When strong companies temporarily fall out of favor, that’s often when long-term investors find their best opportunities. After all, there’s a reason ‘buy low, sell high’ has become such a famous saying.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Stocks can fall in price for all sorts of reasons – but that doesn’t mean investors should necessarily avoid them. Wall Street’s analysts are quick to point out shares that retain their fundamental soundness, even if their prices have fallen.

We’ve looked into the data on the TipRanks platform to find two stocks that are showing sharp losses in recent months – they’re both down more than 40% in 2025 – but that also have solid ratings from the analysts. Let’s give them a closer look, and find out why Wall Street’s analysts are recommending these stocks now they are flirting with bottom-level prices.

Klaviyo, Inc. (KVYO)

We’ll start with a look at Klaviyo, the B2C CRM software company that was founded in 2012 and today is a $7 billion-plus leader in its field. It offers its subscription customers access to the proprietary Klaviyo Data Platform, complete with AI insights, marketing automation, top-end analytics, and quality customer service.

Klaviyo provides personalized service in an industry that tends toward automation. The company’s software systems are designed to bring that automation to bear where it is most needed – on the subscribers’ interactions with their own customers. Klaviyo makes it easy for its enterprise clients to know their customers, to foster profitable relationships, and to drive brand growth.

In the background, supporting all of this, Klaviyo’s services include a wide range of high-quality, data-driven marketing tools, adapted to reap the advantages of AI technology. These include email and SMS marketing, automation for content generation, and a clean data library as a strong foundation.

Despite all of these advantages, Klaviyo’s stock is down 41% so far this year. The shares have come under several sets of headwinds over the past several months, including ongoing worries that the stock may be overvalued. More recently, the company’s CEO, Andrew Bialecki, has been selling large blocks of shares over the past several weeks. One of his notable sales, on September 25, totaled more than $7.5 million worth of KVYO stock; during this month of October, he has sold two blocks worth a combined $8 million. And, during the summer, Klaviyo conducted a secondary stock offering that saw 6.5 million shares go on the market.

When we turn to Klaviyo’s last earnings report, which covered 2Q25, we find that the company generated $293.1 million at the top line. This represented 32% year-over-year growth – and it was also $14.4 million better than had been expected. The company’s 16-cent non-GAAP EPS in the quarter beat the forecast by 3 cents per share.

Wells Fargo analyst Ryan MacWilliams sees Klaviyo’s strong use of AI as one key factor, among several, that bodes well for the company going forward. He writes of the stock, “KVYO’s data platform and Shopify integration provides a unique position to augment workflows with AI and agentic features for its customers. We anticipate that as KVYO scales its AI products and incorporates AI augmented features into its offerings, its growth algorithm will improve. We believe KVYO’s e-commerce market is ripe for AI utilization and its growing customers are more likely to buy vs. build… We view the shares of KVYO as undervalued given the tailwinds from the proliferation of agentic workflows in its core end-markets, the potential of its cross-sell opportunity, and the upmarket penetration opportunity.”

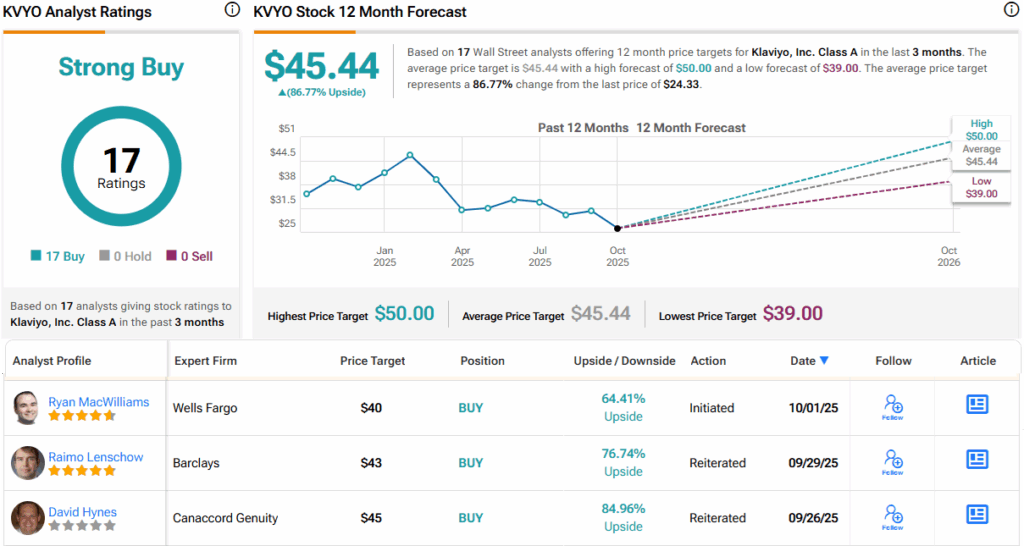

The analyst goes on to rate KVYO as Overweight (Buy) with a $40 price target that suggests the stock has a 64% upside potential for the year ahead. (To watch MacWilliams’ track record, click here.)

This stock has picked up 17 recent analyst reviews, all of them positive and naturally coalescing to a Strong Buy consensus rating. The shares are priced at $24.33, and the average price target of $45.44 implies a one-year gain of 87%. (See KVYO stock forecast.)

Payoneer (PAYO)

Next on our list today is Payoneer, another tech company operating in the world of digital business. Payoneer is an online fintech company, providing financial services to businesses, freelancers, and individual users – and making it easy to conduct international online money transfers. For businesses, Payoneer makes it easy for companies to pay and get paid, to manage workforces, and to manage business financial operations. For freelancers, who frequently have more difficulty managing financial services, Payoneer can facilitate both accounts payable and accounts receivable, while also assisting in managing currency exchanges and even accessing capital.

Payoneer’s customer base is drawn mainly from the small- to mid-sized business sector. These companies are the lifeblood of the global economy, providing an outlet for entrepreneurs’ skills and drive – Payoneer gives them the tools and services they need to support their work, grow their businesses, and move forward. Payoneer bills itself as the go-to service that connects these small and medium businesses, particularly those from the emerging markets, into the larger global economy.

On the practical side, Payoneer facilitates international payments and makes them fast and cost-efficient. Users can conduct up to 200 payments simultaneously, and the services are available in more than 150 currencies for transactions – with 70 of those available for account withdrawals.

Earlier this year, Payoneer suspended its 2025 guidance – it had been predicting just over $1 billion in revenue for the full year – citing high macroeconomic uncertainty, while the company’s earnings results for both Q1 and Q2 were mixed. Against that backdrop, the stock’s price has fallen 41% in 2025.

Nevertheless, Needham analyst Mayank Tandon sees plenty of reasons to recommend this stock. He sees the relatively low share price as an opportunity and notes that the company has plenty of avenues to maintain its growth. Tandon writes of Payoneer, “With strong growth in its higher-value offerings (B2B, checkout, card, etc.) and growth in LATAM and APAC, we see potential for take-rates for its core payments business to increase overtime. Given the inexpensive EV/EBITDA valuation of ~6.5x our FY26 estimate and potential for upside to Street estimates as the core payments business continues to inflect higher, we believe the risk-reward is compelling.”

Putting this stance into quantifiable terms, Tandon rates PAYO as a Buy, and he complements that with a $10 price target that implies a robust one-year upside potential of 68%. (To watch Tandon’s track record, click here.)

This stock holds a Strong Buy rating from the analyst consensus – and that rating is unanimous, based on 5 positive reviews set in recent weeks. The shares are currently trading for $5.96 and have an average target price of $10.38, together pointing toward a gain of 74% in the next 12 months. (See PAYO stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.