Overview

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

The bull case for Esperion Therapeutics (ESPR) neatly falls into three categories. There is a lot to like here, however, the recent missteps need to be addressed to achieve its full long-term potential. Let’s review what has transpired.

The Good

The good is the approval of Nexletol (Bempedoic Acid) by the US FDA in February of 2020 to lower cholesterol. The product’s main claim to fame is its “non-statin” mechanism of action. Due to this unique design, Bempedoic acid is positioned to capture the bulk of an estimated 5-6% of the overall cholesterol-lowering market for patients who can’t tolerate a statin.

The overall cholesterol-lowering market is worth $16 billion, with an estimated CAGR of 7%. The quick back of the envelop math gives us a path to a projected $1 billion treatment in 2025 for Nexletol. Sounds excellent with an impressive runway for growth, but there are significant challenges facing Esperion Therapeutics.

The Bad

What’s the bad? The company’s performance as it navigates the problematic field of trying to launch a new treatment during a pandemic. The results have been abysmal, with Esperion posting mediocre returns. Total sales of Nexletol in the first three quarters of 2020 was $4.8 million. That is a far cry from an estimated peak sales number of $1 billion as the company is failing to gain traction.

That said, the product is far from doomed as anemic initial sales hampering a drug can spring to life as prescribers come around to using the product. The most notable recent example is Eliquis, which took a few years before hitting its stride. Even though the company is having cash burn issues as sales growth has failed to materialize as projected, financing isn’t the main challenge, especially in today’s low-interest-rate environment.

The Ugly

Nexletol is facing an upcoming pivotal data readout, which will determine the overall fate of the company. The trial is called Clear Outcome and follows a large cohort of patients (over 16,000) for multiple years to determine if Nexletol is lowering major cardiac events far and above what is being seen in the control arm. Data from this trial, which is scheduled to conclude in the second half of 2022, could be a seminal event for Esperion. A win in the outcomes trial catapults Nexletol to the forefront of treatment, which will likely assure its path to $1 billion in annual sales. Conversely, a less than robust data set effectively vanquishes the value of the company.

A recent example of over-hyped cholesterol-lowering agents was the PCSK-9 class heralded by Amgen’s (AMGN) Repatha. In the stock’s euphoric run, talk circled the Street that it had a blockbuster on its hands with a sure path towards $5 billion in annual sales. Along came a less than stellar outcomes trial a few years back, and Repatha posted $205 million in sales during the first three quarters of 2020. Its nearest competitor, Regeneron’s (REGN) Praluent, posted sales of $127 million in the same time frame for 2020.

Target Price

To base price targets, we can look at the 28 million shares currently outstanding in Esperion. The executive team does have a large compensation package revolving around stock options that will not be included in the projection. A win in the Outcomes trial gives Esperion a clear path to $1 billion, with multiple suitors lined up to acquire. Under the optimistic scenario, a buyout in the $2 billion range is feasible, netting a share price of roughly $71 a share. In the case of a “Repatha result,” the product might not even hit $100 million in sales, which would translate to a valuation in the single-digit range for Esperion.

Wall Street’s Take

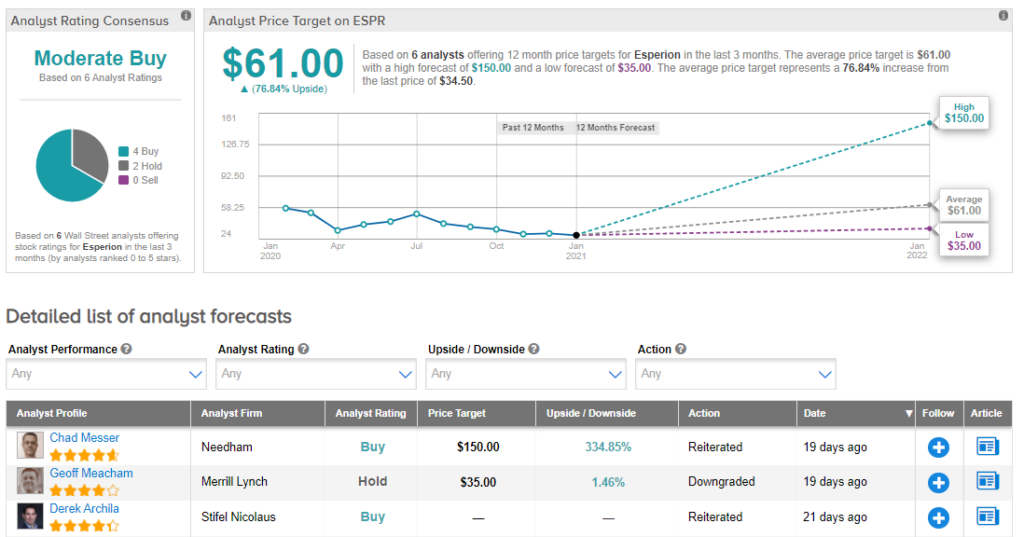

How do Wall Street analysts feel about Esperion Therapeutics? Based on 4 Buys and 2 Holds assigned in the last three months, the healthcare name earns a Moderate Buy consensus rating. At $61, the average analyst price target indicates 77% upside potential. (See Esperion Therapeutics stock analysis on TipRanks)

Concluding Thoughts

Esperion Therapeutics is a classic case of a binary event that can lead to vast rewards or conclude in a stunning defeat with a loss of almost all capital. The outcome will not be revealed until well into late 2022 at the earliest, leaving shares of Esperion without a near-term catalyst to spark its share price higher. However, a buyout can manifest itself at any point. Let’s see how this one plays out.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.