Looking for a market bargain? Most investors are. The real challenge, however, lies in recognizing what’s a bargain and what’s just cheap.

Stock prices can fall for all sorts of reasons, ranging from a fundamental unsoundness in the shares to overarching market conditions. The key to success in bargain hunting is learning how to spot the stocks that are trading low for the wrong reasons, to avoid them, and to do your homework on the rest.

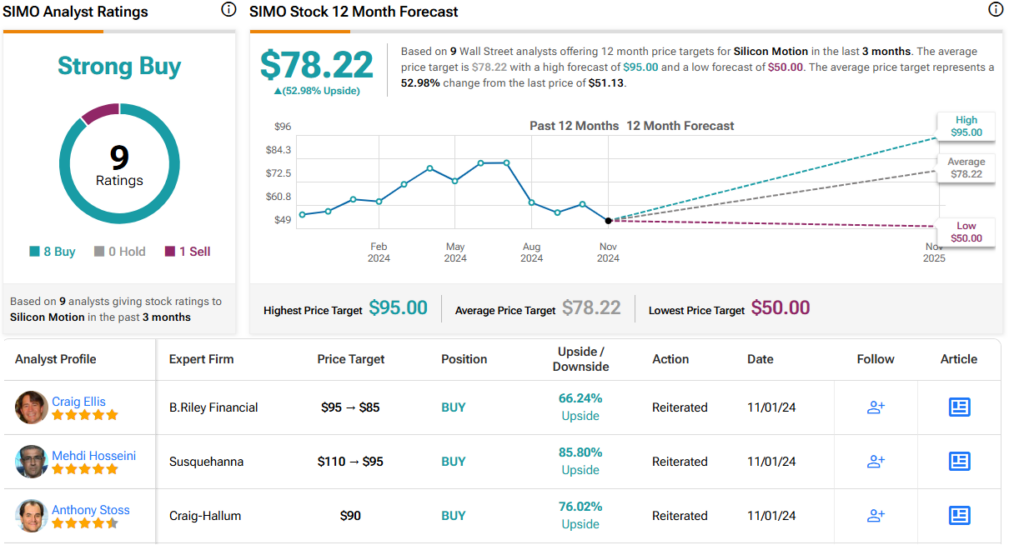

Against this backdrop, we used the TipRanks database to find two stocks that feature an unbeatable combination of attributes to attract bargain-hungry investors: Strong Buy consensus ratings from the Street along with steep discounts. These are stocks that are down more than 30% from the peaks they hit earlier this year – but that also show solid upside potential for the coming year.

Silicon Motion (SIMO)

We’ll start with Silicon Motion, one of the small players in the semiconductor chip industry. Silicon Motion is a specialist in memory chips, and is an important designer and producer of NAND flash controllers in the solid state storage market. The company is also a leading supplier of SSD controllers for servers, PCs, and client devices. In addition, Silicon Motion has its hands in the supply chain for the eMMC and UFS embedded storage controllers that are vital components of smartphones and IoT devices. In short, even though Silicon Motion is a relatively small chip company – it has a market cap of $1.70 billion – it has an important role in an essential industry.

Silicon Motion’s most recent financial report, released last month for 3Q24, showed sound results. The company’s top line hit $212.4 million, for an impressive 23% year-over-year gain and beating the forecast by $1.6 million. At the bottom line, the company’s EPS, by non-GAAP measures, came in at 92 cents per share, or 7 cents better than had been anticipated.

However, the outlook failed to meet Street expectations, and the stock has been trending south since. In fact, since peaking in June, the shares are down by 39%.

Nevertheless, B. Riley’s Craig Ellis, rated by TipRanks among the top 3% of the Street’s stock experts, sees plenty to like here. He writes of this chip maker, “We really like SIMO’s confident ongoing PC and smartphone CY25 controller share gain expression, its first-ever high-end PC controller market entry/SAM expansion for high-value C2H25 growth plus increased confidence now-brewing enterprise and auto SSD ramps can jump to 10% of CY26/7 sales to compliment growth… While not precisely quantifying CY25’s growth potential until 4Q24’s results post in late-Jan/early Feb, we believe mid-to-high single+ is a solid base case, with high single digits possible with any material macro help long-absent in consumer applications, albeit in more back-end fashion given new SIMO and downstream customer product release timing…”

Post the Q3 results, the 5-star analyst’s own bottom line is upbeat on SIMO: “Cash and investment grew to $11/share, should expand steadily ahead barring significant share repurchase on steady cash flow. In sum, while CY24-26 EPS estimates shade 5-10% lower on 4Q’s macro weakness flow-through robust new product and share gain execution tracks our thesis and sustains our positive share stance.”

That ‘positive share stance’ is summed up by a Buy rating, accompanied by an $85 price target that points toward a one-year upside of 66%. (To watch Ellis’ track record, click here)

The Strong Buy consensus rating on Silicon Motion’s stock is based on 9 recent Wall Street analyst reviews, which include 8 to Buy and 1 to Sell. The stock is priced at $51.13 and its $78.22 average price target suggests a gain of 53% on the one-year time horizon. (See SIMO stock forecast)

AES Corporation (AES)

The second stock on our list, AES Corporation, is a Virginia-based power company operating with an emphasis on developing greener power generation capacity, carbon-free electricity, smart grid technology, and digital solutions for the everyday issues of the electric utility business. The company operates worldwide, and has large footprints in North America, South America, Europe, and Asia. AES’s large projects include utility-scale electric providers in the US, power plants in Argentina and Brazil, as well as electric generation facilities in the UK and the Netherlands, and coal-fired plants in India, to name just a sampling.

That footprint gives AES a solid foundation. The company has a $9.7 billion market cap, and brought in well over $12 billion in revenues last year. These are sound numbers, and they give AES the resources needed to continue building for the future.

In the last reported quarter, 3Q24, the company announced completion or progress on multiple important expansion projects. These included 2.2 gigawatts worth of new power supply contracts, which included 1.3 gigawatts of renewable energy with long-term power provision agreements (PPAs), as well as 900 megawatts of new power load growth in AES Ohio based on increasing data center demand. The company is on track to complete 3.6 gigawatts of new projects this year – that is, bringing the projects into operation. AES has also continued to progress on $3.5 billion worth of assets sales, with proceeds targeted through 2027.

Turning to the financial results, Q3’s top line revenues came in at $3.29 billion, down 4.1% year-over-year and $170 million under the forecast. The company’s earnings beat expectations, with the 71-cent non-GAAP EPS beating the forecast by 7 cents per share. Wall Street was not overly pleased with those numbers and shares fell in the aftermath. In total, the stock has shed 36% of its value since hitting a peak in May.

However, Evercore analyst Durgesh Chopra sees an opportunity here and sets out clearly how this company’s combination of scale and expansion bodes well going forward. “We continue to believe that AES’ size and scale positions it solidly to benefit from exponentially growing electricity demand,” Chopra said. “The company made strong progress in the third quarter signing 1.3 GW of long-term PPAs for new renewables, for a total of 3.5 GW in year-to-date 2024… We continue to think that AES is amongst the top beneficiaries of the IRA, and positioned strongly to benefit from growing AI power demand. We believe that patience will be rewarded long term as AES executes on and grows earnings/cash flow from the multi decade long decarbonization trend.”

These comments add up to an Outperform (Buy) rating for the shares, which Chopra complements with a $23 price target to imply a gain of 71% by this time next year. (To watch Chopra’s track record, click here)

AES shares have 9 reviews on file from the Street’s analysts, breaking down to 8 Buys and 1 Hold. The stock’s $13.45 current trading price and $22.57 average price target together suggest that the stock will appreciate by 68% over the next 12 months. (See AES stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.