In this piece, I evaluated two airline stocks, Delta Air Lines (NYSE:DAL) and American Airlines (NASDAQ:AAL), using TipRanks’ Comparison Tool below to see which is better. A closer look suggests a bullish view for Delta and a bearish view for American Airlines.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Both companies are major U.S. airlines, although American also provides freight and mail services in addition to passenger air travel, while Delta operates through its Airline and Refinery segments.

Shares of Delta Air Lines have climbed 33% year-to-date and are up 59% over the last 12 months, while American Airlines stock is up 9% year-to-date and 5% over the last 12 months.

With such a dramatic difference in the airlines’ share-price performances, a closer look is needed to determine whether there may still be upside left in Delta’s shares — and if AAL is now undervalued after Delta’s recent run. We’ll compare their price-to-earnings (P/E) ratios to gauge their valuations against each other and that of their industry.

Notably, the airline industry is trading at a trailing P/E of 13.2x. Over the last three years, the airline industry has been averaging negative earnings, although it continues to trade close to its three-year average price-to-sales ratio of 0.86x.

Delta Air Lines (NYSE:DAL)

Despite its year-to-date rally, Delta Air Lines is trading at a steep discount to its industry. Delta’s P/E of 6.8x, its outstanding earnings results, and strong momentum suggest this stock is too cheap to ignore, calling for a bullish view.

Delta’s valuation has been marching steadily downward since January 2023, when it was trading at a P/E of around 19x. While the stock was richly valued then, the airline has made progress on several fronts, and much of this progress doesn’t appear to be priced in yet despite the year-to-date rally.

Delta posted blow-out results for the first quarter, smashing estimates with adjusted earnings of 45 cents per share on $13.75 billion in revenue versus the consensus numbers of 37 cents per share on $12.51 billion in revenue. Unadjusted net profits came in at six cents per share or $37 million, a vast improvement from losses of 57 cents per share or $363 million a year ago.

Several analysts boosted their price targets for the airline following this earnings report. Delta continues to benefit from renewed commercial air travel and the higher margins in its thriving Premium Services business. The airline is also starting to work off some of the debt it accumulated during the pandemic, and it continues to benefit from its loyalty program.

Looking forward, Delta expects travel demand to remain robust during the current quarter, driving a 5% to 7% year-over-year increase in revenue. For the current quarter, the airline expects earnings of $2.20 to $2.50 per share versus expectations of $2.23 per share. Delta also expects full-year earnings of $6 to $7 a share, also higher than what analysts had been expecting.

Additionally, Delta enjoys some benefits that other airlines don’t have. Delta was one of a very small number of airlines to post a profitable first quarter. Additionally, it’s the only airline with non-unionized labor, according to HSBC (NYSE:HSBC), which may be giving it a leg up in the area of expenses as the travel industry continues to recover from the pandemic.

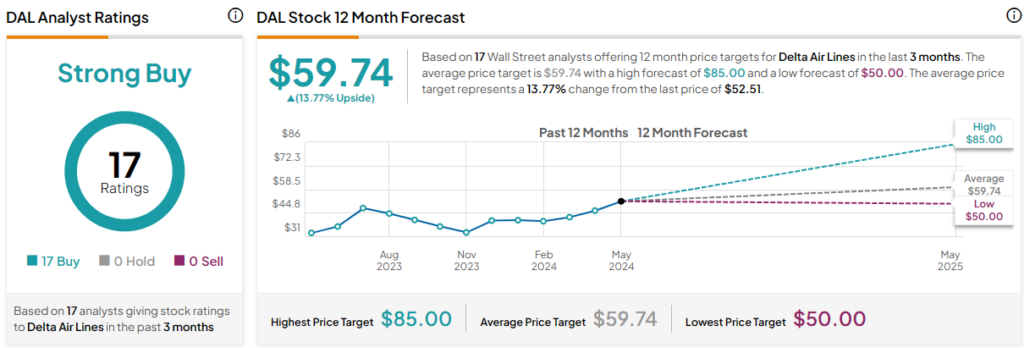

What Is the Price Target for DAL Stock?

