While all eyes are on AI-powered tech stocks, stable and recession-resilient consumer stocks like Costco Wholesale (NASDAQ:COST) are being overlooked. This low-cost warehouse chain retailer has seen its revenue and earnings grow amid challenging conditions while scaling up its operations worldwide, making Wall Street optimistic that it will continue to thrive. While COST appears to be overpriced now, some analysts believe its defensive growth profile justifies its valuation. Like most analysts, I’m bullish on Costco stock.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

During periods of economic uncertainty, many businesses see significant dips in revenues. However, Costco has maintained steady revenue growth even in challenging times, which is probably why its stock has gained 21.5% year-to-date, outperforming the S&P 500’s (SPX) 9.5% gain.

September Retail Sales Results Were Strong

Recently, Costco reported impressive sales for the retail month of September. For the five weeks ended October 1, net sales came in at $22.75 billion, up 6% year-over-year.

Comparable sales were up 4.5%, with sales growth in Canada and other international markets offsetting the decline in sales from the U.S. market. The company’s comparable E-Commerce sales grew by 3.7%. Costco’s management stated that higher gasoline prices pushed the company’s same-store sales by around 0.5% in September.

In addition to selling goods in bulk at a low price to its members, Costco makes money from its self-service gas stations, located both domestically and abroad.

Costco’s global expansion has allowed it to reduce its reliance on any single market. It opened 23 net new units in Fiscal 2023. For Q1 Fiscal 2024, it plans to open another 10 net new units.

For Fiscal 2023, Costco’s revenue grew by around 9% to $242.3 billion. Net income for the same period came in at $6.3 billion, or $14.16 per diluted share.

Its Membership-Based Business Model is a Big Growth Driver

One of the company’s key strengths is its membership-based business model. Customers who join Costco pay an annual fee and gain access to exclusive deals and discounts. The model not only generates a consistent stream of revenue but also garners customer loyalty. During periods of market volatility, consumers often look for ways to save money, making Costco memberships even more appealing.

In Q4, income generated from membership fees came in at $1.5 billion, an increase of 14% year-over-year.

When compared to other retailers, Costco offers more affordable rates on a wider range of merchandise categories. These deals help boost its membership renewal rates every quarter. Costco’s membership renewal rates in the U.S. and Canada came in at 92.7% at the end of Fiscal Q4 and 90.4% globally.

In the last five years, Costco’s revenue and earnings have grown at a compound annual growth rate of 11.3% and 15%, respectively.

Furthermore, Costco’s resilience can also be seen in how quickly it has adapted to a rapidly changing retail landscape via its online platforms.

Costco Stock: Wall Street is Overwhelmingly Bullish

Soon after its Q4 results, Argus Research applauded Costco’s management for valuing customer relationships by not raising membership fees at a difficult time when U.S. consumers are already facing the challenge of rising inflation. Costco’s ability to distinguish itself through “consistent growth and high relevance to value-conscious customers” impressed the research firm. It raised the target price for COST to $650 from $630 with a Buy rating.

Meanwhile, Bank of America Securities analyst Robert Ohmes believes Costco’s productivity is being driven by the growth of its private label brand, Kirkland, and the expansion of its fresh products section. Ohmes also stated that holiday sales seem promising, and September’s results demonstrated Costco’s continued strong performance.

Costco’s other strengths that impressed the analyst were “strong membership trends, the company’s ability to capitalize on digital opportunities, and its competitive advantages from a global sourcing model.” The analyst has a Buy rating with a price target of $610.

What’s more, Robert W. Baird noted that while Costco’s September comparable sales growth of 3.7% came in lower than that of August’s 4.1%, it remained “solid in the face of disinflation.” The firm believes Costco’s defensive growth profile is “worth” its “35-times next-12-month’s expected earnings multiple.” The firm has a Buy rating with a $600 price target on Costco.

No doubt, Costco is expensive compared to its peers in the industry. However, I also believe Costco’s business track record, profitable membership model, and ability to expand globally while growing profits justify its current overvaluation.

Looking ahead, Costco’s offerings of high-quality products at competitive prices are unlikely to fade anytime soon. Therefore, for its Q1 2024, analysts predict Costco to report revenue of around $58 billion, while earnings per share (EPS) are expected to reach $3.40.

Also, for Fiscal 2024, analysts expect an EPS growth of around 10.8% year-over-year to $15.69. Further, revenue for the year could see a jump to $254.0 billion from $242.3 billion in Fiscal 2023.

Is Costco Stock a Buy, According to Analysts?

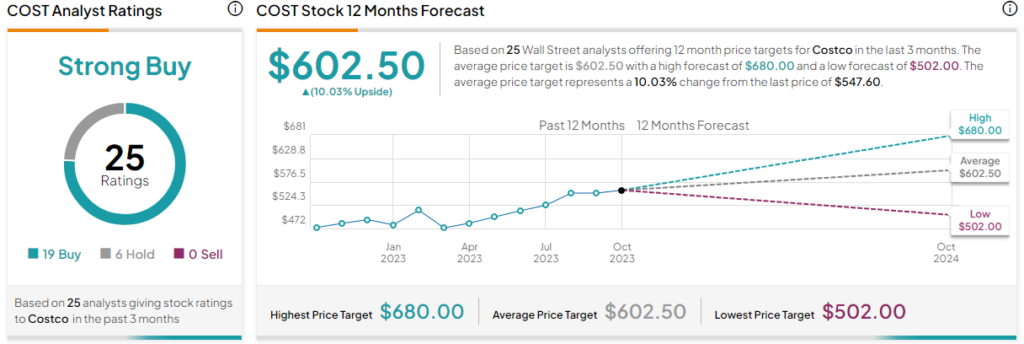

Turning to Wall Street, TipRanks rates Costco as a Strong Buy, with 19 Buys, six Holds, and no Sell ratings assigned in the past three months. The average COST stock price target of $602.50 implies 10% upside potential. The highest price target for the stock stands at $680, while the lowest is at $502 per share.

The Bottom Line for Costco

All in all, Costco Wholesale is a classic example of resilience that has proven its ability to weather economic storms and continue thriving. Its stable revenue growth, smart membership model, cost control, e-commerce expansion, and global presence attest to its ongoing success. Therefore, I share Wall Street’s enthusiasm for this compelling consumer stock now.