Talk of the metaverse has been all the rage lately. Ever since Facebook (FB) – soon to be Meta – announced a change in strategy, investors have been trying to figure out which is the next big metaverse play.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This is such a new industry, and outside of Meta, there aren’t too many options. That said, if there is any company in the world that can make a real run at a self-contained metaverse, it’s Disney (DIS). It is one of the main reasons why I remain bullish on the company.

See DIS stock charts on TipRanks >>

What is the Metaverse?

First, let’s start with describing the metaverse. In its simplest form, it is a term used to describe a 3D virtual world that is inhabited by real people through the use of avatars.

It is also a buzz word that is being used to describe quite a few different projects. It seems like every gaming project is in on its own metaverse, and the lines are quickly blurring.

Interestingly, we are seeing two very different strategies: decentralized and centralized universes. It is shaping up to be quite an interesting battle between these very different approaches.

In a decentralized metaverse, you’ll see inter-operability between many different projects, all working to build a world in which they co-exist. In a centralized metaverse, the control lies within those that built the metaverse and is likely restricted to their own intellectual property (IP).

The spirit of the metaverse, as first introduced in sci-fi lore, is decentralization. It is for the people, by the people. In real life, however, corporations are piling into the metaverse realms, as they see a very lucrative opportunity.

Unfortunately, having multiple metaverses defeats the spirit of the concept. It is for this reason that not every company will be successful. In the end, I foresee only a few left standing. One of those, should the company choose to tackle it head on, is Disney.

World-leading IP

In its annual earnings call, Disney acknowledged plans to build its own metaverse.

“Our efforts to date are merely a prologue to a time when we’ll be able to connect the physical and digital worlds even more closely, allowing for storytelling without boundaries in our own Disney metaverse.”

CEO Bob Chapek

While no specific plans were given, it is easy to see why Disney is likely to be successful. At the end of that day, it all comes down to intellectual property (IP), and no company has a portfolio of iconic IP like Disney’s.

From classic Disney to Pixar, and Marvel to Star Wars, Disney’s brands are tailor-made for the metaverse. No other company has such an established IP portfolio. Disney’s beloved brands are such global powerhouses, that each could sustain a unique metaverse all on its own.

Combined, the potential is limitless.

With the highly successful launch of Dinsey+, the company has shown how its IP can carry it, even if it is late to the game.

This time, the company won’t be late. While there are plenty of other metaverses in full development at the moment, the technology is still very rudimentary. We are likely half a decade away from a fully functional virtual metaverse.

A company like Disney has the funding and expertise to help drive meaningful technological progress in the space. While it’s still unclear how or to what degree Disney is diving into metaverse building, there is one certainty.

If anyone can build a successful centralized metaverse – it’s Disney. As the company has proven time and again, a bet on Disney is likely to result in long-term success.

Wall Street’s Take

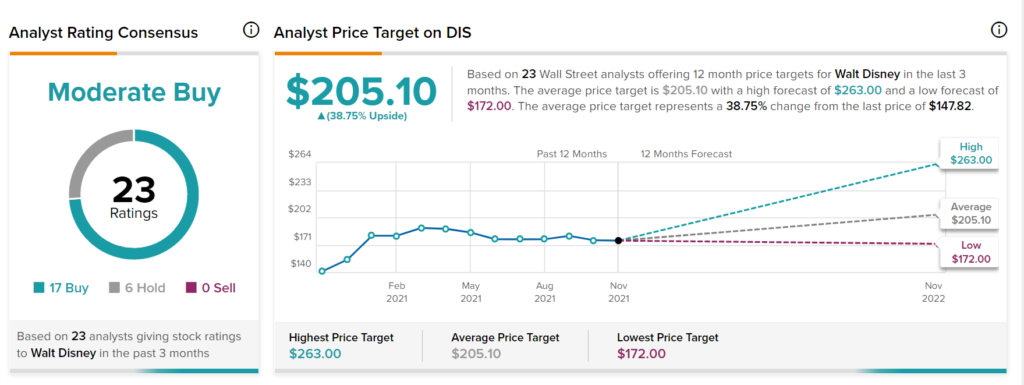

From Wall Street analysts, Disney earns a Moderate Buy analyst consensus based on 17 Buy ratings, six Hold ratings, and no Sell ratings.

The average Disney price target of $205.10 puts the upside potential at 38.75%.

Disclosure: At the time of publication, Mat Litalien has a long position in Disney (DIS).

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >