Mutual funds find their way into almost every investor’s portfolio. Depending on their risk-reward appetite, the MF investments could form either a large or smaller portion of their holdings. Even so, for those investors who crave regular dividend income to meet their financial needs, a mutual fund that generates substantial dividend yields could present a potentially profitable opportunity. This approach offers a safer long-term investment with a lower risk tolerance while also delivering passive income.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Today, we will look at three mutual funds that boast high dividend yields, offer a potential upside of over 15% in the next twelve months, and have an “Outperform” Smart Score of eight.

Vanguard High Dividend Yield Index Fund Admiral Shares (VHYAX)

The VHYAX fund seeks to invest in U.S. companies that have a history of paying larger-than-average dividends to shareholders. This also means that the fund’s investments are focused on high-yielding companies with a lower risk profile and slower growth.

Notably, VHYAX pays a quarterly dividend of $0.23 per share, reflecting a current yield of 2.98%. As of date, VHYAX has 462 holdings with total assets of $63.04 billion. A major focus of the fund remains in the Financial sector, followed by Consumer Defensive stocks.

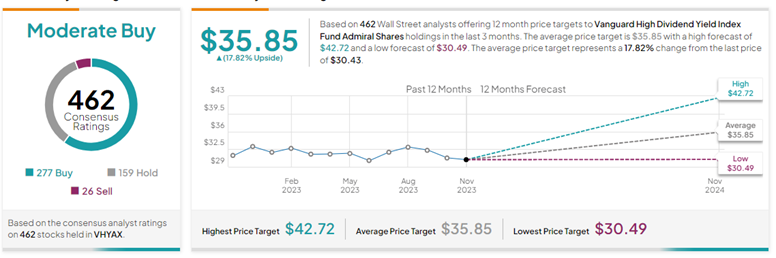

On TipRanks, VHYAX has a Moderate Buy consensus rating. This is based on the consensus rating of each stock held in the portfolio. Hence, of the 462 stocks held by VHYAX, 277 have Buys, 159 have Holds, and 26 stocks have a Sell rating. The average Vanguard High Dividend Yield Index Fund Admiral Sh price target of $35.85 implies 17.8% upside potential from current levels.

Year to date, VHYAX has lost 2.5%. Its top five major holdings include JPMorgan Chase (JPM), Johnson & Johnson (JNJ), Exxon Mobil (XOM), Procter & Gamble (PG), and Broadcom (AVGO). The top 10 holdings account for 24.89% of the portfolio.

Columbia Dividend Opportunity Fund Class A (INUTX)

The INUTX fund invests in companies that have historically paid consistent and increasing dividends. The primary objective of the fund is to focus on the generation of substantial current income, with the secondary goal being capital growth. INUTX also pays a regular quarterly dividend of $0.24 per share, representing an impressive current yield of 3.42%.

The mutual fund has 82 holdings, focused mainly on the Financial and Healthcare sectors. The fund has $2.28 billion in assets, with the top ten holdings accounting for 32.56% of the portfolio.

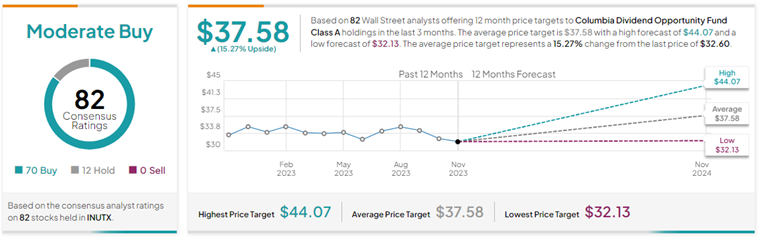

On TipRanks, INUTX has a Moderate Buy consensus rating. This is based on 70 stocks with a Buy rating and 12 stocks with a Hold rating. The average Columbia Dividend Opportunity Fund Class A price target of $37.58 implies 15.3% upside potential from current levels.

INUTX has lost 4.1% so far this year. Its top five major holdings include Exxon Mobil, JPMorgan Chase, Broadcom, Procter & Gamble, and Johnson & Johnson.

Vanguard Equity Income Pt (VEIPX)

The VEIPX fund invests in companies that offer above-average levels of dividend income. Remarkably, VEIPX pays a quarterly dividend of $0.26 per share, with a current dividend yield of 2.52%.

The fund has 194 holdings with total assets of $53.90 billion. A major focus of VEIPX remains in the Financial sector, followed by Healthcare. Its top 10 holdings account for 23.58% of the portfolio.

On TipRanks, VEIPX has a Moderate Buy consensus rating. This is based on 153 stocks with a Buy rating, 40 stocks with a Hold rating, and only one Sell rating. The average Vanguard Equity Income Pt price target of $47.47 implies 21.6% upside potential from current levels. Year to date, VEIPX has lost 1.1%. Its top five major holdings include JPMorgan Chase, Johnson & Johnson, Pfizer (PFE), Merck (MRK), and ConocoPhillips (COP).

Key Takeaways

Every investor seeks to earn at least some amount of regular income, be it a high-risk reward investor or a passive investor. Rightly so, mutual funds that generate handsome dividends like the three discussed above should be part of your portfolio. TipRanks has a variety of tools to help you undertake thorough research to find the best stocks and mutual funds. Try it today!