Whether it’s with pepperoni, pineapple, anchovies, or just tomato and cheese — pizza is a beloved dish for millions worldwide. Generating billions of dollars every year, three renowned brands lead the field in serving this famous Italian delicacy: Domino’s Pizza (DPZ), Papa John’s (PZZA), and Yum! Brands (YUM), better known as Pizza Hut by pizza lovers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

All three pizza titans bring something to the investor’s table, but which pizza stock offers the best investment opportunity for investors looking for a tasty slice of the food and drink services sector in early 2025?

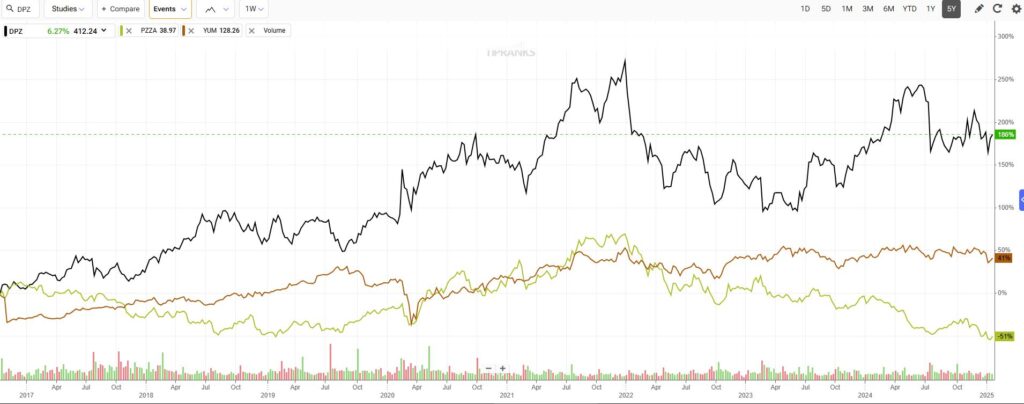

Here’s a snapshot of how these three wholesome pizza stocks have performed over the past 8 years:

From the share price alone, it would seem Domino’s is the clear winner, having added 186% since 2017, while Yum! Brands appreciated 41%, and Papa John’s fell 41%. However, there is more to this pizza showdown than meets the eye. For value investors, share price appreciation is not the only meal on the menu.

Domino’s Pizza (DPZ)

Domino’s Pizza boasts a market cap of ~$15 billion, operating in 20,900 locations spanning an incredible 90 markets worldwide and nearly 7,000 locations across the U.S.

The company is well-known for its efficient operations and streamlined digital ordering process, with the stock delivering superb returns since inception. Over the past decade, Domino’s has delivered a remarkable total return of 408% for its shareholders, far exceeding the S&P 500’s return of 256.4% and assertively making Domino’s a reliable long-term value generator.

Currently, Domino’s trades at 25.5x forward earnings estimates, which is almost exactly the same as the broader market. The S&P 500 (SPX) trades at 25.6x earnings, so Domino’s isn’t noticeably expensive, but it’s also not cheap either. Additionally, Domino’s is an attractive dividend stock paying a handy 1.4%, marginally higher than the 1.2% offered by the S&P 500.

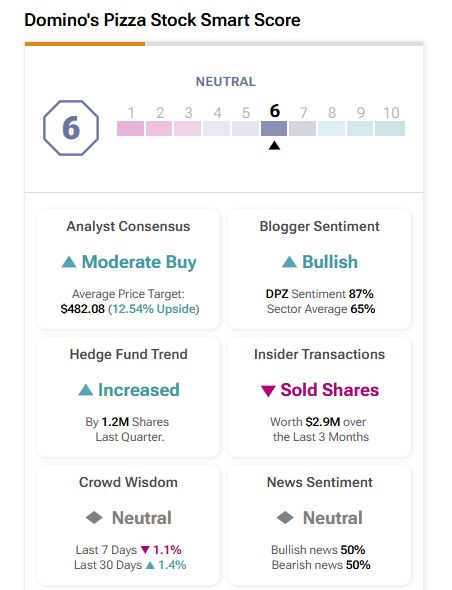

On TipRanks, Domino’s currently features a Smart Score of 6, positioning the stock as NEUTRAL.

Is Domino’s Stock a Good Buy?

