Last week saw big news, as a number of the ‘Magnificent 7’ mega-cap tech giants released their quarterly earnings – and the results from several of these names were highly impressive.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to Wedbush’s top-rated analyst Daniel Ives, those strong results are a preview of what’s still to come. Building on the tech sector’s recent history, particularly the AI-driven boom, Ives argues that the momentum at the top of the tech pyramid is nowhere near finished.

“Over the last few years there have been some seminal moments in the AI Revolution thesis that kicked off with Nvidia’s historic May 2023 quarter following the Microsoft/OpenAI investment in early 2023,” Ives said. “While the bears will continue to yell ‘AI Bubble’ from their hibernation caves we continue to point to this tech cap-ex supercycle that is driving this 4th Industrial Revolution into the next few years. This is our focus and along with our AI use case work in the field is driving trillions of spending over the next few years and thus will keep this tech bull market alive for at least another 2 years in our view.”

Against this backdrop, the Wedbush team takes the logical next step, recommending that investors grab shares in Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL) now that earnings are in. Let’s take a closer look at both of these giants and see what has Wedbush feeling upbeat.

Microsoft

We’ll start with Microsoft, one of the world’s leaders in software, cloud computing, and AI.

Cloud and AI are the key points here, and the main drivers of Microsoft’s revenue gains in recent quarters. Microsoft has long been a backer of AI research and implementation. The company was an early investor in OpenAI, the developer behind ChatGPT, and has put more than $13 billion into the AI company in recent years. And, along with the fiscal 1Q26 earnings release, Microsoft announced a new partnership deal with OpenAI.

Under this new arrangement, Microsoft’s equity stake in OpenAI, which has now gone public, clocks in at 27% and is worth an estimated $135 billion. In addition, OpenAI has made a long-term commitment to purchasing $250 billion in Azure cloud computing services. Overall, the deal has strengthened the Microsoft–OpenAI relationship and cleared up a lot of the uncertainty around their partnership.

The commitment to Azure underlines a key driver in Microsoft’s ongoing shift from software company to cloud services provider. Microsoft spent more than $34 billion in capital expenditures during its fiscal Q1, with $11.1 billion of that total going to expanding its data center footprint. Company CEO Satya Nadella has said that Microsoft plans to increase its AI capacity by 80% by the end of fiscal year 2026 and to double its data center footprint over the next two years.

In the quarter, Microsoft reported a 26% year-over-year gain in cloud revenue, to $49.1 billion. The company’s Intelligent Cloud, which includes Azure and AI, rose 28% year-over-year to reach $30.9 billion.

These gains helped support Microsoft’s $77.7 billion in total revenue. This figure was up 18% from fiscal 1Q25 and beat the forecast by $2.28 billion. At the bottom line, Microsoft’s non-GAAP EPS of $4.13 was up 23% from the prior year and beat the estimates by 47 cents per share.

When we check in for the Wedbush view of Microsoft, we find that Dan Ives – who is rated by TipRanks among the top 4% of the Street’s analysts – bases his bullish outlook on the company’s current and growing strength in AI and the cloud.

“MSFT reported its FY1Q26 results which featured beats across the board as it continues to capitalize on greater growth opportunities with continued strength in the cloud segment pointing to growing demand for its software/AI products… MSFT provided another quarter of strong guidance for FY2Q26 as it remains clear that FY26 remains the true inflection year of AI growth for Microsoft with CIOs lining up behind the red ropes to build for deployments in Redmond as the company invests aggressively to capture this opportunity,” Ives stated.

As for the quarterly results and the share price gain, Ives said, “This was another solid quarter by Nadella & Co. putting the company well on its way to join the $5 trillion club over the next 18 months with the AI Revolution still in the early innings of playing out with Microsoft hitting its next phase of monetization on the AI front. We believe that any knee-jerk reactions represent strong buying opportunities.”

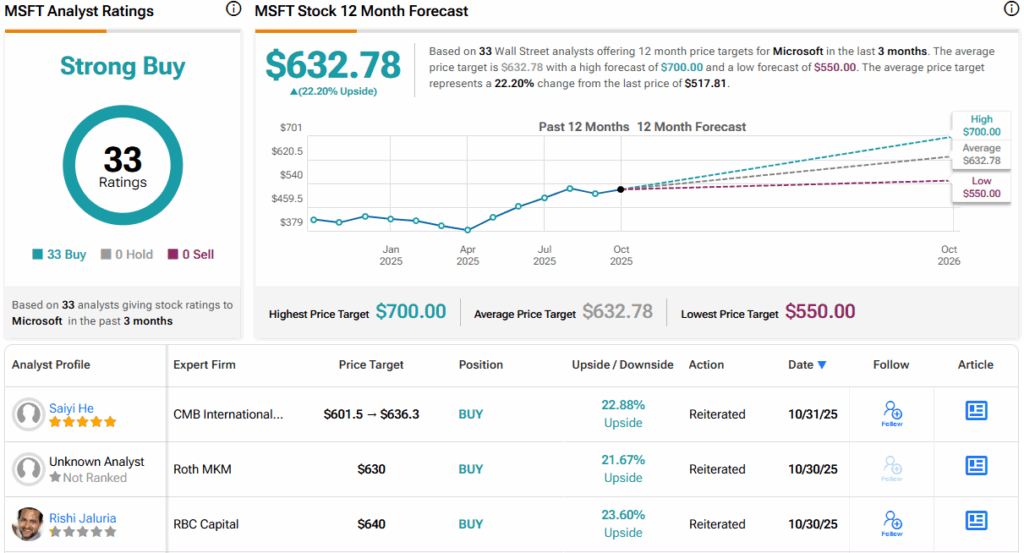

For Ives, this adds up to an Outperform (i.e., Buy) rating on MSFT shares and a $625 price target that points to a gain of ~21% over the next 12 months. (To watch Ives’ track record, click here)

