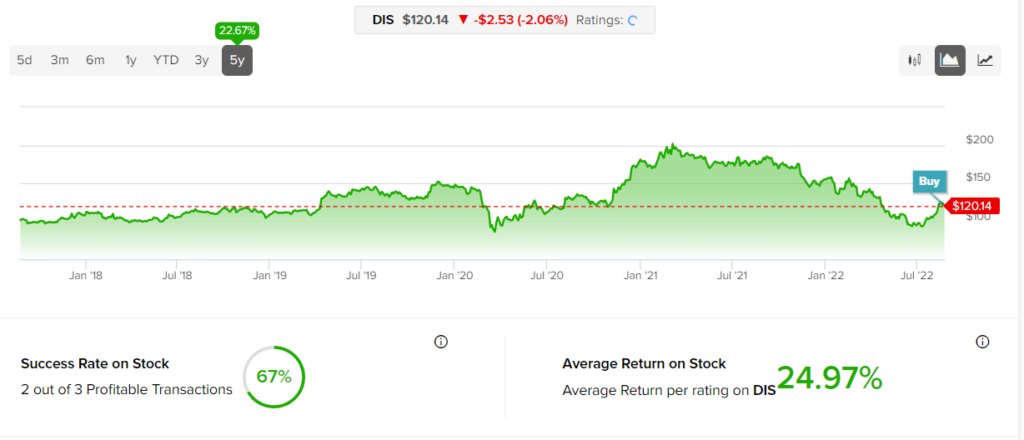

Bar Remains Optimistic About Disney

Founded in 1923, the media behemoth Disney has been a bellwether in the entertainment industry for decades. The company’s interests lie in fields ranging from animation to streaming platforms, from movie productions to theme parks. Presently, the company commands a market cap of $218.83 billion.

The company posted strong numbers in its latest results for the third quarter, as both revenue and earnings surpassed Street expectations. While revenues of $21.5 billion witnessed year-over-year growth of 26%, earnings per share (EPS) for the quarter came in at $1.09, growing 36.3% from the previous year.

Notably, Bar remains bullish about the stock. The blogger opines that the company’s revival in its Parks & Experiences business along with its continued rise in net subscribers gives it a strong footing to grow in the future.

Meanwhile, the blogger enjoys a success rate of 67% and an average profit of 24.97% on the stock.

Overall, 87% of bloggers on TipRanks are bullish on Disney, compared to the sector average of 69%.

AbbVie Gets Endorsement from Bar

Originating as a spin-off of Abbott Laboratories, AbbVie is a biopharmaceutical company established in 2013. The company is focused on key therapeutic areas like immunology, oncology, neuroscience, eye care, virology, women’s health, and gastroenterology. The company’s market cap stands at a mammoth $250.8 billion.

The company posted strong results for the second quarter, with both revenue and earnings rising from the prior year. Net revenues of $14.58 billion represent year-over-year growth of 4.5%. EPS for the quarter stood at $3.37, up 11.2% from the previous year.

Notably, Bar retains his confidence in the stock. He reckons that AbbVie’s high dividend yield of 3.9% and regular share repurchases make it an attractive choice for investors. Further, the company’s robust domestic cash flows and increased market strength of its Humira drug are expected to support its share price.

Meanwhile, the blogger enjoys a success rate of 75% and an average profit of 20.67% on the stock.

Overall, 91% of bloggers on TipRanks are bullish on AbbVie, compared to the sector average of 69%.

Final Thoughts

Zvi Bar’s top picks cover a media conglomerate and a pharmaceutical major, two industries expected to have an impressive growth trajectory going forward. Along with this, Bar’s stellar track record in picking stocks that have risen considerably provides investors with an option to ponder over his picks.

Read full Disclosure