Five Below (FIVE) reported great third-quarter financial results last week.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Net sales jumped by 27.5% to $607.6 million from $476.6 million in the third quarter of fiscal 2020, beating analyst expectations. Comparable sales rose 14.8% from the third quarter of fiscal 2020.

Operating income was $42.4 million, compared to $24.2 million in the third quarter of fiscal 2020. In addition, the company opened 52 new stores and ended the quarter with 1,173 stores in 40 states, an increase in stores of 15.2% from the end of Q3 2020.

I’m bullish on FIVE shares. (See Analysts’ Top Stocks on TipRanks)

Management Takes Credit

Joel Anderson, president and CEO of Five Below, cheered the Company’s performance.

“We delivered record-setting third-quarter performance on top of a record third quarter last year,” he said. “These results reflect the phenomenal execution by our teams in a challenging supply chain environment. They also demonstrate the inherent flexibility of our model as we successfully capitalized on key trends that strengthened during the quarter, which brought new and existing customers to Five Below.”

Still, there’s one thing that stands out in FIVE’s Q3 report, according to Quo Vadis Capital President John Zolidis: margins beat across the board in a challenging environment for the retailing industry. That’s thanks to good execution financed by investment in the business.

Then there’s the company’s pricing strategy, the introduction of prices higher than $5, which is contributing to leveraging across the cost structure.

“Unlike Dollar Tree, FIVE didn’t wait for years before reacting to price pressures,” Zolidis explains. “FIVE’s average transaction size in the third quarter was up 25% over 2019.”

Wall Street’s Take

Wall Street didn’t seem to be impressed with FIVE’s solid financial performance. It sold off following the company’s Q3 report release.

Sometimes, this is due to poor timing. Other times it’s due to hyped market expectations ahead of financial reports. That’s why the shares of these companies sell off if there’s a slight miss in any of the financial metrics closely followed by analysts. Unfortunately, both factors seem to have contributed to the sell-off in FIVE’s shares.

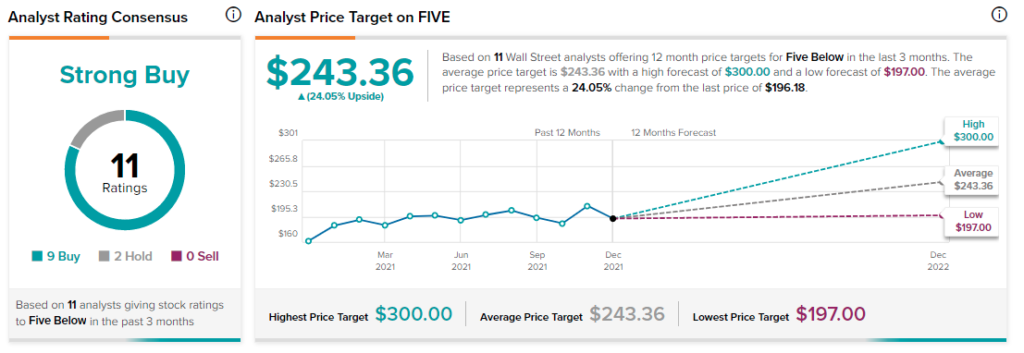

The 11 Wall Street analysts following the company are on the same page as Zolidis. They have a 12-month average price target of $243.36, and a low forecast of $197. The average Five Below price target represents 24.1% upside potential.

FIVE scores a “Perfect 10” on TipRanks’ Smart Score rating system, citing increased hedge fund activity and bullish technical and fundamentals.

The Road Ahead

Looking forward, Zolidis remains bullish on the shares of the Company, pointing to a couple of near-term positive catalysts.

“FIVE has powerful momentum heading into the Holiday season, and we feel good that the company has set specific guidance,” he says. “The next catalyst should be the ICR conference in January. (We will be attending, omicron be damned.) With this in mind, we see positive near-term catalysts and believe the long-term unit growth story remains very attractive.”

Summary and Conclusions

High-flying retailer Five Below had a good Q3, but not good enough to please the inflated expectations of Wall Street’s momentum crowd in a turbulent week for Wall Street.

That’s why its shares sold off following its Q2 financial report. Only time can tell whether Zolidis is right to be bullish.

Disclosure: At the time of publication, Panos Mourdoukoutas did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >