Shares of streaming giant Netflix (NASDAQ:NFLX) gained 8.46% last Friday following a so-so Q4 earnings report. NFLX missed analysts’ earnings estimates but met revenue expectations. Nevertheless, the growing competition continues to dilute its market share, evidenced by the deceleration in its bottom-line growth across its most profitable regions. Similarly, the race to develop the most attractive content library is as hot as ever, which continues to chomp away at the company’s cash reserves. Therefore, we are bearish on NFLX stock at this time.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Netflix experienced a startling decline in its market value near the end of 2021. The stock is down a remarkable 47% from its high as its investors plan for an uncertain future fraught with competition. Growth rates have normalized post-pandemic, and its operating metrics will continue to fluctuate over the next several quarters.

Perhaps the greatest challenge for the firm going forward is its capital-intensive business model. It’s incredibly challenging for Netflix to maintain its expansive content cycle amid the growing competition and its worrying liquidity position.

Despite the headwinds and shaky outlook ahead, NFLX stock trades at a forward P/E ratio of 31.9x, roughly 85% higher than the industry median. Given the lack of a huge competitive advantage, the stock is still trading at a nosebleed valuation.

Netflix’s Unimpressive Q4 Earnings

Although Netflix missed analysts’ expectations for the fourth quarter, its management seemed undeterred, praising the firm’s performance. Netflix was upbeat about how the company’s revenue, operating profit, and membership growth exceeded its estimates by a relatively healthy margin. However, that says little about the company’s fourth-quarter showing.

Revenues grew by just 2% from the same period last year, while operating profit margins slipped to 7%. Per-share profits were down, too, plummeting by 91%. On a more positive note, free cash flows (FCF) came in at a spectacular $332 million, significantly higher than the negative $569 million from the same period last year.

For the full year, revenue growth came in at 6% while its operating profit margin shrunk 310 basis points, and per-share earnings fell 11%. Even though cash continues to flow positively, investors have reason to remain cautiously pessimistic currently.

It appears that Netflix is struggling to make substantial gains in its most profitable regions, such as the United States and Canada (UCAN). Despite the release of the new premium content at the end of the year, Netflix reported a small drop in paid subscribers in the UCAN region. This poor performance spells trouble for future growth plans and affects the overall profitability of the platform. Consequently, Netflix will need to rethink its strategy to expand its presence and recapture its share in these vital regions.

Netflix has undeniably achieved great success by marketing its high-quality original content worldwide in the past few years. However, to stay competitive, its massive debt load will continue to be a thorn in its side. The company faces a tall order with growth rates normalizing and the competition breathing down its proverbial neck.

It currently has $8.3 billion in net debt on its balance sheet, surpassing its cash reserves. Continuing to drive original content has put Netflix in an increasingly precarious situation, putting immense pressure on both lines.

Is NFLX Stock a Buy, According to Analysts?

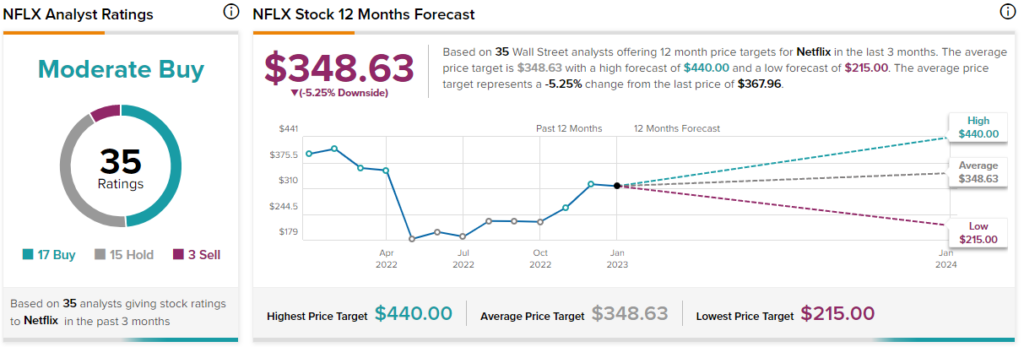

Turning to Wall Street, NFLX stock has a Moderate Buy consensus rating. Out of 35 total analyst ratings, 17 Buys, 15 Holds, and three Sell ratings were assigned over the past three months.

The average NFLX stock price target is $348.63, implying 5.25% downside potential. Analyst price targets range from a low of $215 per share to a high of $440 per share.

The Takeaway

Investing in Netflix doesn’t seem like much of a bargain right now. At its current market cap, it’s still trading at an 80.8x cash-flow multiple. Even if it returns to pre-pandemic growth rates, it’s still a remarkably high valuation.

Additionally, the firm’s fourth-quarter results point to an unimpressive growth trajectory ahead. It seems unlikely that it could start growing its subscriber count and revenue growth rates by double-digit percentages again. It faces stiff competition from companies with enough wiggle room to continue investing in content. Therefore, it’s best to avoid NFLX stock at this time.