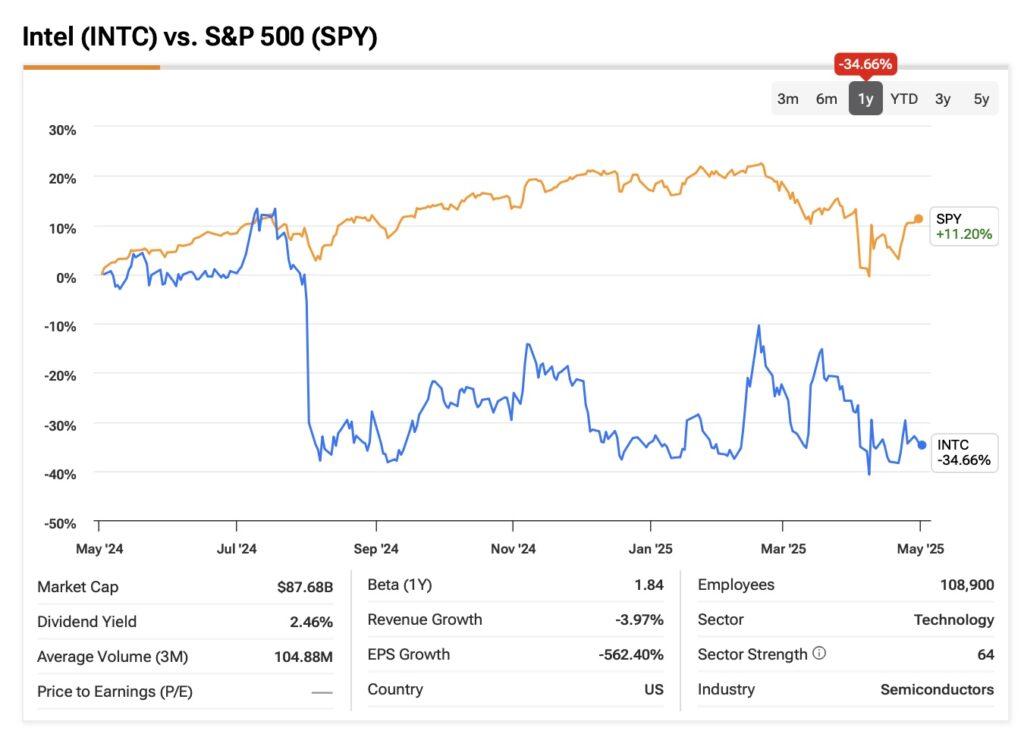

Intel (INTC) has ticked all the boxes to earn the title of a disappointing stock. While it has shown signs of a potential recovery at times this year, it’s still down more than 34% over the past twelve months. And the longer-term picture looks even worse—it’s lost over 65% of its value in the last five years. Staying neutral on INTC stock seems like the most prudent strategy.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

One full-service investment bank, Seaport Global, just initiated coverage on INTC with a Sell recommendation and a price target of $18. Seaport’s analysis pointed to several challenges Intel faces, including losing its manufacturing edge, which has led to its products struggling against competitors. More worrying were concerns regarding the financing of Intel’s Foundry services and internal manufacturing, which is projected to require around $100 billion over the next three years.

A big reason for Intel’s poor performance is its slow adoption of more advanced manufacturing technologies, which has left it trailing key competitors that have moved faster on both performance and efficiency.

So, at a time when AI is booming — and Intel arguably had everything it needed to be a major player—it has struggled operationally. Instead of leading, the company’s been forced to take a step back and get its house in order, trying to play catch-up in the long term under the direction of its new leadership.

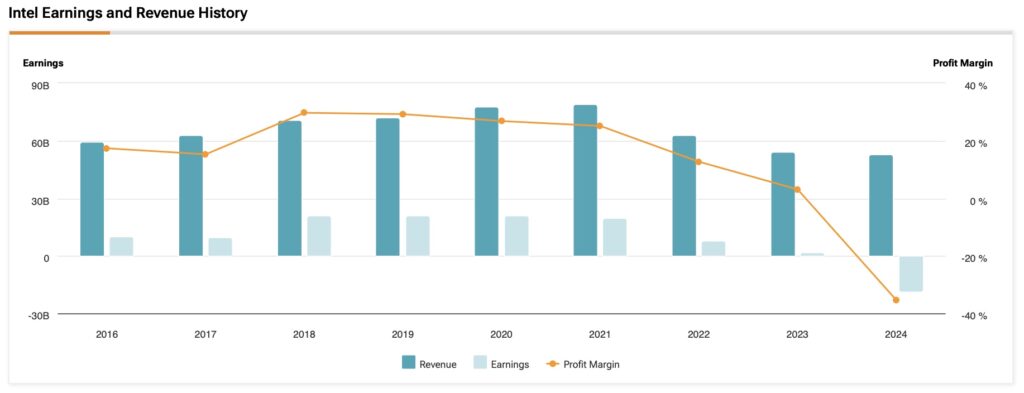

Earnings Blues Haunt INTC

Once again, the most recent earnings were underwhelming. Intel’s earnings call highlighted a solid start to the fiscal year, with revenue and EPS exceeding guidance, driven by strong sales of Xeon and Raptor Lake processors. Under new leadership, the company is implementing strategic cost reductions and a cultural transformation.

However, macroeconomic uncertainties, ongoing losses in the foundry segment, capacity constraints, and competitive pressures present significant challenges. Weak guidance didn’t help, either, failing to spark any real enthusiasm in the market.

Given the updated projections and some aggressive assumptions, I would argue Intel is trading with no margin of safety. That puts a lot of pressure on the turnaround story. In my view, Intel is a Hold—a stock investors are better off staying away from for now.

Intel Focuses on Efficiency While Growth Takes a Back Seat

Intel, which recently reported its earnings results, reaffirmed that it’s still transitioning, prioritizing cost discipline over growth. This was the first quarter under the new CEO, Lip-Bu Tan, and the company is clearly working through execution issues, with a long road ahead to recovery.

For instance, Intel posted Q1 revenue of $12.7 billion, which is flat compared to last year. This happened even as the AI and data center markets grew significantly (up 8% year-over-year), largely offset by continued weakness in Intel’s legacy PC segment, which declined 8% over the same period.

The outlook for Q2 remains soft, with revenue guidance at a midpoint of $11.8 billion, down from Q1, highlighting ongoing market share losses and sluggish demand across key segments. While the Q1 results weren’t particularly surprising, the real news came from the direction set by the new CEO.

Going forward, the focus will shift from expansion to improving operational efficiency. Near-term cost cuts will be modest, but more substantial reductions are expected by 2026, with operating expenses targeted at $17 billion in 2025 and $16 billion in 2026. In line with that, capex was trimmed to $18 billion, down from $20 billion, marking a clear shift away from former CEO Pat Gelsinger’s aggressive investment approach.

Is Intel’s New CEO Taking the Right Steps?

At the moment, it seems Intel is taking the right steps, at least in the short to medium term, to address its ongoing structural issues with operational inefficiency. The company’s plans to cut 20% of its workforce under the new CEO are a move to eliminate long-standing bureaucratic bloat, signaling a shift back to an “engineering-first culture”.

Given the pressure on operating margins and the operating loss in 2024, these measures are necessary to stabilize the business in 2025, provide some near-term support for the stock, and prepare for bigger goals down the line.

However, in the long term, Intel’s strategy raises concerns. While competitors like Nvidia (NVDA) and TSMC (TSM) have been increasing investment to capitalize on the booming AI demand, Intel is going in the opposite direction by cutting back on capex. This could cause Intel to fall further behind in critical areas like advanced node manufacturing and AI accelerators. Unlike its competitors, who have reported strong demand resilience despite tariff risks, Intel’s outlook suggests potential TAM contraction and rising costs. While this conservative approach may be risk-aware, it could hurt Intel’s competitiveness just as the semiconductor industry enters a new growth phase.

The partial sale of its Altera programmable chip business and the decision to retain Intel Capital (the venture capital arm of Intel Corporation) suggest that Intel isn’t fully committing to streamlining or realigning its operations. While improving operational efficiency is important, it’s not enough on its own to drive a true turnaround, in my opinion.

The Difficulty in Trusting Intel’s Turnaround

After updating market estimates following Intel’s Q1 earnings, an inverse discounted cash flow (DCF) model is worth running to see what expectations are baked into the current share price. For this exercise, I’ll use the consensus forecast among analysts, which assumes Intel will grow revenue at a 5% CAGR over the next five years — a fairly modest outlook.

On the profitability side, even though Intel reported a negative operating income in 2024, consensus estimates point to a gradual recovery. Operating margins are expected to hit 3.8% in 2025 and grow at a 42% CAGR, reaching 16% by 2029. Under those assumptions, Intel could generate a net operating profit after tax (NOPAT) of around $8.8 billion in five years, assuming a 15% stable effective tax rate.

Given Intel’s current focus on cutting capex and improving efficiency over growth, I think it’s reasonable to expect depreciation and amortization (D&A) to remain relatively steady. Last year, D&A was around 50% of capex, but based on industry norms and Intel’s asset base, I assume 60% going forward. I’m conservatively estimating it will drop to about 15% of revenue during this transition phase. With Intel also tightening its operations, changes in working capital should be minimal — I’ve assumed 1% of revenue.

Discounting these projections at 7%, with a 3% terminal growth rate, I estimate Intel’s equity value at roughly $90 billion, or about $20.70 per share. At current prices, that leaves no margin of safety for fully believing in the turnaround story just yet.

Is Intel a Buy, Hold, or Sell?

Based on Wall Street consensus, there are clearly more doubts than confidence regarding Intel’s outlook. Of 31 analysts who’ve covered the stock in the past three months, only one is bullish, while 26 are neutral and four are bearish. The average price target is $21.29, suggesting a 6.5% upside over the coming twelve months.

With most Wall Street analysts staying out of the picture and remaining neutral, other bearish analysts include Ingo Wermann from DZ BANK and Harlan Sur from J.P. Morgan. Gus Richard from Northland Securities is the only analyst recommending a buy.

Betting on Intel Is Betting on a Maybe

Overall, Intel showed in its first quarter under the new CEO that it plans to follow a classic turnaround playbook: stabilize first, then rebuild, with a focus on cost discipline and a return to its core business.

Strategically, Intel’s recent moves seem more reactive than forward-looking. But to be fair, pushing aggressive investments and chasing growth while the company still struggles with major operational inefficiencies would likely be a much riskier approach.

That said, even when factoring in the market consensus and some fairly optimistic projections, I don’t think there’s enough margin of safety at current prices to fully buy into the turnaround story. At this stage, I still see it as more of a speculative bet than a trade backed by strong rationale.