From managing back-office operations at banks to facilitating digital currency transfers, one of the newest industries in the field of finance, Fintech, emerges at the forefront of technological innovation, improving and automating the provision and utilization of financial services, and creating new services, adapting finance to the 21st century. The industry is rife with innovative, virtually life-changing companies, some of which can bring immense value to their investors – but finding those that can succeed requires research and analysis.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Fintech: The New Old Industry

The fintech (“financial technology”) industry includes an extensive variety of companies using technology to deliver financial services. These companies compete with traditional financial service providers in existing niches and also create new ones, which wouldn’t be possible without technological advancement.

The 2008 Global Financial Crisis (GFC) is widely considered to be the starting point in the history of Fintech as a modern industry. However, the roots of Fintech in its broadest sense stretch back to the installation of the first transatlantic cable between Europe and America in 1866, laying ground to connectivity, which is essential to the industry. This has given birth to the “Fintech 1.0” period, which featured the adoption of what was then considered cutting-edge tech, such as the telegraph, railroads, and steamships. These advancements further enhanced connectedness, making possible fast transmission of financial information and transactions.

The “Fintech 2.0” era began with the introduction of the first ATM Machine by Barclays (BCS) in 1967 and stretched up to 2008. The second Fintech period was characterized by the increasing digitalization of finance, which included the introduction of electronic payment systems and automated clearing houses, as well as the formation of SWIFT (Society of Worldwide Interbank Financial Telecommunications), a global financial messaging network used by financial institutions to exchange information about financial transactions. The invention of the Internet propelled finance to the next level, as it permitted the inception of Internet banking protocols, and later gave way to the creation of branchless banks, as well as to the proliferation of various online financial services.

The onslaught of technological advancement also changed the psychology, opening the traditional financial sector to disruptive newcomers. One of these newcomers that changed finance was PayPal (PYPL), founded in 1998, whose payment services catalyzed the development of e-commerce. Another disruptor within the broad Financial sector was the British firm ZOPA (now a digital bank), which invented the first-ever Peer-To-Peer (P2P) lending platform in 2005.

The Avalanche of Financial Innovation

Since the GFC, we have been living through the “Fintech 3.0” wave, which was brought on by the loss of public trust in traditional financial institutions, considerable tightening of regulatory oversight of banks, as well as by a significant slack in credit availability left by banks withholding lending in the face of worsened economic conditions. The third wave is primarily defined not by new technologies, however advanced, but by companies that deliver financial services. The leaders of the ongoing financial change aren’t banks of insurance behemoths, but IT firms, applying tech to finance. The building blocks of the modern Fintech industry are mobile connectivity, cloud computing, blockchain, big data, machine learning (ML), and artificial intelligence (AI).

One of the most prominent transformations of the new Fintech era was the launch of the first digital currency, Bitcoin (BTC), in 2009. This development radically changed society’s perception of money, adding the possibility of a completely non-physical, trustless means of payment.

Source: Insider Intelligence

Cryptocurrency also promoted blockchain technology, a decentralized, distributed, and public digital ledger, helping increase the security, verification, and traceability of multistep transactions. Due to its transparency, operational efficiency, cost savings, and enhanced security, many believe that blockchain will eventually have as great an impact on the financial industry, and society as a whole, as the Internet had.

Among other advancements, blockchain allowed the introduction of the decentralized finance (DeFi) concept, a blockchain-based financial system that allows anyone to participate and access financial services without intermediaries or centralized authorities, on a peer-to-peer modality basis. DeFi is widely associated with cryptocurrencies, but its uses for many of the traditional financial applications, such as lending, insurance, and savings, are gaining pace. According to the Dallas Federal Reserve, “DeFi may hold advantages over traditional finance.”

Another notable development of the GFC aftermath also happened in 2009, when a U.S. startup, Square – now Block (SQ) – introduced the on-the-go card reader, significantly advancing the development of mobile payments.

Also in 2009, two U.S. startups, Betterment (still independent and active) and Wealthfront (acquired by UBS) created first-ever consumer-facing robo-advisors, shaking the buttoned-up world of investment management. This was a huge step forward in the retail investment market, making personalized investment advice available to all. Retail investors experienced an even greater leap forward with the introduction of Robinhood (HOOD) in 2013. Through its online platform, the company made trading in the financial markets free and simple, revolutionizing the field and making trading accessible to the general public.

Financial markets globally have been one of the earliest adopters of machine learning, the technology that allows the existence of artificial intelligence. In 2001, IBM (IBM) built a team of “robots” that beat humans at trading. Since then, the onslaught of AI on all aspects of life, including finance, has drastically changed the investment landscape. For years already, high-frequency trading has been fully ceded to machines – thousands of trades a second have no place for human involvement. Now, AI can help forecast stock prices, provide personalized financial recommendations, assist in portfolio optimization, optimize the execution of large trades, model and manage financial risks, calculate optimal options pricing, and answer specific stock-related questions in a human-like fashion.

The FinTech Map: A Road to Financial Freedom

Fintech firms are working in numerous financial spheres, including insurance, asset management, investment and trading, banking services, payments, mortgages, lending and credit, and more.

The Fintech industry isn’t very capital-intensive, with low barriers to entry, which permits a myriad of startups to enter the field every year. They strive to compete with the existing established companies like PayPal, Block, Robinhood, and other market leaders, as well as with traditional financial companies like Visa (V) and banks like Goldman Sachs (GS), which increasingly incorporate technology into their service suite. The number of Fintech startups in the U.S. has grown from ~5,800 in 2018 to 11,700 in 2023, despite the significant drop in funding availability in the past two years.

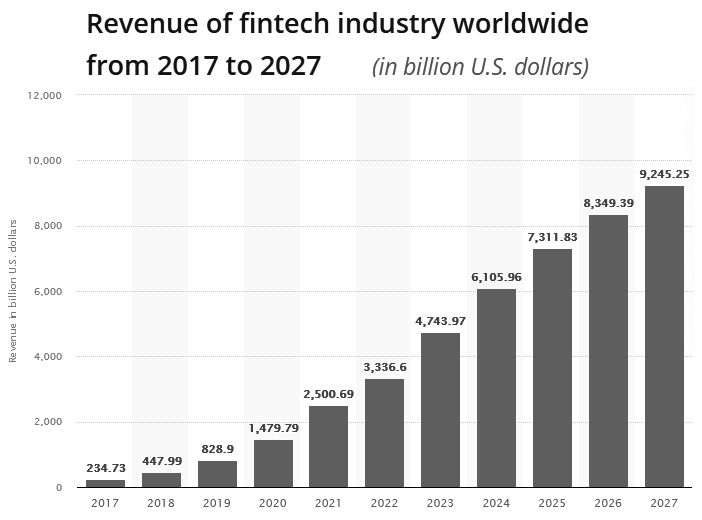

Source: Statista

The Fintech industry is already large, as it has been growing at a very fast clip in recent years; the growth momentum is accelerating, driven by technological advancement and ever-rising penetration of digital services. The global Fintech revenue is forecast to reach ~$9.3 trillion by the end of 2027, from $3.3 trillion at the end of last year. The U.S. controls more than 40% of the world’s Fintech scene, and, as an undisputed global leader in all things tech, is expected to continue leading global growth of the Fintech industry.

Some of the best-known Fintech companies publicly traded on the U.S. exchanges – in addition to those mentioned above – include:

» Lemonade (LMND), an “insurtech” pioneer, offers a digital platform for purchasing home and renters insurance.

» Affirm Holdings (AFRM) offers “buy now, pay later” (BNPL), or point-of-sale installment loans, to consumers.

» Coinbase Global (COIN), an online platform for buying, selling, transferring, and storing cryptocurrency.

» SoFi Technologies (SOFI), an online personal finance company and online bank, offering various loans, loan refinancing, investing products including crypto, and banking services.

» Bill.com Holdings (BILL), a cloud-based platform that streamlines the accounts payable process for small and medium-sized businesses (SMBs).