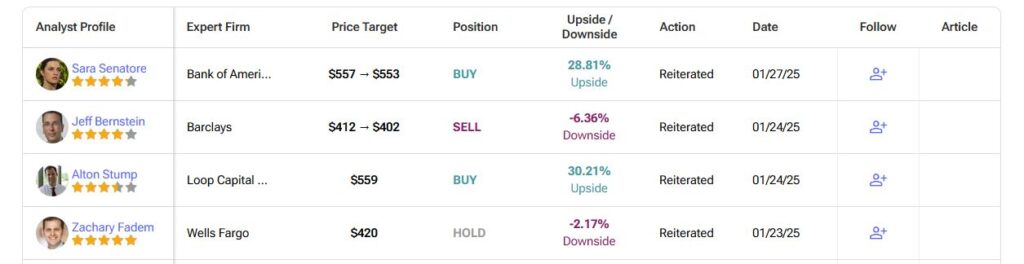

On Wall Street, DPZ earns a Moderate Buy consensus rating based on seven Buy, four Hold, and one Sell ratings assigned over the past three months. The average analyst DPZ stock price target of $482 per share implies a 12.3% upside potential from current price levels.

While Domino’s has been good to shareholders for many years, my concern is that much of the low-hanging fruit has been plucked. The stock trades at an uncomfortable market multiple with a below-market-average dividend yield.

While it is a strong company, there may be tastier morsels elsewhere…

Yum! Brands (YUM)

With a market cap of ~$37 billion, Yum! Brands is the largest of our three pizza titans by market capitalization. The sprawling conglomerate boasts over 59,000 restaurant locations in 155 territories. However, it should be noted that YUM is not a pure pizza-play like Domino’s and Papa John’s, considering that Taco Bell and KFC take up sizable chunks of YUM’s total portfolio. As the pizza brand, Pizza Hut is a major contributor, boasting over 19,750 restaurants in over 110 territories. In 2023, Pizza Hut generated $13.3 billion in total sales (contrasted with $63.8 billion for the entire company).

Yum! Brands has been a solid performer over the years, although its 10-year total return of 193% pales in comparison to that of Domino’s.

YUM stock trades at a discount to both Domino’s and the S&P 500, trading at 21.4x forward earnings estimates, a fairly middle-of-the-road valuation. Additionally, YUM exceeds both Domino’s and the broader market with a dividend yield of 2.1%.

On TipRanks, Yum! Brands currently features a Smart Score of 5, positioning the stock as NEUTRAL.

Is Yum! Brands a Good Stock to Buy?

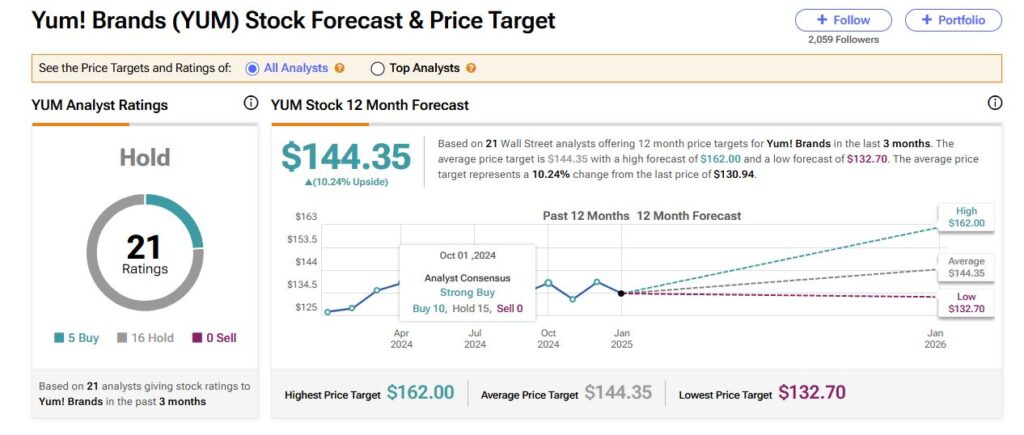

Market analysts have handed YUM a Hold consensus rating based on five Buy, sixteen Hold, and zero Sell ratings over the past three months. The average YUM stock price target of $144.35 per share implies more than 10% upside potential.

Yum! Brands is a solid company trading at a slight discount to Domino’s and the broader market, but it’s not enough of a discount to get excited about.