The Street’s Strong Buy consensus rating on Microsoft is unanimous, based on 33 positive analyst reviews. The shares are currently priced at $517.81, and the average price target of $632.78 implies a one-year upside potential of 22%. (See MSFT stock forecast)

Alphabet

Next up, Alphabet is best known as the parent company that owns both Google and YouTube. Between these two subsidiaries, especially Google, Alphabet holds a dominant position in the online search sector and uses that as the base for its main revenue generator, digital advertising.

That revenue generator is still the leading source of Alphabet’s revenue, which totaled $102.35 billion in the 3Q25 report released on October 29. Of that total, the company’s Google Services as a whole generated $87.1 billion; this included the $74.18 billion that came from the Google advertising segment. Google Cloud, the company’s cloud computing unit, brought in $15.16 billion in revenue.

A look at the year-over-year gain on the revenue numbers underscores how the cloud and AI are starting to slip into the driver’s seat. The company’s consolidated revenues were up 16% year-over-year, but Google Cloud revenues were up 34% in the same period. Alphabet reported that cloud revenue growth was led by the core products, including AI infrastructure and generative AI solutions.

Alphabet has been actively working to expand its AI services and capabilities in the past year. Even casual internet users are sure to have noticed that the company has increased the AI integration in the Google search engine, including an “AI Overview” at the top of Google’s search results, an “AI Mode” as an option for sorting results, and more subtle uses, such as improvements in the search engine’s autocomplete feature for user queries.

In many ways, these improvements to the search engine are a response to the rise of generative AI technology, keeping Google Search relevant even as generative AI models are cutting into the web search segment. In addition to upgrading Google, Alphabet is also developing its own AI applications. The Google Gemini family is a prominent public face of this work, consisting of a family of AI models and apps. These are designed to work across a range of Google products and services and can interact via text, code, audio, and video. Gemini can also act as a personal assistant, installed on PCs or mobile devices.

Alphabet’s combination of strengths – in web search, in AI, and in cloud services – has Wedbush tech expert Scott Devitt feeling bullish. “In our view, 3Q performance further validates Alphabet’s position as a leading AI beneficiary, with management already observing tangible results across advertising and cloud. In the quarter, Google Search demonstrated an acceleration in both overall and commercial query volume growth across new and traditional surfaces, with additional opportunity to unlock more use cases and drive incremental monetization,” the analyst said. “Concerns around the impact of genAI on the business are fading, and following a favorable regulatory outcome for the Search business in the DOJ case last month, we are increasingly constructive on the longer-term durability of the segment.”

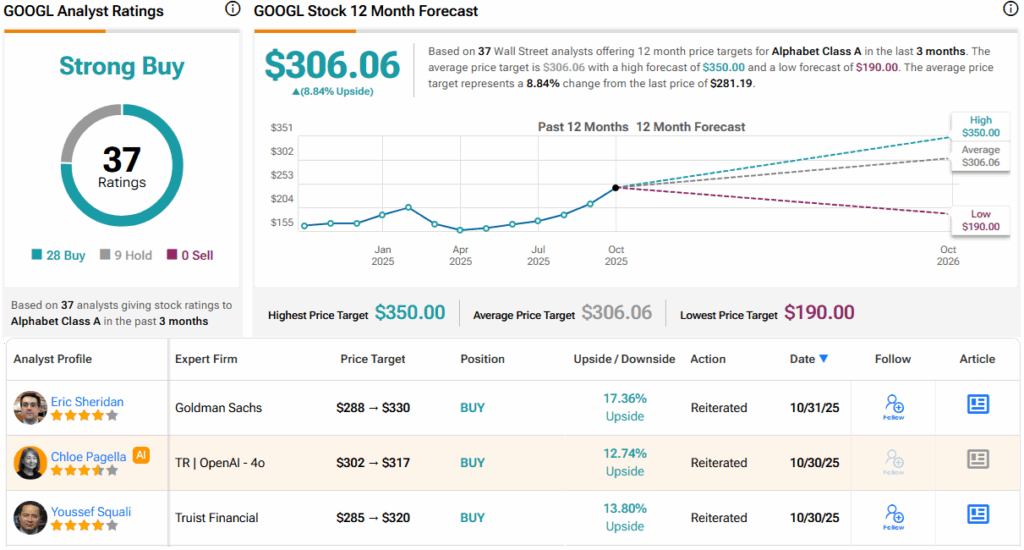

These comments support Devitt’s Outperform (i.e., Buy) rating here, while his $320 price target suggests a one-year gain of ~14%. (To watch Devitt’s track record, click here)

Overall, Alphabet has picked up a Strong Buy consensus rating from the Street, based on 37 recent analyst reviews that include 28 Buys and 9 Holds. The shares are priced at $281.19, and their $306.06 average price target indicates room for an upside of ~9% on the one-year horizon. (See GOOGL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.