Finning International Inc. (TSE: FTT), the world’s largest Caterpillar (CAT) dealer, is set to report its second quarter earnings on August 3, 2021, after markets close. The management team will host a conference call to discuss second quarter results the following morning, at 10:00 a.m. ET.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Finning is the world’s leading Caterpillar dealer, selling, renting and providing parts and service for equipment and engines to customers across diverse industries, including mining, construction, petroleum, forestry and a wide range of power system applications.

Since the beginning of the global pandemic, the stock has more than recovered from its initial decline at the beginning of 2020. Bottoming around $13 per share (CAD) in March of 2020, the stock has since doubled to its current price of C$32.26. (See Finning stock charts on TipRanks)

Given Finning’s current stock momentum, which is tied to the expected recovery of global heavy equipment sales, the coming quarterly result could help maintain momentum for the stock. It truly has the potential now to break out to new all-time highs.

Let’s take a closer look at what analysts are expecting for the company’s Q2 print.

Finning Earnings Preview

Analysts are expecting Finning to report a profit of $0.45 per share on revenues of approximately $1.68 billion. The company didn’t provide specific guidance for the quarter.

Prior Period Results

In the previous quarter, the company reported adjusted earnings of $0.35 per share, compared to adjusted earnings of $0.33 in the prior-year quarter. The result slightly missed the consensus estimate of $0.36. In addition, net revenue increased by 2% year-over-year to $1.469 billion and also missed analysts’ expectations of $1.486 billion.

Factors to Look For

Among the key things investors are watching for this quarter are new orders and the build-up of equipment backlogs. Last quarter, management noted improvements in backlog, driven by additional equipment orders.

To that end, Scott Thomson, president and CEO of

Finning International, said, “We are encouraged by the build-up of equipment backlog in all our regions and product support activity strengthening through the first quarter. We are seeing strong quoting activity for equipment and product support across all market sectors. In the UK & Ireland, we have secured additional equipment orders for HS2.”

As mining activity around the world begins its recovery and COVID restrictions are loosened, this will allow Finning staff to resume operations and continue to safely service customers. Customers are expected to increase their capital expenditures, as spending had been put on hold during the pandemic. Some equipment will need to be replaced or rebuilt, as it has aged from lack of investment. For example, the average age of mining fleets in Chile is 11 years and in Canada is 12 years. This creates a need for rebuilds, which is considered good for margins.

Product support is another important part of revenue mix as it accounts for roughly half of their consolidated revenue and contributes a higher profit margin. In 2020 product support revenues had declined 9% year-over-year, but have begun to improve, albeit they are still down 5% in Q1 vs. the prior-year quarter. Management expects to benefit from several profit drivers in 2021, including product support returning to growth.

“In 2021, we expect to benefit from several profitability drivers, including operating leverage in a recovering market, product support growth in all regions, significant progress towards our mid-cycle SG&A target, and effective allocation of capital,” said Thomson.

Recent Developments

In addition to the cyclical tailwinds beginning to take hold, Finning is also expected to benefit from secular tailwinds in lithium mining.

RBC Capital Markets analyst Sabahat Khan recently put out a report outlining the lithium opportunity that exists for equipment dealers. The demand is driven by global battery manufacturers who have a focus on sustainability and cleaner sources of energy/power generation.

Mr. Khan wrote, “Lithium has become the metal of choice for most global battery manufacturers, powering electric vehicles (“EVs”), smart-phones, laptops, and other means of electric storage that are increasingly in demand.”

Lithium is found underground in brine and mineral ore deposits. There are two methods of extraction: brine and hard rock. Hard rock extraction is the focus for equipment dealers, as this is performed through traditional open-pit mining, which requires a greater amount of heavy equipment. This translates into a larger revenue opportunity for the equipment dealers.

For Finning, lithium is currently a small but growing opportunity, with long-term potential.

The global production of lithium is projected to grow at a 20% compound annual growth rate from 2020 to 2025, reaching nearly 930k tonnes annually. This compares to approximately 370k tonnes in 2020, according to CRU a commodity research firm. Finning is well positioned to capture their share of this market.

Analyst Recommendations

On June 23, 2021 Bank of America Securities Analyst Ross Gilardi raised EPS estimated for 2021 by 4%, post Finning’s Investor Day. He also expects upside to the $39 price target, driven by ramping market demand and new product offerings.

Gilardi expressed his optimism, saying, “Bigger earnings inflection could finally be here in Q2. Normalized earnings commentary suggests upside to prior estimates.”

Bottom Line

As the global economy begins it journey to normalcy, the global mining industry is expected to improve. As COVID restrictions are loosened, allowing employees to safely return to work, construction and mining staff as well as equipment service teams are starting up again.

Recently, heavy equipment spending had stalled, as capital was constrained and companies were facing restrictions. This has built pent-up demand for the heavy equipment industry, which is expected to return to growth as the world re-opens. In tune with the industry, Finning is expected to turn the corner. Shares could break out to new all time highs if the company demonstrates strong execution in a recovery market.

Wall Street Weighs In

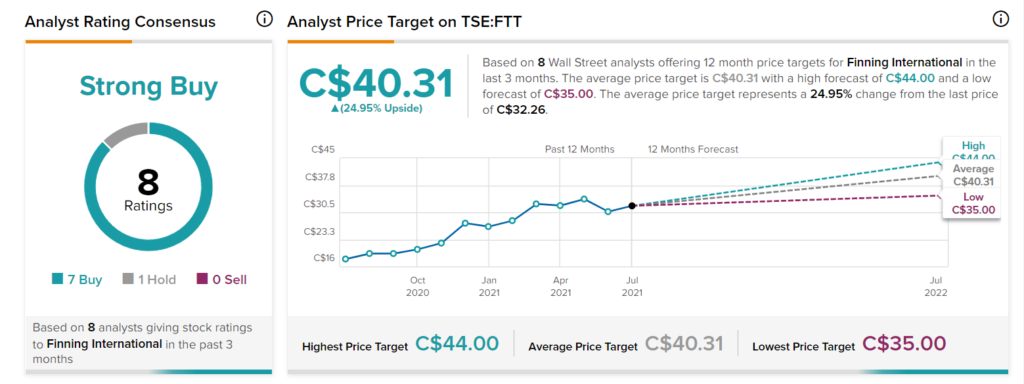

On TipRanks, FTT has a consensus rating of Strong Buy, based on 7 Buy, 1 Hold, and 0 Sell ratings. The average Finning price target is C$40.31, suggesting a possible 12-month upside of 25%. FTT closed trading on Friday at a price of C$32.26 per share.