When I wrote about cloud computing and software giant Oracle (NYSE:ORCL) in July, my outlook was bullish. Just before the Q1 earnings release last month, the stock soared to an all-time high. However, the stock has since declined by ~20%, primarily due to a deceleration in Q1 revenues and a more conservative short-term outlook. Despite the stock’s weakness, my thesis remains intact. I believe Oracle represents a solid long-term investment supported by robust growth prospects and healthy margins.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In fact, I see the recent drop in share prices as an enticing buying opportunity for long-term investors.

Lackluster Short-Term Guidance, but Long-Term Cloud Potential is Strong

On September 11, Oracle reported better-than-expected Q1 EPS, with adjusted earnings of $1.19 per share surpassing consensus estimates of $1.15. However, despite the earnings beat, Q1 revenue growth of 9% fell short of Street expectations and was considerably lower than the 18% growth seen in the previous quarter.

Although the company reaffirmed its prior guidance, the Q2 revenue growth outlook of 5% to 7% was also disappointing compared to Street expectations and the 9% growth recorded in Q1. This led to a decline in the stock price.

Segment-wise, a sequential revenue deceleration was seen across all the business segments. However, management attributed the slowdown to the shifting of revenue recognition from the recently acquired Cerner business to the next quarter.

On the positive side, Cloud revenues continued to represent a larger share of total revenues (77%) and grew by 29% year-over-year. The Cloud segment also boosted overall operating margins, which grew by 200 basis points year-over-year to 41% during the quarter. In addition, free cash flows grew by 76% year-over-year to $9.5 billion on a trailing-four-quarters basis, which is also impressive.

The company remains optimistic about robust cloud demand, further fueled by the need for generative AI-related services. Management believes that Cloud revenues will be a significant driver of revenues and margins for Oracle in the years to come. In fact, compared to other cloud businesses, Oracle’s Cloud business reported the highest growth rate in the recent quarter at 29%. For example, Cloud revenues grew by 26% for Microsoft (NASDAQ:MSFT) Azure, 28% for Google (NASDAQ:GOOGL) Cloud, and only 12% for Amazon (NASDAQ:AMZN) AWS.

More importantly, on September 12, during its annual Cloud World conference, Oracle reiterated its commitment to meeting its long-term targets set earlier for Fiscal Year (FY) 2026. The company is confident in achieving $65 billion in revenue (FY2023: $50 billion), an operating margin of 45% (FY2023: 27%), and annual EPS growth of greater than 10% by May 2026. These are impressive growth metrics and provide a compelling reason to invest in the stock for the long run.

Artificial Intelligence Technology Will Act as a Growth Catalyst

AI has revolutionized the tech world, and leading tech companies are quickly adopting it to stay ahead of the AI curve. The global AI market is expected to grow to almost $2 trillion by 2030 versus the $142.3 billion recorded in 2022, according to Next Move Strategy Consulting.

Oracle is well-positioned to benefit from the expected AI boom in the coming years, as AI’s foundation relies heavily on vast databases. This aligns perfectly with Oracle’s core business of selling database software and related technology. The company is bullish on the AI space and has significantly increased its AI investments.

Oracle is making substantial investments in AI technology, creating efficient networks and databases. Moreover, it has formed meaningful partnerships with other companies heavily invested in AI, such as Nvidia (NASDAQ:NVDA), Amazon, Microsoft, and Alphabet.

At its investor’s day held on September 21, the company management announced a range of generative AI products and services like the Oracle Clinical Digital Assistant. The company is also adding AI features to its NetSuite’s finance software. The newly added AI features to its existing software will enhance efficiency. Further, its continuing innovations will make its software services more cost-effective for its clients.

To further bolster its AI prowess, Oracle has made many acquisitions. For instance, Oracle has recently acquired Next Technik, a field service management solutions provider. The addition of Next Technik capabilities will help Oracle’s NetSuite customers with various services, including enhanced field-to-office communication, easier scheduling and dispatching, better inventory management, and more.

The company’s strategic efforts to advance in the AI race are also showing in its booking metrics. The company has booked AI workloads worth $1.5 billion within the first week of the current ongoing quarter, which is very impressive. For the sake of comparison, Oracle’s AI training business bookings doubled sequentially to over $4 billion during Q1. The bookings may take time to convert into revenues, but they will in the future.

Is Oracle Stock a Buy, According to Analysts?

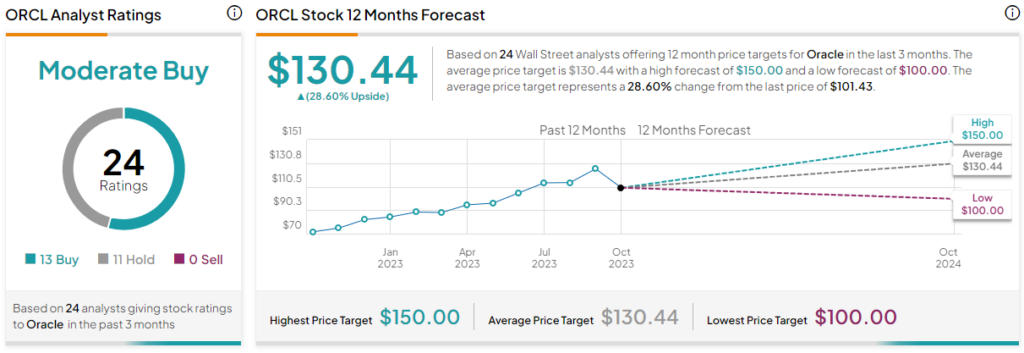

As per TipRanks, analysts are cautiously optimistic about Oracle stock, giving it a Moderate Buy consensus rating based on 13 Buys and 11 Holds. Oracle stock’s average price forecast of $130.44 implies 28.6% upside potential.

Is ORCL Stock Undervalued?

In terms of the stock’s valuation, Oracle is currently trading at a forward P/E ratio of 18.6x, reflecting a 12.6% discount to its peer-group median of 21.3x. Looking at its biggest competitors, Amazon is currently trading at a much higher forward P/E ratio of 59.6x, while Microsoft is trading at a forward P/E of 30x. Given the strong fundamentals, improving margins, and healthy free cash flows, I believe that Oracle stock is fairly valued at current levels.

The Takeaway

I believe that Oracle will continue to benefit from the robust growth of its Cloud business. On top of that, Cloud revenues will receive additional momentum from generative AI tailwinds. The AI-enabled, value-added offerings should continue to boost revenue for years to come.

Therefore, I view the recent dip in the stock price as an opportunity to buy and hold the stock with a multi-year growth perspective.