Stock prices can tumble for all sorts of reasons, but not every beaten-down stock deserves to be written off. Some are weighed down by weak fundamentals or lackluster performance, while others are simply caught in the broader market tide. When a company’s core business remains strong, a dip in its share price might just be a golden opportunity in disguise.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Finding those diamonds in the rough is what separates the savvy investors from the rest. Hone this skill, and you’re well on your way to building a portfolio with serious upside. It’s the classic strategy: buy low, sell high – easier said than done, but worth mastering.

Wells Fargo’s analysts are putting that strategy to work. They’ve pinpointed a pair of stocks that are down more than 30% this year, but still earn a bullish ‘Buy’ rating.

Backed by TipRanks data, we’ll take a closer look at why these names have caught the analysts’ attention. Let’s get into it.

RxSight (RXST)

The first stock we’ll look at here is RxSight, a medical technology company that focuses on the eye – specifically, on the lens of the eye. The company has developed the first, and so far, the only, synthetic intraocular lens that can be adjusted and customized after cataract surgery. In cataract surgeries, a clouded natural lens is removed from the eye and replaced with a synthetic substitute. Because this replacement lens is normally ‘fixed,’ that is, does not self-adjust the way a natural lens does, patients typically don’t experience a return to completely normal vision.

RxSight’s product, the Light Adjustable Lens (LAL), allows for post-surgical adjustments, using precise UV light treatments. This approach allows the ophthalmologist to ‘fine-tune’ the lens after the patient has recovered from the surgery, and after natural post-surgical shifting and refractive changes have occurred. By delaying the lens adjustments in this fashion, the patient can be given a better-adjusted lens for more accurate vision.

This company has advanced its product to the commercial stage. It received FDA approval for the LAL product line in 2017, and has been marketing the product ever since. In the last reported period, 1Q25, the company brought in $37.9 million in product revenue, up 28.5% year-over-year and about in-line with analyst expectations. At the bottom line, the company ran a net loss of 3 cents per share by non-GAAP measures. This net loss came in 5 cents per share better than had been expected.

For the full-year 2025, the company is predicting revenue in the range of $160 million to $175 million, which would represent year-over-year growth between 14% and 25%. That guide represented a reduction; the previously published guidance range had been set at $185.0 million to $197.0 million. The stock fell sharply by nearly 40% after the guidance was revised downward back in April. For the year-to-date, shares in RXST are down 53%.

For Wells Fargo analyst Larry Biegelsen, the key points here are RxSight’s revenue potential and the sound risk-reward profile. He writes, “Our Overweight rating on RXST reflects the company’s first-in-class IOL technology that can be customized after cataract surgery and its growth opportunity in the multi-billion-dollar premium IOL market where the company holds a significant first-mover advantage. In addition, we see incremental revenue opportunities from the coming wave of post-LASIK patients and international expansion. At current valuation levels, we see an attractive risk-reward profile for RXST shares… RXST currently trades at 2.0x consensus 2025 sales, or >50% discount to SMID cap peers. RXST has above average growth, a strong moat, & relatively high gross margins which should increase over time. Therefore, we think it should trade at least at a market multiple.”

That Overweight (i.e., Buy) rating is backed up by a $25 price target, implying a one-year upside potential of 54%. (To watch Biegelsen’s track record, click here)

RxSight has picked up a Moderate Buy consensus rating based on 10 recent analyst reviews, including 5 Buys, 3 Holds, and 2 Sells. The shares are priced at $16.23 and their $25.30 average target price indicates room for an upside of 56% this coming year. (See RXST stock forecast)

Omnicell (OMCL)

California-based Omnicell, the second stock on our list here, has been working in the medical field since 1992. The company is known as a leader in the field of autonomous pharmacy technology, using a combination of smart devices, robotics, and software to improve efficiencies, cost savings, and supply chain controls in the global pharmacy sector. Omnicell’s devices, tools, and methods are particularly popular among hospital and other institutional pharmacy settings.

