Coupang (CPNG) stock had a strong listing in March 2021. It was a period when e-commerce stocks were doing well, as the pandemic accelerated online shopping.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, the positive momentum for CPNG stock fizzled out relatively soon. What followed was a sustained period of downtrend for the stock. The sell-off seems to have accelerated, with CPNG stock declining by 57% in the last six months.

At around $13 per share, Coupang stock seems to trading at attractive levels. I believe that the stock is poised for a reversal rally, and am therefore bullish.

Reasons for the Stock Decline

Let’s look at the factors that triggered the sharp correction.

First and foremost, the pandemic period was characterized by healthy growth for e-commerce companies. With the markets discounting a relatively lower post-pandemic growth scenario, the stock has corrected.

Furthermore, Coupang stock maintains a healthy growth trajectory. However, cash burn has sustained for the company. This is another factor that has impacted the stock sentiment.

However, it seems that the stock has more than discounted growth and profitability concerns.

Positive Industry Outlook

It’s worth noting that even if an industry has multi-year tailwinds, there can be short-term challenges. As an example, the EV industry faces near-term headwinds of chip shortages, and raw material price inflation.

In a post-pandemic era, the e-commerce industry faces the challenge of relatively lower growth. Coupang is not the only stock that has corrected in the recent past. Most e-commerce stocks have been discounting relatively lower growth.

Having said that, the industry outlook is robust for the long term. For 2022, the global e-commerce market is expected to be worth $5.55 trillion. Online purchases will constitute 21% of the total retail sales in 2021. This number is expected to swell to 24.5% by 2025.

Clearly, the industry will continue to grow. The market overreaction therefore presents a good opportunity.

Coupang seems to be among the attractive investment options.

Growth Likely to Sustain

For 2021, Coupang reported revenue growth of 54% to $18.4 billion. The company has not provided any revenue guidance for 2022. However, it seems likely that growth will decelerate.

At the same time, I don’t expect a very significant decline in growth because of the following factors.

Coupang estimates that total online shoppers in Korea are 37 million. Currently, the company has an active customer base of 18 million. Therefore, there is a significant market that can be captured in the coming years. In 2021, Coupang added 15 million square feet of infrastructure. Overall infrastructure ramp up will help in adding new customers.

In January 2022, it was reported that Coupang plans to start its logistics business with a strong network, and aggressive investments. CJ Logistics, the market leader in Korea, has been losing market share and Coupang seems positioned to make inroads.

As of December 2021, Coupang reported cash and equivalents of $3.5 billion. This provides ample headroom for aggressive investments and growth in the logistics segment.

Coupang has also been expanding into international markets to boost its growth. The company already has presence in Japan and Singapore. It’s likely that Coupang will enter the attractive Southeast Asian market in the coming years. As the addressable market expands, Coupang is positioned for sustained growth.

EBITDA Margin Improvement Likely

Coupang stock has also been depressed with widening cash burn. For 2020, the company reported adjusted EBITDA loss of $357 million. However, for last year, losses widened to $748 million.

However, it seems that the worst is over in terms of cash burn. For the current year, the company has guided for adjusted EBITDA loss of $400 million. At the same time, Coupang expects long-term EBITDA margin to be in the range of 7% to 10%.

Gradual margin improvement is on the cards considering the following factors.

First, for 2021, the average annual customer spend increased by 30% for every annual customer cohort dating back to the oldest in 2010. As average revenue per customer increases, it will have a positive impact on the margin.

Further, in 2021, the company’s paid WOW members approached 9 million. With WOW membership providing discounts, same-day delivery, and travel discounts, among others, it’s likely that members will continue to swell. Growth in recurring revenue is another factor that will support margins.

Overall, Coupang expects product commerce adjusted EBITDA to be profitable by Q4 2022. If this guidance holds, CPNG stock is likely to trend higher.

Wall Street’s Take

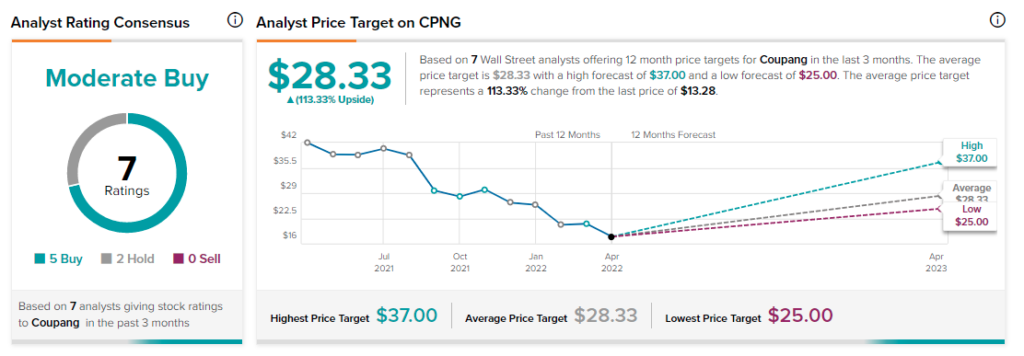

Turning to Wall Street, Coupang has a Moderate Buy consensus rating, based on five Buys and two Hold ratings assigned in the past three months. The average Coupang price target of $28.33 implies 113.3% upside potential.

Concluding Views

Coupang stock has been punished by investors with growth and profitability concerns. However, markets tend to overreact on both sides. It seems that the stock is oversold at current levels.

The Korean market is the third-largest e-commerce opportunity globally. It’s too early to write off Coupang. The company expects EBITDA margin improvement, and is pursuing international expansion for growth. Coupang also has a strong balance sheet to sustain near-term cash burn. The financial risk is therefore low.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure