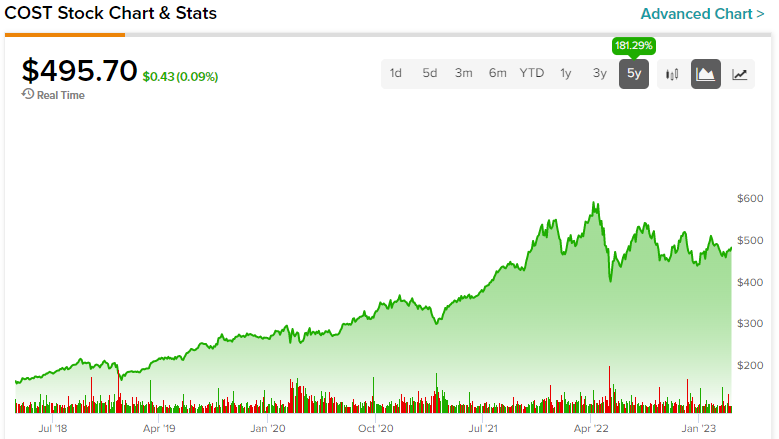

Value retailer Costco (NASDAQ:COST) has produced handsome and consistent returns for its investors, and its share price has almost tripled over the past five years, even though it’s currently trading about 19% lower than its all-time high. What sets Costco apart from its peers is its sturdy business model that provides value offerings to its customers that are mostly unmatched. With the likelihood of higher membership fees directly adding to the bottom line in the future and the possibility of a higher dividend or a special dividend, I’m bullish on the stock.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Resilient Business Model in Uncertain Times

Costco has a resilient business model that has stood the test of time, especially in periods of macro uncertainty. In an inflationary environment, consumers usually move away from buying discretionary items. In such times, Costco’s value offerings come to the rescue.

Further, Costco’s subscription model is incredibly enticing. For an annual fee, members get great deals on a wide variety of products ranging from a wide variety of consumables to pharmacies to even gasoline. It is no wonder, then, that Costco has consistently grown its member count over the years. As recession fears increase, current customers should continue to stay, while newer customers should keep coming due to Costco’s value proposition.

In addition, Costco’s unique membership model allows it to sell merchandise at lower margins compared to other big-box retailers. Notably, over the past 10 years, the company’s revenues and earnings have more than doubled. As well, while many retailers have seen a deceleration in revenues since the pandemic, Costco reported comparable growth of 6.8% in its fiscal Q2 results, and it topped earnings expectations (although it lagged revenue expectations slightly).

Moreover, the company continues to add to its store count, with 848 warehouses now compared to 830 reported a year ago. Additionally, the company has high renewal rates (92.6% in the U.S./Canada and 90.5% in international regions). While sales growth for big-ticket, discretionary products has slowed down recently, sales of necessities like food and medicine have remained resilient.

A Potential Membership Fee Hike will Act as a Tailwind

There is a high likelihood that Costco will increase its membership fee in the coming months. According to five-star-rated UBS (NYSE:UBS) analyst Michael Lasser, membership fees generally see an upward revision every five years and seven months. For reference, the last membership hike was made in June 2017.

Due to the current macro situation, the company may wait a few months before doing that. But eventually, a hike looks imminent in the near term. Higher membership fees will immediately lead to higher revenues and profitability.

Higher Dividend Imminent in 2023

Costco has consistently grown its quarterly dividend over the past 20 years at a compound annual growth rate (CAGR) of 13%. However, despite the regular hike in dividends, COST’s current dividend yield stands at only 0.73%. Nonetheless, its current payout ratio of 26.4% is sustainable and allows for more hikes.

It’s important to note that the company also has a strong record of rewarding its shareholders with special dividends over and above its regular quarterly dividends. In fact, Costco has paid four special dividends in the last 10 years. The last special dividend of $10 per share was paid out in December 2020, suggesting that another one could be coming in the near future — or at least another dividend hike.

This belief is backed by Costco’s strong balance sheet and robust cash flows. As of its most recent report, Costco had a cash position of $13.7 billion.

On top of that, in January, Costco announced a share repurchase program of $4 billion, valid until January 2027. This means that the company may reduce around 2% of its outstanding shares over the coming years, adding value for its shareholders. During Fiscal 2022, the company bought back $450 million worth of shares.

Is Costco Stock a Buy, According to Analysts?

The Wall Street community is clearly optimistic about the stock. Overall, Costco stock commands a Strong Buy consensus rating based on 17 Buys and five Holds. The average COST stock price target of $553.52 implies 12% upside potential from current levels

Costco Stock’s Valuation is Expensive but Justified

In terms of its valuation, Costco has mostly traded at a premium to its peers. Nonetheless, the premium is justified given its resilient organic comparative sales growth, sturdy economies of scale, and steady growth in its revenues and earnings over the years.

Currently, it’s trading at a P/E ratio of 35.9x, which is much higher than its peer group average of 19x. For reference, Target (NYSE:TGT) is trading at a P/E of 26x, while Walmart (NYSE:WMT) is trading at an over 32x P/E.

However, compared to its own five-year historical average P/E of 37.5x, the current valuation reflects a 4% discount.

Conclusion: Consider Buying Costco Stock

In times of tightened consumer spending like now, a big-box retailer like Costco, with its attractive value offerings, could emerge as a strong market-share gainer. On top of that, the company has additional tailwinds, such as a probable hike in its membership fee and an increase in its dividend. Therefore, I will buy the stock at its current levels.