Exxon Mobil (NYSE:XOM) and AbbVie (NYSE:ABBV) are popular dividend aristocrats that have increased their annual dividend payments for decades. Both companies are a member of the S&P Dividend Aristocrats Index. The index tracks companies that have annually increased their dividend for at least 25 years in a row. Strong fundamentals and robust cash flows add to the appeal of these stocks.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Let’s delve deeper into why Exxon and AbbVie could be the safety plugs for your investment portfolio in the rest of 2022:

Exxon Mobil (NYSE:XOM) Stock

Having had a glorious record of raising annual dividends for 39 straight years, Exxon had distributed $7.6 billion to shareholders, including dividends worth around $3.7 billion in the second quarter of 2022. The energy company offers a dividend yield of 3.68% along with a healthy dividend payout ratio of 35.73%.

XOM delivered impressive second-quarter 2022 results on the back of high oil prices, increased production, realizations, and margins, as well as tightened cost control initiatives. The company’s mammoth balance sheet boasted cash and cash equivalents of $18.86 billion as of June end.

Is XOM a Buy, Sell or Hold?

As of now, Exxon stock seems very appealing to scoop up. Wall Street is optimistic about the prospects of XOM stock and has a Strong Buy consensus rating based on 10 Buys, and two Holds. Also, XOM stock’s average price target of $112.21, signals a 19.2% upside potential from its current level.

XOM stock scores 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform the market. Moreover, financial bloggers are 83% Bullish on Exxon stock, compared to the sector average of 72%.

As per TipRanks, retail investors, too, look bullish on the stock, as they increased their holdings in XOM stock by 1.2% in the last 30 days.

AbbVie (NYSE:ABBV) Stock

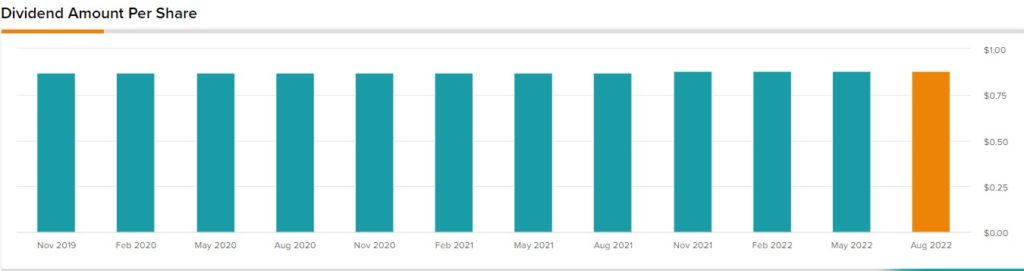

Abbvie has an impressive track record of 50 consecutive years of dividend increases. It also boasts an attractive dividend yield of nearly 4.06%. The dividend payout ratio of 41.96% is also worth mentioning.

The drugmaker reported encouraging results for the second quarter of 2022. It has been witnessing a rise in the demand for Skyrizi and Rinvoq. The company is on track to deliver combined global annual net revenues of $7.5 billion for Skyrizi and Rinvoq. Moreover, significant progress in ABBV’s product pipeline instills optimism among investors.

Is AbbVie a Good Stock to Buy Now?

At the moment, ABBV stock seems to be a decent option to invest in. Overall, the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on seven Buys, five Holds, and one Sell. TipRanks data shows that hedge funds are apprehensive about the company, as they sold 1.1 million shares of ABBV stock in the last quarter.

On the contrary, financial bloggers are 91% Bullish on ABBV stock, compared to the sector average of 68%. Adding to the optimism, ABBV stock’s average price target of $160.54, indicates the stock can rise 15.7% from its current level.

Final Thoughts

Dividend aristocrats are a wise way to deal with market upheavals as they provide a stable income source. Amid the turbulent market backdrop, the 9.1% drop in the S&P 500 Dividend Aristocrats index has outperformed the S&P 500 index’s 16.5% fall so far in 2022. Giving investors more reasons to invest in them, Exxon and AbbVie have managed to beat the S&P 500 Dividend Aristocrats index by gaining 52.8% and 5.4%, respectively, in the year-to-date period.

Read full Disclosure