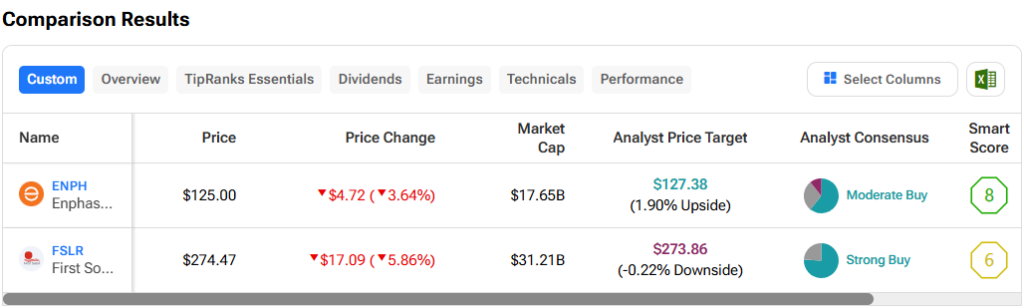

In this piece, I evaluated two solar stocks, Enphase Energy (NASDAQ:ENPH) and First Solar (NASDAQ:FSLR), using TipRanks’ Comparison Tool to see which is better. A closer look suggests neutral views of both stocks.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Enphase Energy offers energy-management solutions for the global solar industry, including micro-inverters for solar panels and software for home energy solutions and storage. Meanwhile, First Solar designs, manufactures, and markets photovoltaic solar power systems and solar modules.

Shares of Enphase Energy are down 5% year-to-date after plummeting 31% over the last year, although things could be turning around, as the stock is up 9% over the last five days. On the other hand, First Solar stock has skyrocketed 59% year-to-date, bringing its 12-month return to 42%.

With such a dramatic difference in the companies’ year-to-date returns, a gap between their valuations would be no surprise. However, what is surprising is that Enphase Energy is the one with the significantly higher valuation — even after the sell-off in the shares.

Both stocks received a boost on Wednesday from the cooling inflation report. High inflation and interest rates have made it challenging for consumers and businesses to finance new solar-energy systems, so any signs of potential relief in these areas offer support for solar companies like Enphase Energy and First Solar.

Below, we’ll compare the companies’ price-to-earnings (P/E) ratios to gauge their valuations against each other and that of their industry. For comparison, the renewable energy industry is trading at a P/E of 60.5x, which is far more reasonable than its three-year average of 420x.

Enphase Energy (NASDAQ:ENPH)

At a P/E of 69.1x, Enphase Energy is trading at a premium to the renewable energy industry despite the sell-off in its shares. On a P/E basis, the company’s valuation has come back down from the exuberant heights it traded at in 2021 and 2022, peaking at around 277 in July 2021. However, due to its high valuation relative to other renewables and the fact that more volatility is likely ahead, a neutral view seems appropriate for now.

Unfortunately, Enphase Energy came up short on both earnings and revenue in its most recent earnings report. The company posted adjusted earnings of 35 cents per share on $263.3 million in revenue versus expectations of 41 cents per share on $276.3 million in revenue.

Enphase also missed estimates for its guidance, which Wall Street never takes too kindly. For the second quarter, the company expects revenue to be between $290 million and $330 million versus the previous consensus of $350.7 million.

The biggest issues facing Enphase Energy now are inflation and interest rates, but these are industry-wide concerns that should abate once rates start to fall. Unfortunately, the May Consumer Price Index (CPI) print again revealed persistent inflation that rose 3.3% year-over-year, although it was slightly better than the consensus prediction of a 3.4% increase.

As a result, when the Federal Open Market Committee wrapped up its June meeting on Wednesday, it updated its dot-plot prediction to a single interest-rate cut this year — down from the three cuts projected at the March meeting. Thus, the biggest dangers for the solar industry could last longer than current expectations are pricing in, as evidenced by Enphase’s guidance miss.

