Investment management giant Fidelity recently converted several of its mutual funds to actively managed ETFs. Three of them, the Fidelity Enhanced Large Cap Growth ETF (NYSEARCA:FELG), the Fidelity Enhanced Large Cap Core ETF (NYSEARCA:FELC), and the Fidelity Enhanced Large Cap Value ETF (NYSEARCA:FELV), look particularly promising.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Based on their long-term performances, diversification, and reasonable expenses, I’m bullish on this trio of newly-converted ETFs.

Why the Conversion Makes Sense

The conversion to an actively managed ETF makes a lot of sense. It allows Fidelity to capitalize on the popularity of ETFs, which have grown in popularity while providing a more tax-efficient offering than the typical mutual fund.

Fidelity’s Head of ETF Management and Strategy told VettaFi that the firm is “committed to offering investors innovative ETFs to meet their evolving needs, including active, passive, and factor strategies… We continue to see demand for active ETFs as investors seek the potential for outperformance with the benefits of an ETF wrapper.”

VettaFi’s head of research Todd Rosenbluth says, “Fidelity has shown strong commitment to being a leading provider of actively managed ETFs… They are using their scale to offer competitively priced ETFs and leveraging long-standing track records.”

So, without further ado, let’s look at these three new ETFs.

Fidelity Enhanced Large Cap Growth ETF (FELG)

FELG is a growth ETF with $2.1 billion in assets under management (AUM). Fidelity describes FELG as “a U.S. equity strategy maintaining a large-cap growth profile, leveraging a disciplined approach investing in companies with attractive characteristics.”

FELG has a diversified portfolio, with 179 holdings. Furthermore, its top 10 holdings comprise just 33.9% of the fund’s assets.

Below is an overview of FELG’s top 10 holdings using TipRanks’ holdings tool.

One thing you’ll notice about FELG’s top holdings is that they feature strong Smart Scores. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

Eight of FELG’s top nine holdings feature Outperform-equivalent Smart Scores (note that the fund currently has cash as its fourth-largest holding). The fund’s highly-rated top holdings include the types of top U.S. growth stocks you would expect, such as Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), and Nvidia (NASDAQ:NVDA).

FELG features an Outperform-equivalent ETF Smart Score of 8. While FELG is new to the ETF scene, its predecessor fund has been around for a long time and produced a solid track record of performance over the years.

As of November 30, FELG’s predecessor had an annualized three-year total return of 9.7%. It has an even more impressive five-year total return of 15.6%. Over a 10-year timeframe, it generated an annualized return of 13.5%.

FELG’s three-year performance was on par with the S&P 500 (SPX) over the same timeframe, while it outperformed the S&P 500 over the five- and 10-year time horizons.

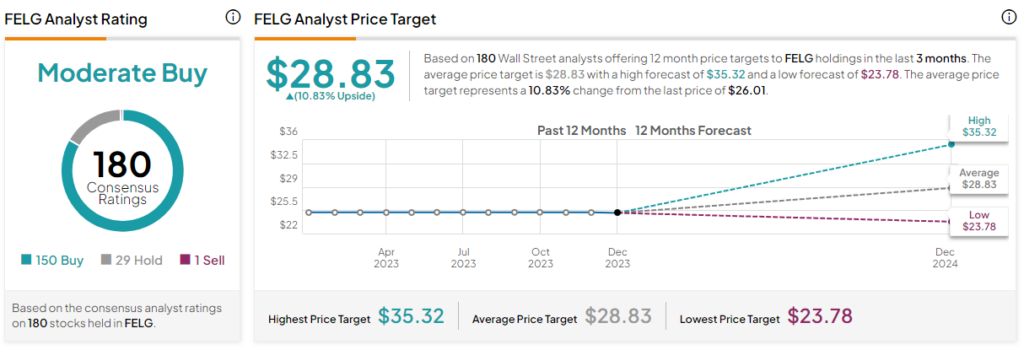

Is FELG Stock a Buy, According to Analysts?

Turning to Wall Street, FELG earns a Moderate Buy consensus rating based on 150 Buys, 29 Holds, and one Sell rating assigned in the past three months. The average FELG stock price target of $28.83 implies 10.8% upside potential.

Fidelity Enhanced Large Cap Growth ETF (FELC)

According to Fidelity, FELC is a “U.S. equity strategy maintaining a large-cap core profile, leveraging a disciplined approach investing in companies with attractive characteristics.”

It is similar in size to FELG, with $2.0 billion in AUM, and because of its large-cap focus, it owns many of the same stocks as FELG (because large-cap growth stocks have come to dominate the overall market).

FELC holds 179 stocks; its top 10 holdings comprise 33.9% of the fund. Below is an overview of FELC’s top 10 holdings.

Like FELG, FELC’s top holdings feature impressive Smart Scores. FELC also has an Outperform-equivalent ETF Smart Score of 8.

FELC’s predecessor fund put up solid results over the years. As of November 30, it had an annualized three-year return of 10.8% (slightly outperforming the S&P 500 over the same timeframe). Over the past five and 10 years, its 12.5% and 11.6% annualized returns align with the S&P 500.

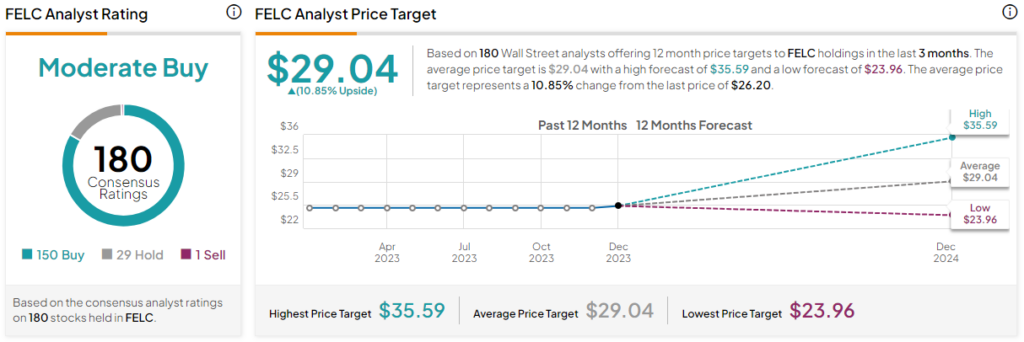

Is FELC Stock a Buy, According to Analysts?

Analysts give FELC a Moderate Buy consensus rating based on 150 Buys, 29 Holds, and one Sell rating assigned in the past three months. The average FELG stock price target of $29.04 implies 10.9% upside potential.

Fidelity Enhanced Large Cap Growth ETF (FELV)

Lastly, FELV is the value-oriented fund in this group. Fidelity states that FELV is a “U.S. equity strategy maintaining a large-cap value profile, leveraging a disciplined approach investing in companies with attractive characteristics.”

FELV has $1.85 billion in AUM. FELV is even more diversified than its counterparts. It holds 347 positions, and its top 10 holdings comprise 18.6% of assets. Below is an overview of FELV’s top 10 holdings.

Because it is value-oriented, FELV’s top holdings look different from its counterparts. Instead of the big tech stocks, FELV owns stocks like Warren Buffett’s Berkshire Hathaway (NYSE:BRK.B), energy giant ExxonMobil (NYSE:XOM), and retail behemoth Walmart (NYSE:WMT).

Because growth stocks have outperformed value stocks in recent years, FELV’s predecessor fund’s returns aren’t quite as impressive as those of FELG’s or FELC’s. However, it still generated respectable returns for its holders. As of November 30, FELV has generated a three-year annualized return of 9.4%, a five-year annualized return of 8.1%, and a 10-year annualized return of 8.7%.

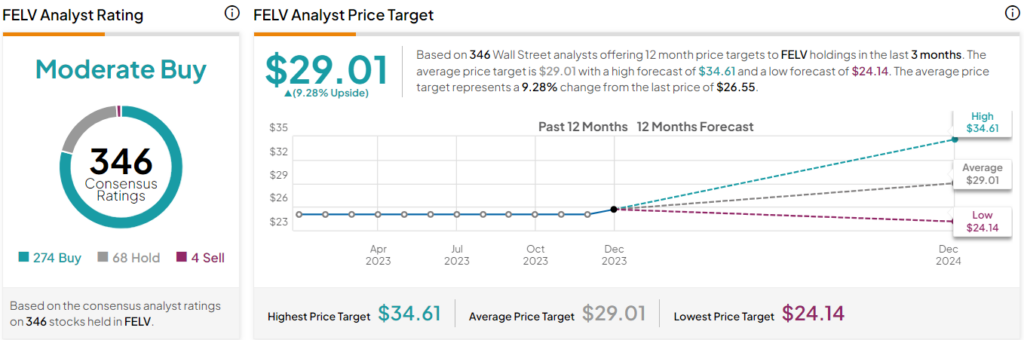

Is FELV Stock a Buy, According to Analysts?

Sell-side analysts collectively assign FELV a Moderate Buy consensus rating based on 274 Buys, 68 Holds, and four Sell rating assigned in the past three months. The average FELV stock price target of $29.01 implies 9.3% upside potential.

Reasonable Expense Ratios

The nice thing that all three of these ETFs have in common is that they all charge an expense ratio of just 0.18%, which is reasonable. It is also particularly reasonable in comparison to other actively-managed ETFs.

This expense ratio means an investor putting $10,000 into FELC, FELG, or FELV will pay just $18 in fees over one year. Assuming that the fund returns 5% per year and maintains this 0.18% expense ratio, this same investor will pay just $230 in fees over 10 years.

These modest expense ratios are even more favorable than other popular actively-managed growth ETFs. For example, the high-profile ARK Innovation ETF (NYSEARCA:ARKK) has a considerably higher expense ratio of 0.75%, more than four times as much as these Fidelity ETFs. An investor putting the same $10,000 into ARKK would pay $75 in fees in year one and $931 in costs over a decade (assuming the same parameters discussed above).

Even Fidelity’s own Fidelity Blue Chip Growth ETF (BATS:FBCG) charges a considerably higher 0.59%, more than three times as much as the three funds mentioned above. An investor putting the same $10,000 into FBCG would pay $59 in fees in year one and $738 in costs for a decade (assuming the same parameters as discussed above).

As you can see, FELC, FELG, and FELV are competitively priced actively-managed ETFs

Investor Takeaway

While FELG, FELC, and FELV are new to the world of ETFs, they all come with solid long-term track records of performance, diversified portfolios, and modest expense ratios. I’m bullish on these actively-managed ETFs from Fidelity for these reasons.