Oil stocks are looming in deep uncertainty as oil and gas prices continue their downward spiral after peaking last year. Indeed, 2022 was one of the best years for the American multinational energy stock Chevron (NYSE:CVX). It outperformed the benchmark indices last year, gaining around 40%. However, the stock is down over 10% year-to-date. The recent jitters in banking stocks have also led to further weakness.

However, with humungous buybacks coming up in the near term, a strong long-term growth outlook, and a reasonable valuation, I’ll keep a close eye on CVX in the coming months. I will buy the stock on further downward price movements to maximize long-term returns. I am neutral on the stock for now.

Increased Buybacks & Dividends Backed by Growing Free Cash Flows

Despite a weak economy and falling energy prices, Chevron increased its share buyback guidance range to $10 billion – $20 billion per year at its Investor Day held on February 28. This means that the company will likely reduce 3% to 6% of its total shares outstanding per year, creating value for shareholders.

Markedly, within a span of one year, CVX has increased its annual buyback outlook three times. Also, strikingly, the increased buybacks came about a month after the company tripled its buyback program to $75 billion (~25% of the current market cap) along with its Q4 earnings reported on January 2023. Note that the buyback program does not have an expiration date.

On top of that, Chevron has consistently grown its quarterly dividend at a compounded annual growth rate (CAGR) of more than 5% between 2017 and 2022. Further, despite a tough economic environment, on January 25, the company increased its quarterly dividend by 6.3% to $1.51 per share. CVX’s current dividend yield is attractive at 4% and is superior to its peer group average of 3%. Its payout ratio of 30.6% is also sustainable.

And believe it or not, the company has ample cash flows to support the dividends and buybacks. During 2022, the company registered a free cash flow yield of 12.6% of the current market cap, which is very impressive ($37.6 divided by $293 billion). In fact, CVX expects to achieve 10% growth in free cash flow this year, based on an assumed Brent crude oil price of $60 (lower than the current price of $74).

Overall, in 2022, the company returned $22.3 billion to shareholders via dividends and buybacks. This implies a solid return of around 7.5% of the current market capitalization of $298 billion. Importantly, the returns to shareholders were achieved even after spending $12 billion in capital expenditures during the year, which is extremely commendable.

Chevron Raises Multi-Year Production Growth Outlook

Thanks to increased pressure from the U.S. government to move production back to the U.S., oil companies are making increased investments to produce more oil domestically. On February 28, the company announced that it will increase its daily production in the U.S. by 750,000 barrels of oil and gas.

Despite the ongoing macro weakness, the company reiterated its plans to increase oil and gas production by more than 3% every year until 2027. In addition, it will invest $13 billion – $15 billion in annual organic capital expenditures through 2027.

OPEC+’s expected production cut through 2023, as well as Russia’s likely decision to curb its exports by as much as 25% in the coming months, will give an added advantage to energy majors like Chevron. This will lead to a reduction in global supply and should lead to higher oil prices. Further, the much-awaited opening of the Chinese economy should also cause a rise in oil demand and prices.

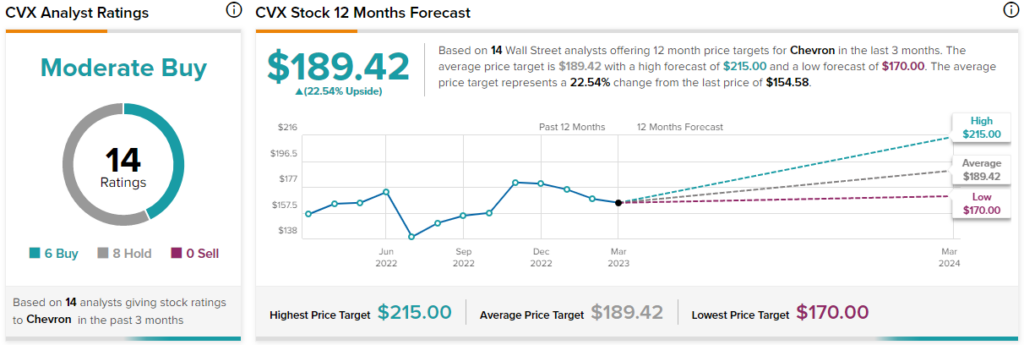

Is CVX Stock a Buy, According to Analysts?

As per TipRanks, analysts are cautiously optimistic about the stock and have a Moderate Buy consensus rating, which is based on six Buys and eight Holds. Chevron’s average price forecast of $189.42 implies 22.5% upside potential.

In terms of its valuation, Chevron is surprisingly not trading at a premium price. Currently, its P/E ratio comes in at an attractive P/E ratio of 8.1x, much lower than its five-year average of 17x. This implies a good buying opportunity, given the strong growth potential for the oil producer.

Conclusion: Consider Buying Chevron Stock on Price Weakness

Increased share buybacks for the third time give a clear and loud signal regarding management’s confidence in Chevron’s growth outlook. Oil remains one of Warren Buffett‘s favorite investments, too. It is well-known that he has significantly increased his stake in Occidental Petroleum (NYSE:OXY) over the past year and now owns 22.2% or $11.3 billion in the oil company. However, his present stake in CVX is much higher at $25.2 billion and represents his third-largest holding.

What’s more reassuring is that Chevron has a sturdy balance sheet with a strong cash position and a net debt ratio of 3.3% that has seen a significant reduction over the past few years.

While the outlook for oil prices is positive, there may be short-term distortions due to macro weakness. Therefore, I will wait for such distortions to buy the stock and maximize the long-term return on it.