While the tech-heavy Nasdaq Index (NDX) surged over 40% in 2023, there are several tech stocks trading significantly below all-time highs. The rally in 2023 was primarily driven by large-cap companies, including Nvidia (NASDAQ:NVDA), Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Tesla (NASDAQ:TSLA), and Meta Platforms (NASDAQ:META). Meanwhile, shares of The Trade Desk (NASDAQ:TTD) are currently trading 40% below all-time highs, valuing the company at $33.6 billion.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Despite the pullback in the last two years, TTD stock has returned over 2,280% to investors since its initial public offering in September 2016, but can the tech stock replicate these gains in the future?

I am bullish on TTD stock, as the company is part of a rapidly expanding market, allowing it to grow revenue and profit margins at a comfortable pace in the upcoming decade, which should translate to outsized gains for shareholders. Let’s see why.

An Overview of The Trade Desk

The Trade Desk offers an enterprise-facing demand-side digital platform allowing companies to better optimize their online marketing campaigns. TTD’s portfolio of tools and solutions leverages the power of data, allowing customers to reach a wide range of audiences at a lower cost.

A global technology company, TTD empowers the buyers of digital ads. Using its cloud-based platform, ad buyers can create, manage, and optimize data-driven digital ad campaigns across formats and channels, including video, connected TV (CTV), audio, display, and social.

TTD’s platform boasts seamless integration with key inventory, publisher, and data partners, providing ad buyers with reach while improving decision-making capabilities. Its client base includes ad agencies, brands, and other ad-oriented service providers.

TTD enters into master service agreements with its customers and generates revenue by charging them a platform fee based on total ad spend. Additionally, it drives sales through data services and other advanced platform functionalities.

TTD: Positioned for Growth

The Trade Desk is well poised to benefit from the growing digitization of media and a fragmented audience base, which has increased the complexity of advertising in the past decade, leading to demand for an automated ad-buying process.

TTD aims to increase enterprise demand by developing the programmatic capabilities of its platform and ad inventory. It believes the growth of the programmatic ad market is essential for top-line growth, while the widespread adoption of these services allows the company to acquire new clients and increase spending from existing ones.

In its quarterly filing, TTD explained, “Although our clients include some of the largest advertising agencies in the world, we believe there is significant room for us to expand further within these clients and gain a larger amount of their advertising spend through our platform.”

A report from Market Research Future estimates the programmatic ad market to grow from $56.28 billion in 2022 to $138.25 billion in 2030, indicating an annual growth rate of 13.7% in this period.

TTD ended 2022 with sales of $1.58 billion, suggesting it had a market share of 2.8%. If the company can raise its market share to 5% in the next few years, it might end 2030 with sales of almost $7 billion.

The Trade Desk expects the adoption of programmatic advertising by inventory owners and content providers to expand the volume and type of ad inventory for its clients. For example, it has expanded its CTV, native, and audio ad offerings via integrations with supply-side partners.

The gross spending on The Trade Desk has risen from $552 million in 2015 to $7.74 billion in 2022, allowing the company to increase sales from $114 million to $1.58 billion in this period.

How Did The Trade Desk Perform in Q3 2023?

In Q3 2023, The Trade Desk reported revenue of $493.3 million, an increase of 25% year-over-year. Programmatic ad platforms such as TTD continue to grow at an enviable pace as advertisers are ready to pay a premium for precision and transparency while maximizing returns from their campaigns.

TTD ended Q3 with a customer retention rate of 95%, a rate it has maintained for the last nine years.

With an EBITDA (earnings before interest, tax, depreciation, and amortization) margin of 40%, TTD expanded its adjusted earnings by 27% year-over-year to $0.33 per share in Q3.

Is TTD Stock Undervalued or Overvalued?

Analysts tracking TTD expect sales to rise by 21.9% to $1.92 billion for Fiscal 2023 and by 20.5% to $2.32 billion this year. Its adjusted earnings are forecast to rise from $1.04 per share in 2022 to $1.27 per share for Fiscal 2023 and $1.43 per share for Fiscal 2024.

So, priced at 54.3x forward earnings, TTD stock trades at a lofty valuation, especially since the sector’s multiple is much lower at 15.7x.

Is TTD Stock a Buy, According to Analysts?

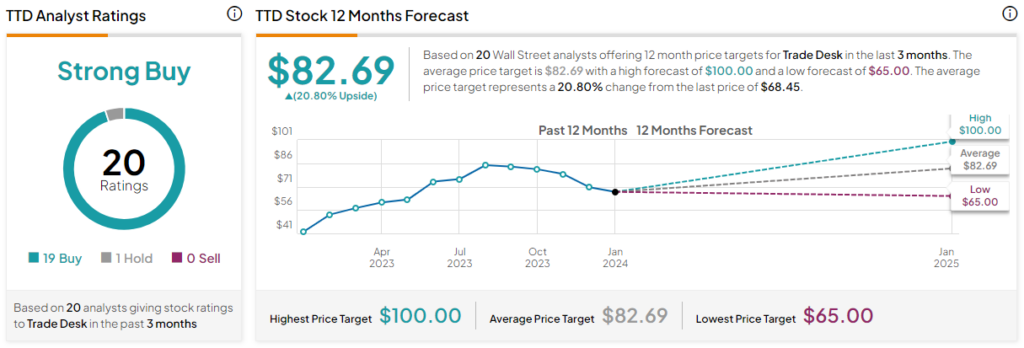

Out of the 20 analysts covering TTD stock, 19 recommend a Buy, one recommends a Hold, and none recommend a Sell. The average TTD stock price target is $82.69, 20.8% above the current price.

The Takeaway

The Trade Desk is a high-growth company that commands a premium valuation. Still, it’s part of an expanding addressable market, providing it with enough room to grow its revenue, earnings, and cash flows in 2024 and beyond. The secular shift towards CTV advertising in key markets should also act as a positive catalyst for TTD, making it a top investment choice right now.