» Upstart Holdings (UPST) provides an online platform connecting customers requiring personal loans, and banks that supply these loans.

» Marqeta (MQ), a cloud-based, open API platform, which allows Fintech companies to launch and manage their payment card programs.

» Intuit (INTU) provides financial and business management online services, compliance products and services, and payroll solutions for small businesses, accountants, and individuals.

» Fiserv (FI), a provider of payment and mobile banking systems, account processing systems, risk and compliance solutions, and electronic payments products and services.

» Opendoor Technologies (OPEN) works as an end-to-end online real estate platform enabling consumers to buy and sell a home online

» Toast Inc (TOST), a cloud-based platform for the restaurant community, provides a comprehensive suite of software-as-a-service (SaaS) solutions that integrate all aspects of the restaurant business.

» AvidXchange (AVDX), which provides accounts payable (AP) automation software and payment solutions for middle market businesses and their suppliers.

» Remitly Global (RELY), an integrated financial services platform helping immigrants and migrant workers perform digital cross-border money transmissions.

» Enfusion (ENFN), a cloud-native SaaS platform that unifies front, middle, and back-office functions for investment management operations.

» Oscar Health (OSCR), a health insurance company built on a full stack technology platform, helps consumers through transparency and personalization.

The Automated Investor Help Machine

While the Fintech scene is teeming with companies of all shapes and sizes, changing the world of finance with their innovative products and services, choosing those that can persist, grow, and reward their investors with significant gains is not an easy task. The vast differences in these companies’ financial and business metrics, as well as their prospects, call for a thorough analysis, which requires digging into the data, analyzing companies’ finances, industry competitiveness, growth prospects and risks, and more.

However, Fintech can help investors choose the right Fintech stock: they can leverage the existing analysis, utilizing research done by Wall Street’s leading analysts, collected and made accessible by TipRanks. TipRanks also has several tools, such as a stock screener, stock comparison tool, technical analysis screener, and others, which can help investors employ the vast amounts of data and research stored in its database, to their benefit.

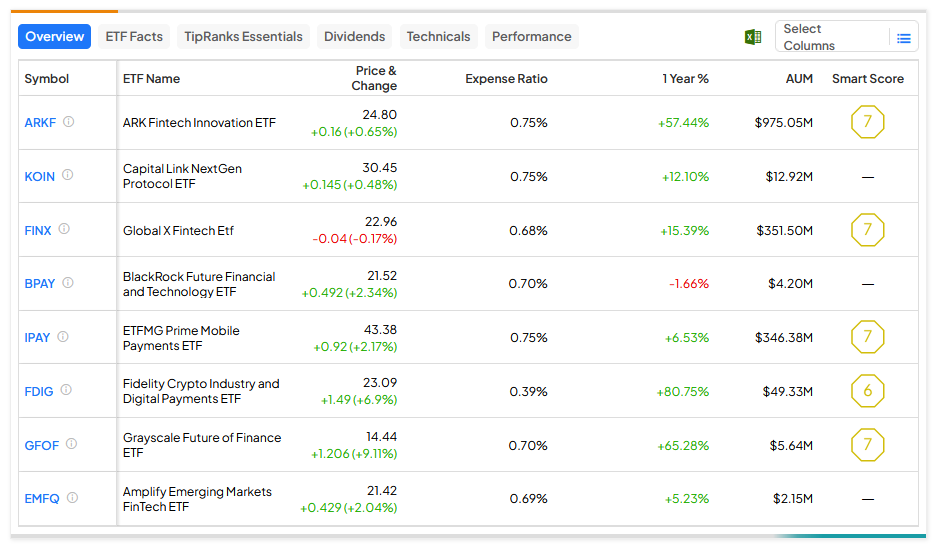

As another option, investors can buy into one of the robotics ETFs, utilizing one of the many TipRanks ETF tools to pick the winning fund:

To conclude, the Fintech industry stocks provide investors with an opportunity to profit from an accelerating financial modernization and digitalization trend. However, it is important to take into account the companies’ finances and prospects to pick the winners that can create long-term value for their shareholders.