Cryptocurrencies and Web 3.0 is increasingly become a part of our reality. Despite best efforts by regulators to slow momentum, decentralization is upon us here to stay. It is why I’m quite bullish on crypto stocks which includes Coinbase (COIN).

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Coinbase is the leading cryptocurrency exchange platform in the United States and has operations worldwide. The company provides a safe and regulation-compliant point of entry for retail investors and institutions into the cryptocurrency economy.

Users can use Coinbase to buy and sell crypto and the company also acts as a custodian for cryptocurrency, giving the company breadth beyond that of a traditional financial exchange. The company generates most of its revenue from transaction fees charged to customers. (See Analysts’ Top Stocks on TipRanks)

Leading Crypto Exchange

What makes exchanges like Coinbase attractive is that as in intermediary, it is not dependent on high crypto prices. In fact, the company benefits when there are large dips as well because that means an increase in volatility and subsequently volume on the exchange. More volume equals more revenue.

As of last check, the company has over 73 million users across 100 countries. Last quarter, $327 billion in crypto volume was traded on its platform. The company isn’t just a crypto exchange, as its subsidiary Coinbase Ventures is investing in projects across the Web 3.0 spectrum.

That includes spaces such as DeFi, Web 3.0 infrastructure, Developer tools, CeFi and NFT/Metaverse. It is the latter that is exciting and that is likely to drive the next phase of growth for Coinbase.

NFT Marketplace

In early October, Coinbase announced plans to launch a peer-to-peer NFT marketplace. From minting to purchasing and selling, the news made waves in the NFT space.

At the moment OpenSea is the largest NFT platform in the world. While there are smaller niche platforms, no Ethereum platform comes close to its reach and scale. As such, OpenSea effectively has a monopoly on the NFT space.

The business model is simple, OpenSea charges a fee to buy and sell NFTs on its platform and recently, it crossed the $10-billion total volume mark. This notable achievement came just a few months after hitting $1 billion in total volume.

Early Stage Industry

The NFT boom is upon us and despite this, we are still very much in the early stages on the industry. In June, it was reported that only 2% of Americans bought or sold NFTs and 66% had never heard of NFTs. While this has likely changed over the past few months, we are still talking very small numbers.

In fact, OpenSea has less than 650,000 users on its platform. Furthermore, according to NonFungible there were only around 250,000 active wallets over the past month with a total NFT sales volume of $1.8 billion. This is just the beginning.

Part of why NFTs have been slow to gain traction is related to the complexities around minting and trading NFTs. Coinbase’s NFT marketplace can be a game changer.

With 73 million users on its platform, Coinbase can introduce NFTs to the masses. In fact, 24 hours post-announcement, it was estimated that more than 1.35 million users signed up to become users of the yet-to-launch NFT platform. Already, that is more than double the number of OpenSea users.

Furthermore, if it can make the NFT process much simpler, it will be just a matter of time before its platform eclipses OpenSea to become the largest NFT marketplace in the world.

NFT Projects have been lining up to be included in Coinbase’s early access and this platform has the potential to be a high-margin endeavor for the company.

How big can the NFT marketplace become? According to Coinbase’s CEO, it has the potential to be “as big or bigger” than its crypto business.

Wall Street’s Take

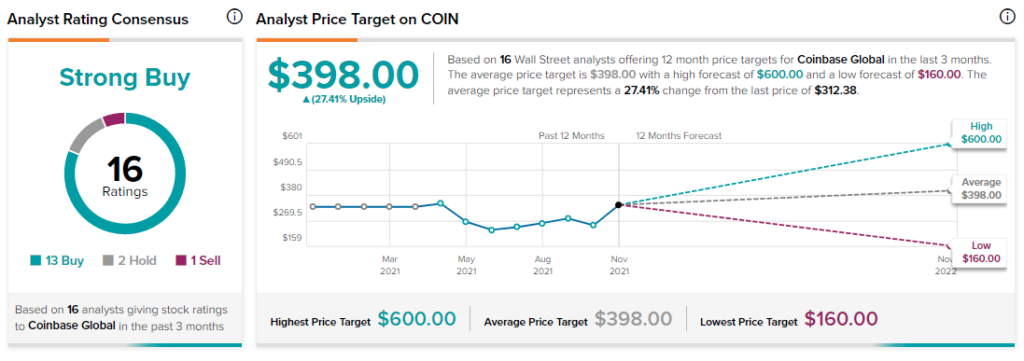

From Wall Street analysts, Coinbase earns a Strong Buy analyst consensus based on 13 Buy ratings, two Hold ratings, and only one Sell rating.

The average Coinbase price target of $398 puts the upside potential at 27.4%.

Disclosure: At the time of publication, Mat Litalien did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >