Throughout the pandemic PayPal (PYPL) saw a massive surge with the rise in e-commerce after a stagnant few years. Following the pandemic, this overwhelming activity subsided, and PYPL returned to its pre-pandemic stock price returned. However, things are looking up for PayPal.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

As the world becomes increasingly digitalized, activities as simple as taking cash out of an ATM are becoming a distant memory. The number of ATMs in the United States has decreased by about 20,000 in the past two years and this number is only continuing to fall. The world doesn’t use cash like it used to as platforms like Venmo, CashApp, and Apple Pay are at the constant touch of our fingertips.

Catalysts of High Potential Upside

PayPal has a number of catalysts that could send this stock higher. Venmo, a subsidiary of PYPL, is known for its ease of use and convenience in personal transactions. Recently Venmo announced Venmo Teen, which will slowly begin to be released this month. Venmo Teen is designed for people under 18 to create Venmo accounts and gain access to the platform. This Teen account will connect to their parent’s account so children can be monitored while simultaneously increasing the number of Gen Z users of the app.

Additionally, PayPal Ventures recently invested $14 Million is a Series A funding for Nocnoc, which is a Latin American company aiming to help businesses grow with new sales channels. This industry is rapidly growing and could provide PayPal with additional financial returns and income.

Also, members of the House are pushing to repeal the $600 tax reporting threshold for payment apps, which currently leads users to limit their use of PayPal and Venmo to reduce their taxes. If the repeal is approved and the limit is raised to an amount the average user is unlikely to transfer within a year, PayPal and Venmo can expect to see an increase in users for both business and personal use.

Is PYPL a Buy?

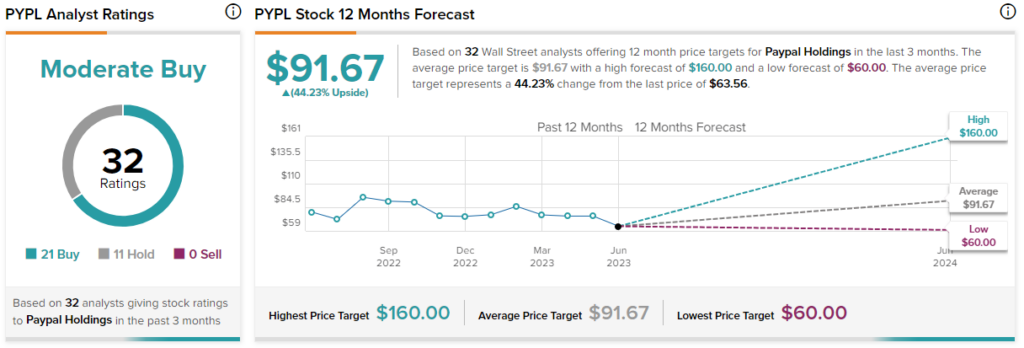

According to recent Wall Street Analyst sentiment, there is a Moderate Buy view, based on 32 analyst ratings on PYPL in the past 3 months. Of these 32 ratings, there are 21 Buys, 11 Holds, and therefore 0 Sells. Analysts’ overall prices targets have resulted in an average future stock price of $91.67 implying a 44.23% upside. Year-to-date, Paypal stock is down 13.4%.

Takeaway

The overall view of a high potential upside is a result of various company actions pushing for growth. New platforms and laws could provide PYPL with the tools to grow beyond current reports of 13.3% ROE and 1.82% Asset Growth TTM. The convenience of making payments with just a few clicks delivers customers far more accessibility than physical cash. That, along with several other significant catalysts, give PayPal stock the potential to continue to rise.