Meanwhile, its yield of 2.2% isn’t bad but isn’t high enough to make it a compelling investment opportunity from an income standpoint alone. It’s a decent stock, but the middling valuation, dividend yield, neutral Smart Score, and limited potential upside based on current analyst price targets suggest there are likely to be sweeter opportunities elsewhere, which brings us to the final stock in our gladiatorial pizza stock clash…

Papa John’s International (PZZA)

With a market cap of just $1.3 billion and a store count of about 6,000 across 50 territories, Papa John’s is by far the smallest pizza titan of the three. In fact, the company is more of a David among Goliaths than a titan.

The stock does not boast nearly the same long-term profile as its titanic peers, posting a total loss of 27.5% over the past decade. The company has suffered in recent times, too. PZZA’s share price has tumbled nearly 50% over the past year, down to ~$55 today. To provide some perspective, PZZA stock was trading above $130 per share after the pandemic in early 2022. But therein lies the opportunity.

While Domino’s and Yum! Brands have grown and matured on the back of low-hanging fruit and keep chugging along with fairly flat but consistent multiples. Papa John’s still has significant work to do, and investors have far more spare capacity to capitalize on.

Following some hard times, PZZA is currently executing a turnaround under a new CEO, which presents a value proposition for investors. In August last year, Papa John’s recruited former Wendy’s chief Todd Penegor to serve as the company’s new CEO. During Penegor’s time at Wendy’s, the burger chain achieved unsurpassed revenue and earnings growth while expanding its store count nationwide. Moreover, Penegor achieved 12 consecutive years of same-store sales growth and has outlined plans to repeat the trick at Papa John’s by simplifying its operations, revamping marketing, and better leveraging data and technology to drive performance.

Trading at just 16.6x forward earnings estimates, Papa John’s is comparatively cheap, with its valuation reflecting its recent struggles. Also, PZZA is significantly cheaper than the broader market, including Domino’s and Yum! Brands. The substantial discount makes Papa John’s the most appealing of the pizza titans, at least from a valuation perspective. PZZA is also the stock with the most upside potential of the three, given its younger stage of market maturity.

Papa John’s recent struggles also mean it has by far the highest dividend yield of the trio. While Domino’s and Yum! sport relatively pedestrian yields, Papa John’s boasts a spirited yield of 4.7%, substantially higher than its larger peers and the broader market.

On TipRanks, Papa John’s currently features a Smart Score of 8, positioning the stock as OUTPERFORM.

Is Papa John’s a Good Stock to Buy?

On Wall Street, PZZA carries a Moderate Buy consensus rating based on six Buy, seven Hold, and zero Sell ratings over the past three months. The average PZZA stock price target of $56.90 per share implies a 45% upside potential from current levels.

I’m bullish on Papa John’s based on its discounted valuation, high dividend yield, and the fact that the company is turning a new page with a new, experienced CEO wielding a successful track record. It’s also worth noting that with a market cap of just $1.3 billion, Papa John’s could be a tasty bite-sized acquisition for investors looking to add something stable yet consumer-related to their portfolio. Notably, PZZA stock rallied last year following speculation that Restaurant Brands (QSR) was eyeing a takeover.

From Crust to Cash Flow, Papa John’s Delivers Best

Domino’s Pizza and Yum! Brands have been strong stocks to varying degrees over the years, and I expect them to keep ticking along in the years ahead. However, their valuations, lower dividend yields, neutral Smart Scores, and muted average analyst price targets suggest they will be middle-of-the-road investment opportunities, at best, going forward.

On the other hand, Papa John’s has struggled in recent years and is now trading at bargain basement levels. Past struggles have forced the company to change, improve, and evolve into a healthy investment opportunity featuring the lowest valuation of the group and, by far, the highest dividend yield at 4.72%. The stock’s high Smart Score and analyst price target indicate a significant potential upside in the months and years ahead.

I particularly like that Papa John’s is now under fresh leadership that’s been field-tested with proven results. This factor alone suggests that the company is committed to establishing best practices and may find itself where Domino’s and Yum! are today in the not-so-distant future. Given the inexpensive valuation, substantial dividend yield, outperformative Smart Score, and compelling analyst price target, Papa John’s has earned its title as the Most Investable Pizza Stock of 2025.