Citigroup (NYSE:C) recently reported its Q1-2023 results, which I’ll discuss in detail in this article. The bank had a strong start to 2023, with revenue developments outpacing initial 2023 expectations. On top of that, one-off gains on disposals boosted results. Notwithstanding the positives, profitability fell short of medium-term goals. That said, the valuation remains undemanding, the company is on track to outpace its 2023 guidance, and I think the shares are worth buying at the moment.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Tailwinds on Citi’s Back

Citigroup benefits from multiple tailwinds, some of which are valid for all of the big banks, while others are more Citi-specific.

Big bank tailwinds to mention are, first and foremost, the distress at small regional lenders. As the calamity with Silicon Valley Bank happened at the end of the quarter, the full effects of liquidity flowing to the top four lenders will become visible as the year progresses.

The other big-bank tailwind to mention is dollar weakness. The U.S. dollar, as measured by the U.S. dollar index, is down 2.7% on a year-to-date basis, which boosts reported results. That’s because big U.S. banks derive a larger portion of their income overseas, as opposed to regional lenders. Citigroup, albeit divesting some non-core businesses, still has above-average overseas exposure.

Citigroup-specific tailwinds are positive operating leverage in the first quarter, as opposed to expectations for negative operating leverage when guidance was initially issued. Furthermore, high retained earnings and the Mexican retail bank on its books for longer (a business which it intends to sell) mean higher earnings capacity for the bank. Now, let’s dive into Citigroup’s operations.

Operational Overview

Citigroup reports results in four main operating segments: Institutional Clients Group at 52.4% of Q1-2023 revenues, Personal Banking and Wealth Management at 30% of revenues, Legacy Franchises at 13.3%, and Corporate/Other at 4.3% of revenues. Let’s analyze how major segments performed.

Institutional Clients Group saw revenues rise 1% year-over-year, below the 4% increase in expenses. For comparison, revenue growth was 3% in 2022, while expenses increased by 10%. Despite the negative operating leverage, Q1 net income increased 23% year-over-year, driven by provision releases. Return on tangible common equity (RoTCE) was 13.8% (11.1% in 2022).

Personal Banking & Wealth Management revenue and expenses both increased 9% year-over-year (2022 revenues grew 4% while expenses increased 11%). However, credit costs were a significant drag on Q1 performance, with growth in revolving card balances, macroeconomic deterioration, and a prudent reserve build all contributing negatively. As a result, RoTCE was 5.5% in the quarter (2022 10.2%).

Legacy Franchises was the main outlier in the quarter, with a $1.06 billion gain from the India consumer business sale boosting results. Vietnam operations were also sold in the quarter. The largest remaining country slated for exit is Mexico, accounting for 46.4% of the Legacy Franchise’s Q1-2023 revenues.

For the bank as a whole, Q1 revenues increased 12% year-over-year, or 6% excluding divestments, ahead of the 5% increase in 2022. Operating leverage was marginally positive, with expenses excluding divestments up 5%. RoTCE came in at 10.9%, or 9.3% when excluding divestment gains (8.9% in 2022). Further, tangible book value was up 3.1% quarter-over-quarter to $84.21/share, and earnings per share were $2.19/share in Q1, up 8% year-over-year.

Citigroup Securities Portfolio Looks Manageable

Following the asset-liability mismatch at Silicon Valley Bank, investors place increased scrutiny on the securities portfolio held by banks.

Relative to Q4, both available-for-sale (AFS) securities (gains and losses on these securities are recorded quarterly through other comprehensive income) and held-to-maturity (HTM) securities (gains and losses on these are not recognized until maturity) decreased on an absolute level. AFS securities were down 4%, while HTM securities, which made up about 10.8% of all Citigroup assets, decreased by 1.9%. The duration (a measure of interest rate sensitivity) was two years for AFS securities and four years for HTM securities.

Still, against the Federal Reserve’s expectations for slightly higher/flat interest rates over the remainder of 2023, the securities portfolio should prove manageable, as interest rate stability can help minimize fluctuations on the bank’s AFS and HTM securities.

Citigroup’s Capital Position Improved

Citigroup’s CET1 ratio (which looks at a bank’s capital relative to its assets) finished Q1 at 13.4%, up 0.4% or 40 basis points quarter-over-quarter. The main driver for the increase was retained earnings at 29 basis points. Meanwhile, the bank’s payout ratio at just 23% underscores the focus management has on building capital buffers.

The CET1 of 13.4% represents a 1.4% capital buffer relative to Q1-2023 regulatory requirements.

2023 Outlook — Unchanged

Citigroup made no updates to its 2023 outlook, with the caveat that the revenue number excludes gains on divestitures. Citigroup expects the following:

- Revenues of $78 billion-$79 billion, or growth of 3.6%-4.9% over 2022

- Expenses of $54 billion, or growth of 5.3% over 2022

Judging by Q1-2023’s performance, I think the bank is on track to beat this outlook, with revenue developments outpacing anticipated expense headwinds.

However, the bank targets a return on tangible common equity of 11%-12% in the longer term. Even with one-off gains recorded in 2023, Citigroup will likely fall below the target range this year.

Is Citigroup Stock a Buy, According to Analysts?

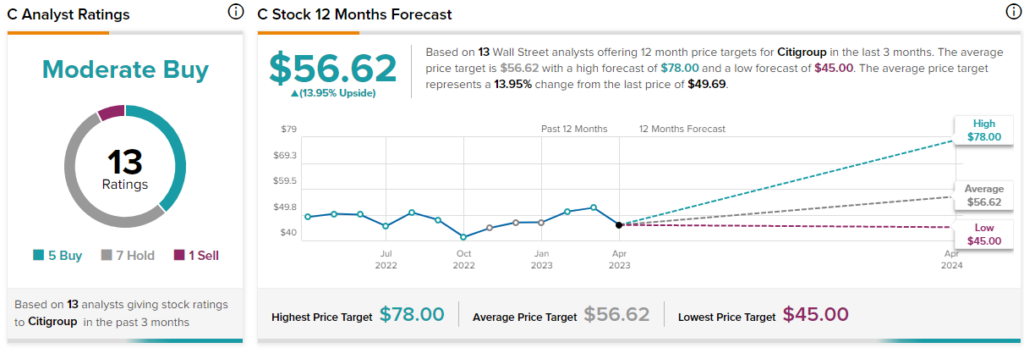

Turning to Wall Street, Citigroup earns a Moderate Buy consensus rating based on five Buys, seven Holds, and one Sell rating. Additionally, Citigroup stock’s average price target is $56.62, implying 13.95% upside potential.

The Takeaway

Citigroup management is taking a cautious approach — they did not boost their revenue guidance range despite a strong start to the year. The company’s capital position is also being strengthened, helped by the low payout ratio. Last but not least, provisions are being built to cover yet unrealized credit losses.

As soon as there is further clarity on the economic front, we can expect Citigroup to increase its payout ratio. That said, work remains to be done for the bank to reach its medium-term profitability aspirations.

Catalysts for the shares in the remainder of the year should be the finalization of its Mexico retail business exit, which is the biggest single contributor in the Legacy Franchises segment, a weak dollar, operating leverage, and a resumption of the share buyback given the large discount relative to tangible book value (0.6x price/tangible book ratio).