As such, solar stocks could see additional near-term volatility. Additionally, with Enphase’s valuation so high versus the rest of the renewable industry, I’d like to see a more attractive entry price before becoming more constructive on the stock.

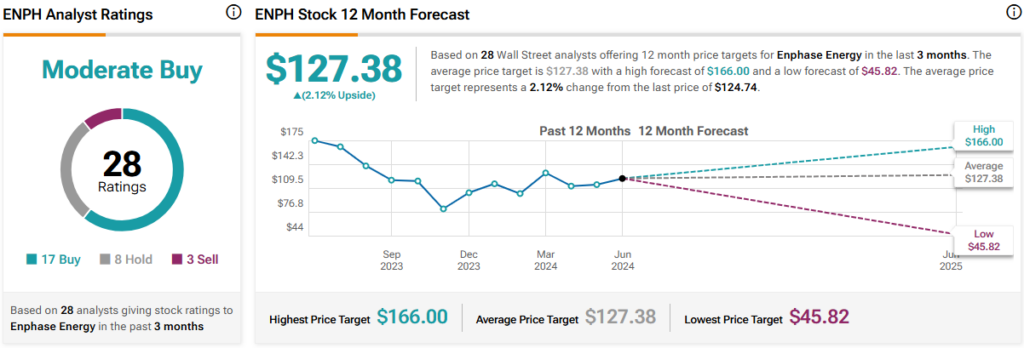

What Is the Price Target for ENPH Stock?

Enphase Energy has a Moderate Buy consensus rating based on 17 Buys, eight Holds, and three Sell ratings assigned over the last three months. At $127.38, the average Enphase Energy stock price target implies downside potential of 2.1%.

First Solar (NASDAQ:FSLR)

At a P/E of 31.3x, First Solar is trading at a steep discount to its industry despite smashing earnings estimates in its latest quarter. However, its current P/E is toward the high end of its normalized range of about 15x to 35x since August 2019, and the stock is just coming down from overbought territory. Thus, a neutral view seems appropriate.

In the latest quarter, First Solar posted adjusted earnings of $2.20 per share on $794.1 million in revenue versus expectations of $2 per share on $720.3 million in revenue. While the initial reaction to the May 1 report was lackluster, First Solar shares surged following the announcement that the Biden administration was ending the exemption from tariffs on imports of two-sided solar panels from Southeast Asia. That announcement came the day after the administration doubled tariffs on imported solar panels.

While both developments are excellent news for First Solar and Enphase Energy in the long run, the companies aren’t out of the woods yet. In addition to the inflation and interest-rate concerns highlighted above, many solar panel companies used the tariff-exemption period to stockpile mass quantities of panels from Asia.

Now, to avoid paying tariffs on those panels, companies must sell all of them in less than 180 days, which could result in discounted prices that weigh on their near-term sales. Enphase Energy is facing more of an indirect impact from the situation, as evidenced by the company’s statement that shipments were down in the fourth quarter due to high inventories at its distribution partners.

However, the impact on First Solar will likely be quite direct. The company boasts manufacturing facilities in the U.S. with another on the way, but if the U.S. market is flooded with deeply discounted solar panels due to those mass stockpiles, First Solar’s sales could be dragged down, suggesting near-term volatility in its results.

Finally, First Solar tipped into overbought territory on Wednesday as its Relative Strength Index (RSI) rose to 80.5. It has come down since, but it still isn’t far from overbought territory.

What Is the Price Target for FSLR Stock?

First Solar has a Strong Buy consensus rating based on 19 Buys, six Holds, and zero Sell ratings assigned over the last three months. At $273.86, the average First Solar stock price target implies downside potential of 0.2%.

Conclusion: Neutral on ENPH and FSLR

Over the long run, Enphase Energy and First Solar will likely be excellent plays on the solar market, but for now, there are just too many issues weighing on the U.S. solar market to warrant a more constructive view on either stock. Thus, I would recommend a wait-and-see approach for both companies to see which valuation reaches a more acceptable range sooner.