Delta Air Lines has a Strong Buy consensus rating based on 17 Buys, zero Holds, and zero Sell ratings assigned over the last three months. At $59.74, the average Delta Air Lines stock price target implies upside potential of 13.8%.

American Airlines (NASDAQ:AAL)

At a P/E of around 24.2x, American Airlines is trading at a steep premium to its industry. However, its first-quarter earnings release was disastrous, albeit pretty typical of the airline industry currently. In fact, the airline revised its guidance to the lower end of its previously provided range before the first-quarter release. High debt levels complete a bearish view for the airline.

Unlike Delta, American Airlines posted a loss for the first quarter, as did most other airlines. Adjusted losses came in at 34 cents per share on $12.57 billion in revenue, worse than the consensus expectations of 27 cents per share in losses on $12.6 billion in revenue. Also, unadjusted net losses amounted to 48 cents a share or $312 million.

For the current quarter, American Airlines expects adjusted earnings of $1.15 to $1.45 per share for the second quarter and adjusted earnings of $2.25 to $3.25 per share for the full year.

Although AAL has been making progress on its debt, trimming about $950 million of it during the first quarter, it still has much further to go than Delta. At the end of 2023, American Airlines had over $32 billion in net debt, an amount that’s been somewhat stable over the last several years. The question now is whether it has turned a corner because its net debt fell under $31 billion after the latest quarter. It hasn’t been that low since 2019.

Unfortunately, though, American Airlines began facing another round of strikes in early May as flight attendants pushed for higher wages. The federal government has not yet given permission for that strike, which is required for airline workers, although the airline’s talks with the union are said to be progressing.

Importantly, AAL is already facing wage pressure from the recent deal to give its pilots higher pay, which could mean increased fares and fees for travelers as the airline struggles to turn a profit.

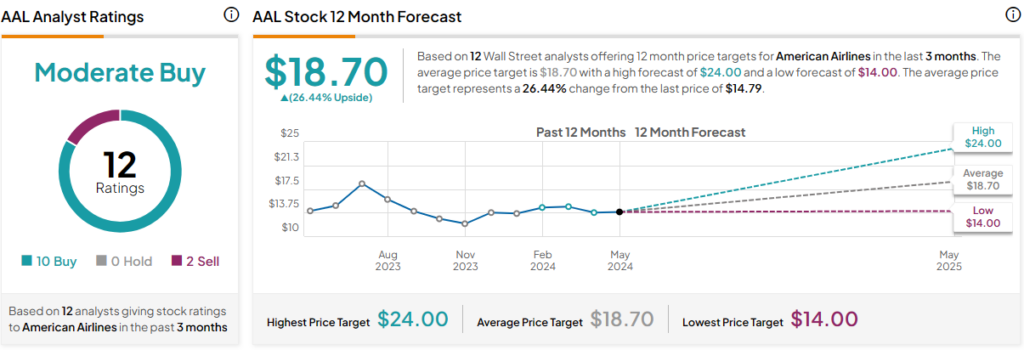

What Is the Price Target for AAL Stock?

American Airlines has a Moderate Buy consensus rating based on 10 Buys, zero Holds, and two Sell ratings assigned over the last three months. At $18.70, the average American Airlines stock price target implies upside potential of 26.4%.

Conclusion: Bullish on DAL, Bearish on AAL

While the travel industry as a whole took a major hit during the pandemic-era lockdowns, it appears as if Delta Air Lines is significantly further ahead in its recovery than American Airlines, making Delta the clear winner of this pairing.

Zooming out to their long-term share price performances reveals that Delta wins there, too. Ironically, Delta stock is up by roughly the same percentage as American Airlines has fallen over the last 10 years (+56% for DAL, -58% for AAL).