The stock market has struggled badly over the past month, with the broad market S&P 500 (SPX) falling an unsightly 11.8% over the past 30 days and the tech-centric NASDAQ (NDX) faring even worse, shedding 14% over the same time frame. Investors are struggling to accept the Trump administration’s rollout of tariffs, which were higher and more wide-reaching than the worst-case scenarios had forecasted.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

But not all stocks have languished amidst the tariff turmoil. Whether it’s a growth stock making a well-received acquisition, a consumer staples stock that stands to potentially benefit from consumers looking to cut costs, or gold miners benefitting as savers and investors flock to the relative safety of gold, plenty of stocks have bucked the trend and posted strong performances over the past month.

Here are three stocks that have posted substantial gains over the past 30 days—Celsius Holdings (CELH), Dollar General (DG), and Harmony Gold Mining (HMY)—and why they performed well, including avoiding the tariff maelstrom.

Celsius Holdings (NASDAQ:CELH)

No one told CELH we are in a market correction, as the former high-flyer is again finding its footing, up 29.8% over the past month.

What’s interesting about Celsius’ move higher is that while consumer staples often hold up well in market downturns due to their mature and defensive business models and lower valuations, Celsius doesn’t necessarily fit the traditional profile of a consumer staples stock—it’s more of a growth stock. It trades at a higher multiple and does not pay a dividend.

So, how did the once-hyped energy drink maker buck market trends to deliver massive gains over the past month? While stocks often sell off after announcing an acquisition, news that Celsius was acquiring energy drink company Alani Nu for $1.8 billion was received positively by the market.

Investors and analysts like the notion of Alani Nu being a female-focused energy drink and functional beverage brand with traction with millennial and Gen Z consumers. This should complement Celsius’ flagship offering, which is already popular with female customers in a category where marketing by brands like Monster (MNST) and Red Bull is often perceived to be geared towards male consumers.

Data from Nielsen shows that Celsius and Alani Nu have a 16% market share in the energy drink category. Still, Truist analyst Bill Chappell estimates they enjoy about 50% market share among women. The female customer base could be particularly lucrative going forward. Chappell predicts that women will drive almost all the growth within the energy drink market as category growth amongst men becomes stagnant.

Celsius is still reasonably expensive, trading at 37x 2025 analyst earnings estimates. Still, its valuation has come down quite a bit since the heady days when it was trading at around $100 per share last year, and now it looks quite a bit more appetizing. Looking ahead to 2026, it seems a bit more palatable, trading at 28x 2026 estimates. Celsius looks relatively attractive from a price-to-sales perspective, trading at just over 4x expected revenue.

Is CELH Stock a Good Buy?

Turning to Wall Street, CELH earns a Moderate Buy consensus rating based on 13 Buys, three Holds, and one Sell rating assigned in the past three months. The average analyst CELH stock price target of $41 implies ~10% upside potential from current levels.

I’m bullish on Celisus going forward based on the strong growth potential of its complementary Alani Nu acquisition and its recent strength in a challenging market. While it is still a bit expensive on a price-to-earnings basis, its valuation is a lot more appealing than it has been in the past, and its relative strength is an indicator that it could continue to push higher when the market eventually turns around.

Dollar General Corp. (NYSE:DG)

Discount retailer Dollar General Corp. is another stock that has stood firm and defied the Trump-induced downturn. Dollar General struggled for much of 2024 but has rebounded with a strong 12.4% gain over the past month.

In fact, research firm Bespoke Group finds that Dollar General is the best-performing stock in the Russell 1000 since President Trump’s inauguration on January 20th, posting a searing 35% gain since then, which is even more impressive given the downturn in the overall market.

The Tennessee-based company is best known for selling consumer staples like groceries and other consumables at low prices to cost-conscious consumers — it generates approximately 60% of its revenue from customers with household incomes of $30,000 or below. In an environment where consumers are cautious and may eventually feel the pinch of tariffs regarding their spending power, a discount retailer like Dollar General could be one of the few stocks that benefit from the slowdown as consumers gravitate toward its low-cost, no-frills offerings.

Dollar General has also held up well partly because of its reasonable valuation—even after its strong run, the stock trades for 16.5x forward earnings estimates, below the S&P 500’s valuation of 19.5x forward 12-month earnings. This lower valuation has helped the stock hold up better than stocks trading at higher multiples.

Dollar General is a dividend stock with a 2.6% yield, roughly double that of the S&P 500. Investors are often drawn to the stability and income provided by dividend stocks during times of market instability.

Is Dollar General Stock a Good Buy Now?

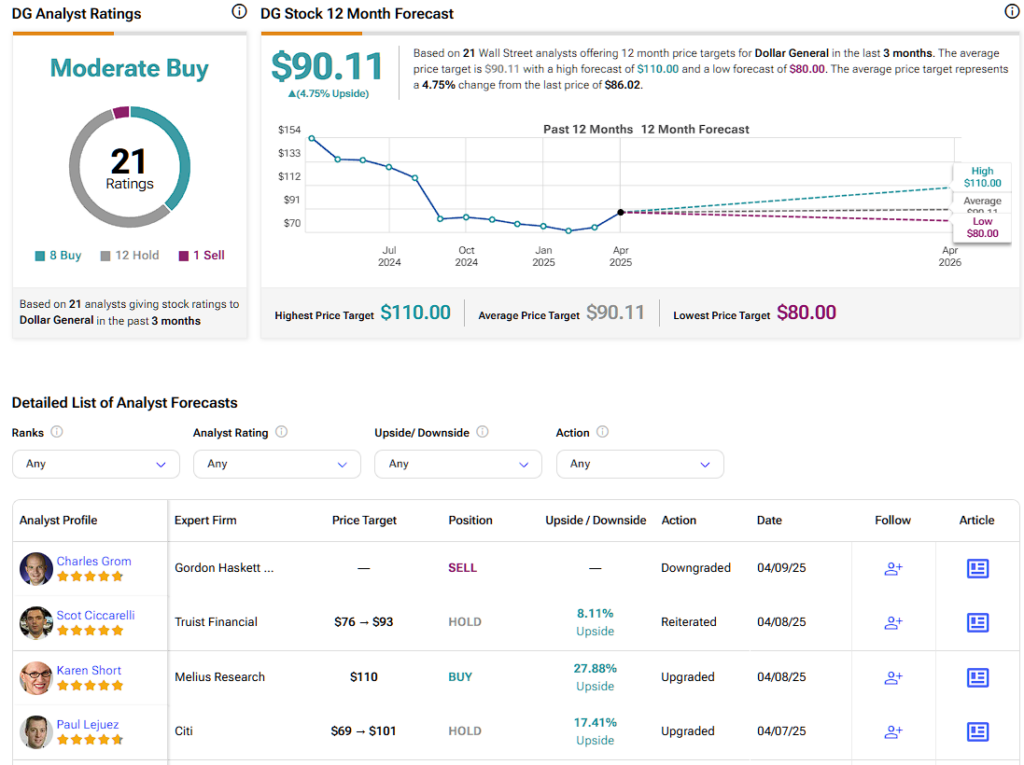

Turning to Wall Street, DG earns a Moderate Buy consensus rating based on eight Buys, twelve Holds, and one Sell rating assigned in the past three months. The average analyst DG stock price target of $90.11 implies ~5% upside potential from current levels.

I remain bullish on Dollar General based on its reasonable valuation, above-average dividend, and unique positioning to benefit from a cautious consumer environment.

Harmony Gold Mining Co. (NYSE:HMY)

It’s not hard to see why a stock like Harmony Gold Mining has prospered in the current environment, gaining 11% over the past month. Investors are flocking to gold, which has long been viewed as a safe haven asset and a store of value in times of geopolitical and economic uncertainty. Gold prices have climbed 2.5% over the past month as stocks plummeted.

The South African company has properties in South Africa, Australia, and Papua New Guinea. In addition to gold, Harmony also gives investors exposure to other metals like copper and silver. Harmony shares are inexpensive, trading at 12x consensus earnings estimates for 2025 and just 6.6x for 2026 estimates. Additionally, Harmony is a dividend stock that currently yields 0.8%, slightly below the S&P 500’s 2%.

Is Harmony Gold Mining a Buy?

HMY earns a Hold consensus rating based on zero Buys, one Hold, and zero Sell ratings assigned in the past three months. The average analyst HMY stock price target of $14.73 implies a ~0.3% upside potential from current levels.

While Harmony has performed well during the market downturn, trades at an undemanding multiple, and pays dividends, I’m not quite as enthusiastic about shares going forward. Gold miners have often proven to be cyclical stocks, and if the gold price retreats from recent highs (and it is already cooling down a bit from the high of $3,163 it hit earlier this month), shares of Harmony could pull back just as quickly.

More than One Way to Win in the Market

The resilience of these very different stocks during a very challenging period for the market shows that opportunities for enterprising investors are everywhere, even during a downturn. Of the three, I like Celsius and Dollar General the best, and I am bullish on both going forward.

Celsius’ Alani Nu acquisition looks like a hit. It will help the company gain a share in the fast-growing female segment of the energy drink market, where it already has a strong position. Plus, the stock’s relative strength during the pullback is encouraging, and I believe the stock can continue to perform strongly when optimism returns to the market. Its valuation is still a bit high but has decreased considerably from recent levels.

I’m bullish on Dollar General based on its undemanding valuation, attractive dividend yield, and unique positioning to benefit from a more defensive consumer. I’m Neutral on Harmony as it has performed well, but gold mining stocks often pull back when gold prices ease, making these stocks relatively cyclical investments.