The first big challenge in building a profitable stock portfolio? Picking the right stocks, naturally. Whether it’s blue-chip giants known for steady gains, high-risk plays that offer outsized returns, or dividend stocks that let you sit back and collect, every strategy has its champions. But today, we’re zeroing in on bargain stocks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Everyone likes a bargain. It’s the truth behind the old market cliché of “buy low and sell high.” Investors can build a solid portfolio by bottom fishing – that is, looking for stocks that have taken a hit but still hold the potential for a strong comeback.

With that in mind, we turned to the TipRanks database to uncover stocks that have tumbled more than 50% in recent months but still carry a coveted “Strong Buy” consensus rating from Wall Street. These are companies with solid fundamentals that analysts believe could regain momentum in the upcoming year – they see big upside ahead. Let’s find out why.

First Solar (FSLR)

The first stock we’ll look at is First Solar, a leading player in the US domestic solar power industry. First Solar has been in the business since 1999 and today bills itself as a “solar technology company and global provider of responsibly produced eco-efficient solar modules,” an important set of technologies in the fight to maintain a sustainable climate policy. First Solar is an American company, making it unique among the largest global solar companies – it is the only US-based solar company and does not conduct its manufacturing activities in China.

First Solar’s other major claim to fame is more important. The company is known for its advanced thin-film photovoltaic (PV) modules, the next generation of solar power technology. Thin-film PV modules offer a lower-carbon alternative to the conventional crystalline silicon (c-Si) PV panels that have long been the industry standard – and they offer that alternative without sacrificing quality or performance.

Turning to financial results, we find that in 4Q24, First Solar delivered a mixed report. The company’s revenue came to $1.51 billion, up more than 30% year-over-year. and beating expectations by $30 million. However, the company’s bottom line came to $3.65 per share, missing the estimates by $1.04.

While the shares got a temporary bump in the wake of the results, the uptick didn’t last long with the shares subsequently retreating again. That has happened quite often over the past year; the stock is down 58% since it peaked last June. A challenging environment in the international market has weighed on profits, and the company faces another headwind in the form of the Trump administration’s energy policy – the new President has made no secret of his preference for fossil fuels over solar power.

Nevertheless, this company gets the support of Mizuho analyst Maheep Mandloi, who is impressed by First Solar’s potential in the long term. Mandloi writes, “Our opinion on the sales outlook post-2026 has materially improved. Based on channel checks, we now see better moat vs cSi competition in the US as other U.S. cell manufacturers opt for the expensive/inefficient PERC cells due to FSLR’s hold on the more efficient TOPCon tech. Separately, the stock has likely underperformed YTD given negative sentiment around 45X manufacturing tax credits surviving Republican administration but, even in our base case assuming 45X expires after 2026 (1-year off-ramp), we see less pain for FSLR anyway offset by tariffs, leading to better negotiating power in 2027.”

Mandloi quantifies this stance with an Outperform (i.e., Buy) rating and a price target of $252 that points toward a one-year upside potential of 97.5%. (To watch Mandloi’s track record, click here)

The 25 recent analyst reviews of FSLR shares show a lopsided split of 22 Buys to 3 Holds, for a Strong Buy consensus rating. The stock is currently selling for $127.63, and its $252.67 average price target is practically the same as Mandloi’s objective. (See FSLR stock forecast)

Denny’s (DENN)

For the second stock on our list, we’ll shift gears and go to Denny’s. The restaurant chain, with its distinctive red & yellow signage, its all-day breakfasts, and its reputation as a watering hole for hungry college students at 3am, has been a staple of the franchise restaurant and coffee shop scene since 1954.

Denny’s operates 1,568 restaurants under two brand names, Denny’s and Keke’s; the Keke’s brand, based in Orlando, was acquired in 2022. Of the company’s full chain, 1,493 of the restaurants are franchised and 75 are company owned. Denny’s has locations across the United States, and has expanded internationally – its largest presence outside the US is in Canada, where there are 86 locations. Denny’s has 15 locations each in Mexico and the Philippines, as well as restaurants in Honduras, Costa Rica, El Salvador, and Guatemala. There are even locations in such far-flung places as New Zealand, Guam, the UAE, and Indonesia. Of these locations, 1,499 are branded as Denny’s.