Autonomous pharmacy tech, Omnicell’s specialty, plays a vital role in the medical field, improving patient outcomes by improving compliance with prescription directions. Omnicell’s systems allow for clearer, more accurate prescription fills, giving improved medication packaging, better regulatory compliance, and even allowing additional tools for patients to manage medication. Distribution errors in medication can have serious, even severe, repercussions for patients, and Omnicell provides medical providers with the tools and technology to minimize those errors. Chief among the company’s product lines is the XT Amplify Automated Dispensing System.

In its earnings release for 1Q25, Omnicell reported a 10% year-over-year gain in revenue to $270 million, beating the forecast by almost $10 million. At the bottom line, Omnicell’s non-GAAP EPS came to 26 cents, or 6 cents per share better than the estimates, based on a total non-GAAP quarterly net income of $12 million. The company finished the quarter with a balance sheet featuring $387 million in cash and liquid assets, $341 million in total debt, and $2.2 billion in total assets.

We should note here that shares in Omnicell are down for the year. OMCL stock has fallen 33% so far in 2025 – due in part to concerns over the company’s exposure to tariffs.

That share price drop hasn’t stopped analyst Stan Berenshteyn from taking an upbeat view of this stock. In his coverage for Wells Fargo, the analyst says of OMCL, “We see Omnicell as a leading strategic vendor of pharmacy automation solutions for health systems. While we see some more near-term drag from XT upgrade reaching an end, we see a path for Bookings acceleration in 2026 from upgrades and robot adoption and think at least partial tariff resolution should drive upside momentum to EBITDA estimates beyond 2025… While tariff risks remain fluid, we believe trade talks will likely steer outcomes toward the lower end of the risk range, supporting a more optimistic stance.”

Quantifying his stance, Berenshteyn gives the stock an Overweight (Buy) rating, and his price target of $37 points toward a 12-month gain of 24%. (To watch Berenshteyn’s track record, click here)

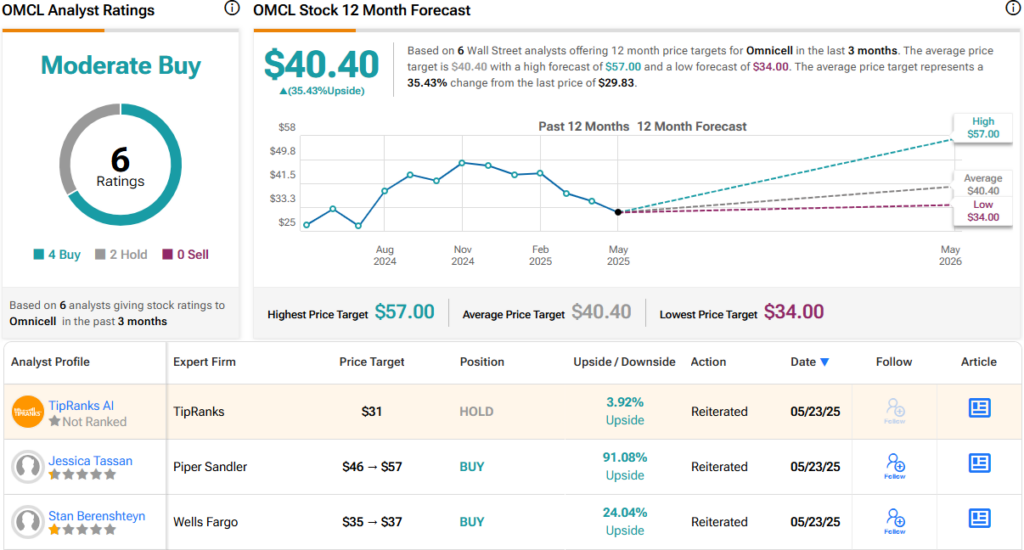

This stock’s Moderate Buy consensus rating is based on 6 recent reviews that break down to 4 Buys and 2 Holds. The shares have a current trading price of $29.83 and the average target price, at $40.40, suggests that the stock will gain 35.5% by this time next year. (See OMCL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.