Steve Robertson is an analyst at Canaccord Genuity who mainly covers technology and software companies in the UK market.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

He is ranked 300 out of 7,915 analysts on TipRanks and 394 out of 20,755 total experts. The TipRanks Expert Centre provides a detailed list of analysts covering various sectors and the stocks rated by them.

As per the TipRanks star rating system, Robertson is a five-star rated analyst with a success rate of 72%, and an enviable average return of 26% per rating.

Robertson is known for being bullish on software solutions companies. Out of his total ratings, around 75% of stocks have Buy ratings.

In today’s article, we will discuss two stocks from Robertson’s list.

Let’s see the two stocks in detail.

NCC Group

NCC Group (GB:NCC) is a UK-based software solutions company, with operations worldwide. The company mainly deals in cyber security and verification services.

Recently, the company’s CEO Adam Palser resigned from his post, to be replaced by Mike Maddison. Maddison comes from EY and has successfully driven growth in its cybersecurity operations.

Palser said, “The Group now has a great opportunity to grow by offering its unmatched skills to a blue-chip client base at a time when cyber risk has never been higher.”

The fast-growing cybersecurity market provides a boost for the company’s pricing power without losing its market share.

NCC expects the revenue growth in the second half to be higher than the 14.2% as reported in the first half.

View from the City

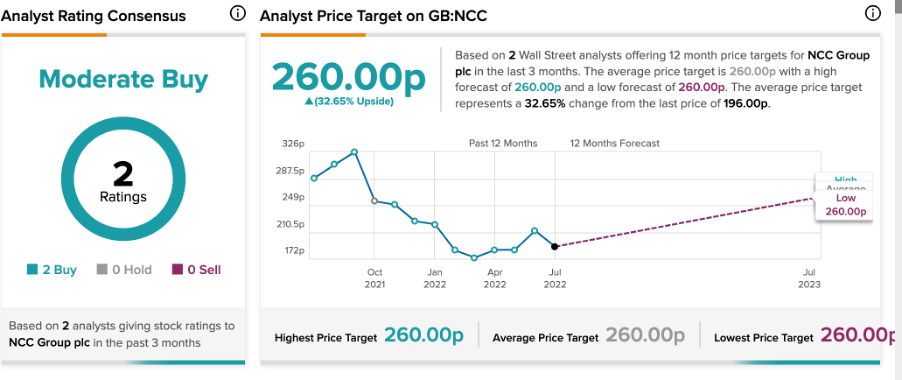

According to TipRanks’ analyst rating consensus, NCC Group stock is a Moderate Buy. The company has two buy ratings.

The average price target is260p, with a high and a low forecast of 260p. The price target implies upside potential of 32.4%.

As per Robertson, the price target for the stock is 310p, which is higher than the current price by 58%. He has a success rate of 75% on this stock, with an average profit of 10.7%.

The stock is currently trading down by 20% year-to-date.

Beeks Financial Cloud Group

Beeks Financial (GB:BKS) is a UK-based cloud computing and analytics provider for financial services.

The company’s stock has been volatile in recent months and is down by 30% in the last six months. However, over the last year, the stock has given positive returns of 17%.

Last month, Beeks launched Exchange Cloud, which is a further expansion of its earlier launched Proximity Cloud. This is created to cater to the needs of exchanges around the world.

Together with these two products, the company is expecting solid growth in its sales in the second half of financial year 2022.

Gordon McArthur, CEO of Beeks, said, “With financial services organisations accelerating their cloud transition strategies, we see a huge opportunity ahead for our Private Cloud, Proximity Cloud, and Exchange Cloud offerings, and are focused on the conversion of our record sales pipeline and execution of our product roadmap.”

View from the city

According to TipRanks Beeks stock has only one rating of Moderate Buy from Robertson. The average price target is 220p, which is 59% higher than the current price.

He has a 63% success rate on the stock and an average profit of 20%.

Conclusion

Both the stocks make an attractive buying opportunity.

- The analysts are impressed with the new CEO, Maddison’s addition to NCC. He is already well-connected in the market. This, coupled with the high growth prospects of the cybersecurity market, gives a lot of room for the company to grow.

- Beeks Financial is betting big on its suite of products including Private Cloud, Proximity Cloud, and Exchange cloud. Investors are expecting a big push to top-line growth.