The old investing adage ‘buy low, sell high’ might sound like a tired cliché – but there’s a reason it’s stuck around: it works. Scoring a quality asset at a discount has long been a proven path to profits, and right now, the market is offering up some intriguing markdowns.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Following a sharp market pullback triggered by sweeping new tariffs from the Trump administration, stocks have taken a huge hit. Both the S&P 500 and Nasdaq just posted their steepest drops since 2020, and the widespread sell-off has sent stocks down across the board. The challenge for investors, of course, is knowing which beaten-down stocks are primed for a rebound.

That’s where Wall Street’s analysts come in handy. Banking giant Morgan Stanley has a few of them on the books and these market pros spend their days digging through financials, tracking trends, and identifying the most promising opportunities — all to help investors make smarter calls. Now they have pinpointed an opportunity in two names that have taken a hit this year – each down by more than 40% – but which, according to the Morgan Stanley analysts, could be poised for a comeback.

We’ve turned to the TipRanks database to see if the rest of the Street takes a similar view of their prospects. Let’s dive in.

Block, Inc. (XYZ)

We’ll start with Block, a fintech company whose two main subsidiaries, Square and Cash App, give it strong exposure to both the seller and buyer ends of the digital payment spectrum. Investors may recognize Block by the ‘SQ’ ticker, which the company used until January of this year. On January 21, Block switched its ticker to XYZ, while keeping the stock’s historical data. Since its founding in 2009, by the tech billionaire Jack Dorsey, Block (which used to be known as Square) has become a global leader in online payment processing. The company has a $31 billion market cap, even after its stock has fallen 41% year-to-date.

While Block owns and operates several subsidiaries, its main business comes from Square and Cash App. Square is a merchant-centered online financial application that smooths out business transactions, allowing merchants to access the app via smartphones or tablets – and to turn those mobile devices into cash registers or card readers at any location. Cash App brings a similar flexibility to the buyer’s end, letting its users create streamlined financial accounts with easy access to cash, checking and savings accounts, credit services, and a wide range of payment options.

Turning to the company’s financial results, we find that in the last reported quarter, 4Q24, Block had total revenues of $6.03 billion. This was up 4.5% from 4Q23, although it missed the forecast by $230 million. The company’s adjusted EPS for the quarter was $0.71, a strong gain from the $0.47 EPS reported in 4Q23 – but like the revenue, it was below expectations, missing by 16 cents per share. The company’s gross profit for the quarter came to $2.31 billion, for a 14% year-over-year gain. Of that total, $1.38 billion in gross profit came from Cash App, up 16% year-over-year, and $924 million came from Square, up 12% y/y.

In his coverage of Block for Morgan Stanley, analyst James Faucette notes that the stock currently has an appealing valuation, and that the business is in better shape than the bears would have you believe.

Summing up his views, Faucette writes, “Our scenario analysis suggests a 3:1 bull-to-bear skew. We are particularly positive as: 1) Valuation appears more compelling at 7x ’26 EV/Ebitda and (vs. our $67 PT at 8x EV/Ebitda), with macro risks well priced in. 2) Investor sentiment has become decidedly mixed, but we think most expect weak Square Seller trends in 1Q and potential for the outlook to be revised lower, however we are slightly more optimistic given, 3) spending and SMB trend updates from payments companies suggest consistency in 1Q, despite some nuances related to weather, Leap Year, and tax refund timing in February. 4) At the same time, our internal checks among SMB merchants suggest that Square’s product/service combination is modestly more favorably viewed than we had expected, improving our still conservative view that Square will show modest volume acceleration over the course of 2025 (~3 ppts barring material macro/tariff impacts). 5) Meanwhile, recent headcount reductions and third-party data that shows already high employee churn point to profitability outperformance potential in ’25.”

These comments back up Faucette’s Overweight (i.e., Buy) rating on XYZ shares, and his $67 price target indicates his confidence in a 33% upside potential for the coming year. (To watch Faucette’s track record, click here)

This stock has 28 recent analyst reviews on file, and they break down to 27 Buys and 1 Hold – for a Strong Buy consensus rating. The shares are currently priced at $50.47, and their $94.32 average target price implies a robust one-year gain of 87%. (See XYZ stock forecast.)

Liberty Energy (LBRT)

For the next stock on our list, we’ll switch from fintech to energy services. Liberty Energy is a leading company in this field, offering a range of services in the energy industry – completion tech and services for North American onshore oil, gas, and geothermal energy producers, as well as advanced power and energy storage solutions in various commercial, industrial, data center, and mining fields. The latter is provided under Liberty Power Innovations LLC, which Liberty Energy owns and operates.

On the oilfield side, Liberty is well-known as a provider of equipment for hydraulic fracturing; modular and greaseless wireline systems; and innovative proppant sourcing and delivery. The company’s power generation services include low emissions power, as well as mobile power generation. Liberty also owns natural gas assets for CNG and field gas processing operations. This past March, Liberty announced that it had acquired IMG Energy, a distributed power systems developer. The acquisition brings IMG’s capabilities – in engineering design and development, construction management, enhanced software and monitoring systems, and operations and marketing – into Liberty’s portfolio and will enhance the power solutions that Liberty offers.

Since the start of this year, Liberty’s stock has fallen by 47%, with the sharp 30% drop seen over the last week the most recent hit. The company has felt pressure from a downward trend in earnings in recent quarters – the last quarter, 4Q24, showed a non-GAAP bottom line of 10 cents per share, down from 54 cents in the prior-year period and in-line with expectations. The company’s top line, at $943.57 million, was down 12% from the prior year and missed the forecast by $34.86 million.

The company’s full-year revenue for 2024 came to $4.3 billion, a 9% drop from 2023’s $4.7 billion top line. The full-year EPS, $1.64 by non-GAAP measures, was down sharply from the 2023 figure of $3.16.

Despite the downward trend in earnings and revenues, Morgan Stanley analyst Daniel Kutz sees room for Liberty to grow – particularly on its power generation side. He says of the company, “Earnings prospects for LBRT’s new Power Generation Services (PGS) business and the value that these investments create seem underappreciated, in our view. Additionally, its experience developing proprietary mobile power gen units for its ‘digi’ electric frac fleet, established gas logistics business (Liberty Power Innovation “LPI”), culture of innovation, and the depth of its human capital all leave LBRT uniquely well positioned for success in this new venture, in our view. Meanwhile, although NAm frac fundamentals have degraded over the last ~2yrs, we think this market may find support related to supply attrition outpacing expectations and the eventual rebound in gas-directed activity (vs. LBRT’s valuation arguably reflecting further degradation.)”

Looking ahead, Kutz puts an Overweight (i.e., Buy) rating on Liberty’s shares, along with a $25 price target that suggests an impressive 138% upside in the next 12 months. (To watch Kutz’s track record, click here)

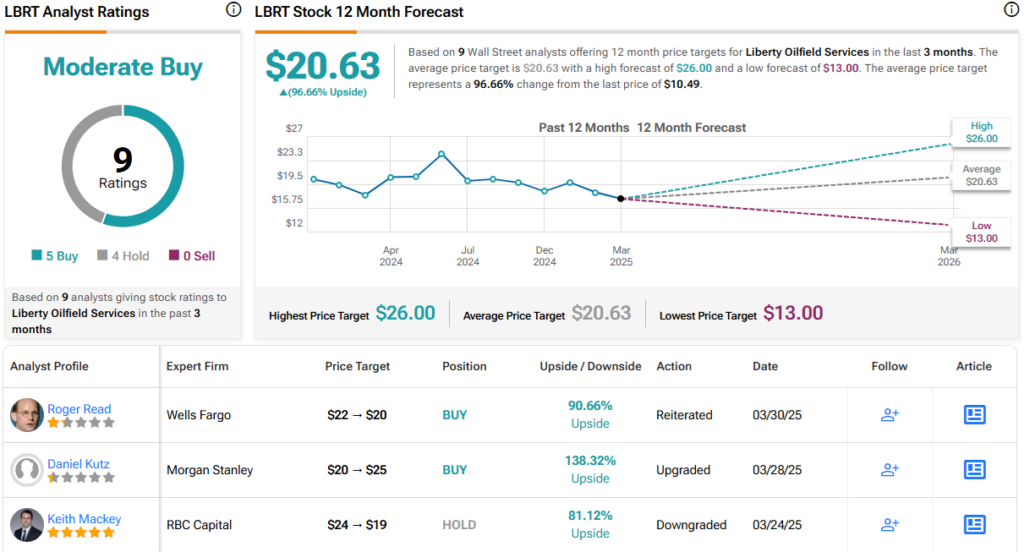

Turning now to the rest of the Street, where the stock claims a Moderate Buy consensus rating based on 9 reviews that include 5 Buy and 4 Hold. The bulls are strong here as the average target price of $20.63 points toward a one-year gain of 97%. (See LBRT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.