In October of last year, Denny’s announced that it has plans to expand the Keke’s brand. Over the coming year, the company intends to close approximately 150 Denny’s locations, while opening an equivalent number of Keke’s restaurants – effectively swapping 10% of the Denny’s restaurants for Keke’s. Through this move, Denny’s intends to expand its presence in the ‘morning eatery’ category, and to capitalize on the local popularity of Keke’s.

Like First Solar above, shares in Denny’s are down over the past year. In the last 12 months, the stock has fallen by ~51%. The headwinds are different, however; Denny’s management has cited the LA wildfires as a local headwind, and recent extreme winter weather as a wider-spread headwind in northern states. The most serious obstacle to growth, however, is declining consumer sentiment. Inflation ticked up in both December and January, and the macroeconomic situation has grown more uncertain.

In that environment, Denny’s released its 4Q24 and full-year results on February 12. The company’s quarterly revenues came to $114.7 million, relatively flat year-over-year but $1.34 million less than had been anticipated. Earnings were reported at 14 cents per share, by non-GAAP measures, missing expectations by a penny per share. Full-year revenue of $452.3 million was down 2.5% y/y.

The results hardly helped sentiment, but this bit of genuine Americana has caught the attention of Wedbush analyst Nick Setyan, who is impressed by the potential in the Keke’s brand, as well as by Denny’s great asset as a franchise company – its real estate. He says of the company, “First, we believe Keke’s is meaningfully undervalued and underappreciated, and is poised to contribute to a resumption in DENN’s annual 5-7% EBITDA growth algorithm. Second, we believe drivers of upside vs. current 2025 SSS growth expectations at both Denny’s and Keke’s exist. Third, we expect a step-up in share repurchases in 2025, resulting in annual FCF/share growth of 10%+. Lastly, we view DENN’s ~$100M in owned property and interest rate swaps that ensure an interest rate on its debt in the low-5% range through 2033 as not fully appreciated by investors.”

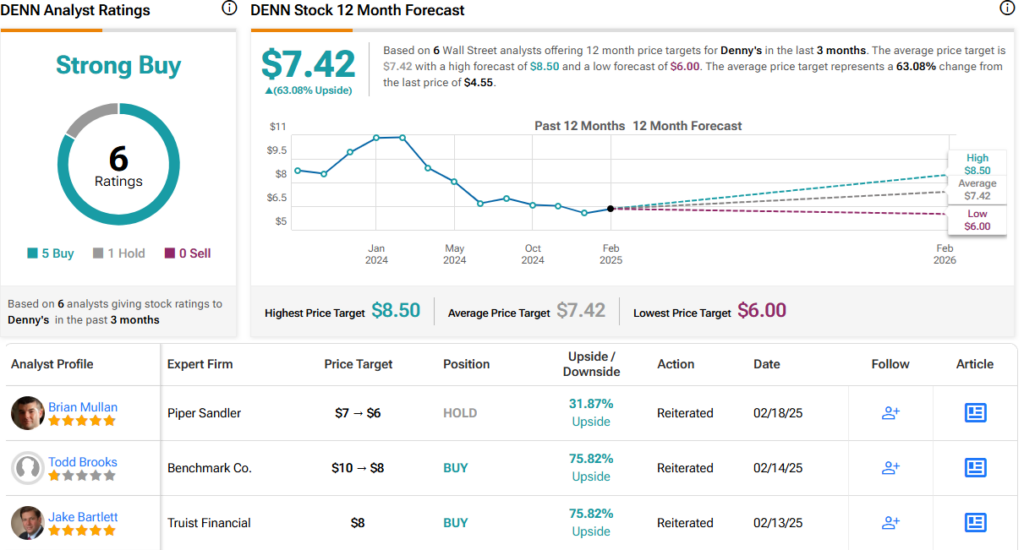

The 5-star analyst puts an Outperform (i.e., Buy) rating on DENN shares. He complements that with a price target of $8.50, suggesting an 87% gain for the shares in the next 12 months. (To watch Setyan’s track record, click here)

There are 6 recent analyst reviews on file for Denny’s stock and these break down into 5 Buys and 1 Hold, making the consensus view a Strong Buy. The stock is priced at $4.55 and its average price target, $7.42, implies a potential one-year upside of 63%. (See DENN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.