With its monthly dividend payouts and high dividend yield, the JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI) has become one of the most popular dividend ETFs in the market. This has inspired a slew of similar ETFs and an interesting newcomer, the Rex FANG & Innovation Equity Premium Income ETF (NASDAQ:FEPI), which launched in October and has the potential to yield over 25% if it keeps its dividend steady (more on this later).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

FEPI seeks to replicate JEPI’s strategy of selling covered calls to generate monthly income for investors and an above-average dividend yield. However, it eschews JEPI’s diversification and invests in a handful of top tech stocks.

I’m very intrigued by FEPI, and I am adding it to my watchlist, but I’m neutral on it for now based on its lack of diversification and its relatively high expense ratio. I’m also watching to see what kind of monthly payouts it makes over time. That being said, it could still be a good fit for investors who already own JEPI or similar ETFs and are looking to add more monthly income to their portfolios.

What is the FEPI ETF’s Strategy?

According to RexShares, FEPI “combines big tech stock exposure and potential for steady income in a covered call ETF.” FEPI invests in an equal-weighted index of 15 tech stocks called the Solactive FANG Innovation Index, and it “sells call options against these big tech stocks, seeking to harness their volatility.”

FEPI will pay a monthly dividend with no K-1. In a way, it attempts to give investors the “best of both worlds.” It does this by providing exposure to the upside of top tech stocks while also providing the high dividend income often associated with sectors of the market characterized by lower growth potential.

Additionally, FEPI says that this covered-call strategy can help provide investors with a buffer against downside during turbulent markets.

As always with these types of ETFs, it’s worth pointing out that while these strategies are effectively for producing monthly income and large dividend payouts, they likely leave some capital appreciation on the table as selling covered calls caps some of the upside from potential price appreciation of the stocks it holds.

As long as investors know this and are okay with potentially sacrificing some capital appreciation, these types of covered call ETFs make sense as part of a balanced investment portfolio.

A Tech-Centric Portfolio

While other ETFs in this space, like JEPI, the JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ:JEPQ), and the Parametric Equity Premium Income ETF (NYSEARCA:PAPI) feature diversified portfolios where the top 10 holdings make up a minuscule percentage of assets, FEPI takes the opposite approach.

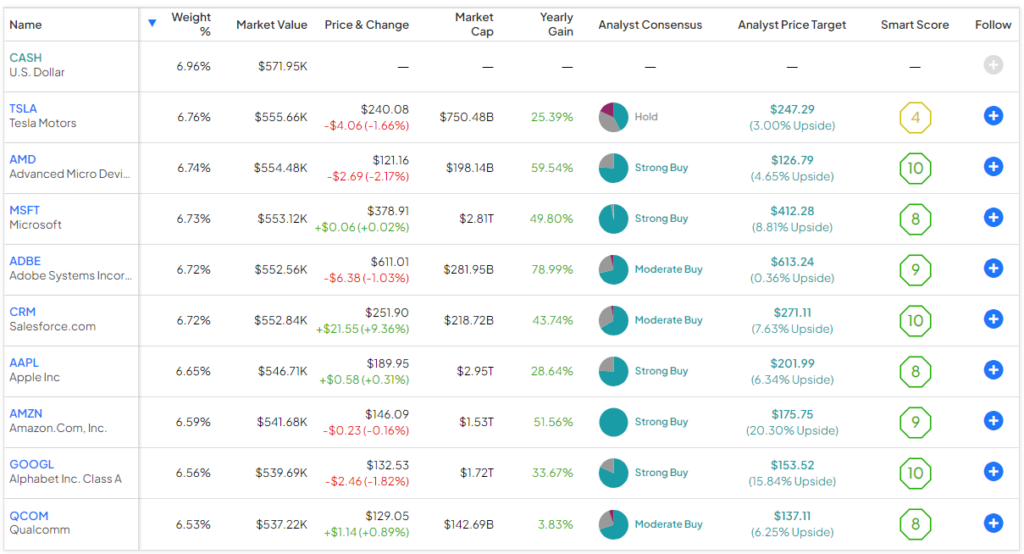

FEPI owns just 15 stocks, and its top 10 holdings account for 67% of the fund. Below, you can take a look at an overview of FEPI’s top 10 holdings using TipRanks’ holdings tool.

RexShares states that FEPI’s underlying index is comprised of eight core components — essentially the “Magnificent Seven” stocks plus Netflix (NASDAQ:NFLX). The other holdings can come from industries like semiconductors, information technology, and internet software and services.

As you can see, FEPI’s portfolio is indeed heavily skewed towards popular tech stocks like Tesla (NASDAQ:TSLA), Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), and Amazon (NASDAQ:AMZN).

While ETFs like JEPI own portfolios mainly comprised of dividend stocks and then supplement this income by selling covered calls, most of FEPI’s holdings do not pay a dividend at all, and it generates income simply by selling covered calls against them. At this point in time, it’s too early to say whether this approach is better or worse, but it’s certainly different.

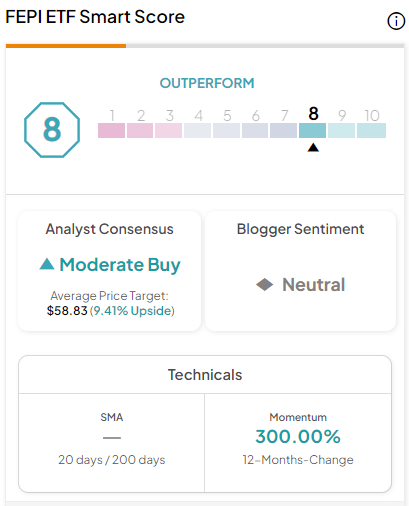

Another thing to note is that FEPI’s holdings feature excellent Smart Scores. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating. An impressive 12 of FEPI’s 15 holdings feature Outperform-equivalent Smart Scores of 8 or better.

FEPI itself has an Outperform-equivalent ETF Smart Score of 8.

A Potentially Massive Dividend Yield

FEPI just launched in October. Thus, it has paid out only one monthly dividend so far. However, it made quite a splash with this one payout. FEPI paid out a dividend of $1.15 a share.

While this shows up as a 2.1% yield on many websites, remember that this is on a trailing-12-month basis. FEPI intends to pay a dividend every month going forward. If we were to take this $1.15 a share and assume that FEPI pays this every month going forward, that means that it yields an incredible 25.7% on a forward basis.

To be clear, the amount that FEPI will pay will vary by month, and it seems unlikely it will pay this much each month and maintain this yield, as it is clearly an outlier among its peers. Still, it does seem like it will absolutely be able to generate a compelling yield based on this evidence.

For comparison, JEPI currently yields 9.1%, and other comparable monthly dividend ETFs, like JEPQ, yield 10.8%, so it’s possible that FEPI’s yield will eventually come closer to those, but only time will tell.

We don’t yet know for sure what future dividends look like, but FEPI certainly made a statement with its first payout.

What is FEPI’s Expense Ratio?

FEPI’s expense ratio of 0.65% is on the higher side. Peers and competitors with similar strategies like JEPI, JEPQ, and PAPI all feature much lower expense ratios. JEPI and JEPQ charge 0.35%, while PAPI charges just 0.29%.

FEPI’s 0.65% expense ratio means that an individual investing $10,000 in FEPI would pay $65 in fees over the course of one year. Assuming that the fund returns 5% per year going forward and the expense ratio remains consistent at 0.65%, this investor will pay $208 in fees over a three-year time horizon.

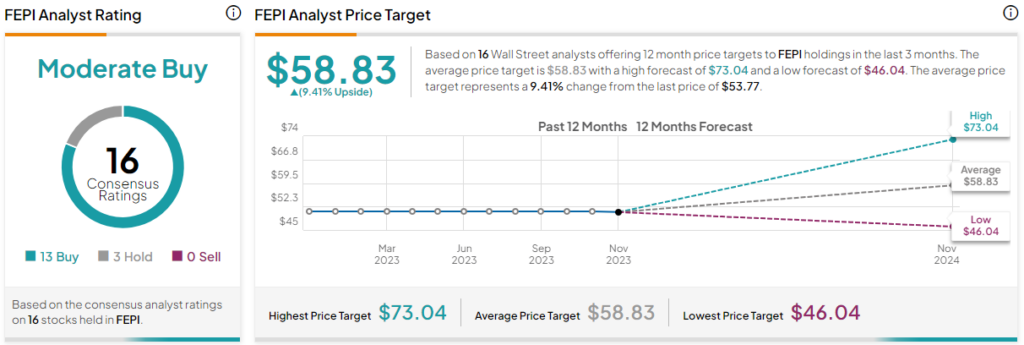

Is FEPI Stock a Buy, According to Analysts?

Turning to Wall Street, FEPI earns a Moderate Buy consensus rating based on 13 Buys, three Holds, and zero Sell ratings assigned in the past three months. The average FEPI stock price target of $58.83 implies 9.4% upside potential.

Investor Outlook

In conclusion, I’m very intrigued by FEPI. It is a unique ETF in what is becoming an increasingly crowded field of ETFs that generate monthly income by selling covered calls. It stands out due to its tech-centric holdings, concentrated approach, and the massive dividend payout it has started out with. I like FEPI’s approach of mixing the upside potential of top tech and growth stocks with frequent and above-average dividend payouts.

On the other hand, I’m a bit concerned by FEPI’s lack of diversification with just 15 holdings and the fact that it skews so heavily towards big tech.

Another downside is that its expense ratio is quite a bit higher than those of competitors like JEPI, JEPQ, and PAPI, so this isn’t the most cost-effective ETF in the space. The tech-centric JEPQ offers similar but more diversified exposure to top tech stocks with a lower expense ratio.

FEPI has certainly turned heads with its first monthly dividend payout, which implies a forward yield of over 25%. We will have to see what future monthly payouts look like to get a clearer picture.

FEPI is intriguing. I am adding it to my watchlist but staying on the sidelines for now just based on the expense ratio and lack of diversification. However, for investors who are keen to add more monthly income to their portfolios, I like the idea of investing in a more established, diversified covered call ETF like JEPI or JEPQ and then buying FEPI to gain some different exposure and add a different stream of income into the mix.