Regional bank Capital One Financial’s (NYSE:COF) recently reported May monthly metrics warn of higher risks and reflect the impact of macro pressures on consumers. Capital One’s significant exposure to subprime borrowers makes it more vulnerable to macro challenges. Nonetheless, hedge funds have been accumulating COF stock and are bullish about its long-term prospects.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

May Metrics

A diversified financial holding company, Capital One reported a rise in May 2023 credit card net charge-off rates (4.50% compared to 4.26% in the prior month) and delinquency rates (3.64% vs. 3.57% in the prior month). These metrics indicate a risky portfolio for the bank. Meanwhile, credit card loans stood at $135.3 billion on May 31, 2023, up from $132.7 billion on April 30, 2023.

The credit card debt of Americans is piling up amid high inflation and difficult macro conditions. As per the Federal Reserve Bank of New York, consumers’ credit card balance is approaching $1 trillion.

Hedge Funds Bullish on COF

In the last quarter, hedge funds increased holdings in COF by 11.2 million shares. As per TipRanks’ Hedge Funds Trading Activity Tool, hedge funds have a Very Positive confidence signal for Capital One.

In particular, Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) and Michael Burry’s Scion Asset Management both added Capital One shares to their respective portfolios in the first quarter. Berkshire purchased 9.9 million shares worth $954.1 million, taking the fund’s ownership to 2.6% of the company. Meanwhile, Berkshire offloaded all its holdings in two banks in Q1- Bank of New York Mellon (BK) and U.S. Bancorp (USB).

Scion Asset Management acquired 75,000 COF shares valued at $7.2 million. This forms 6.7% of its total portfolio.

Is Capital One a Buy or Sell?

Over the past three months, COF stock has risen about 19%, taking the year-to-date gains to 16%.

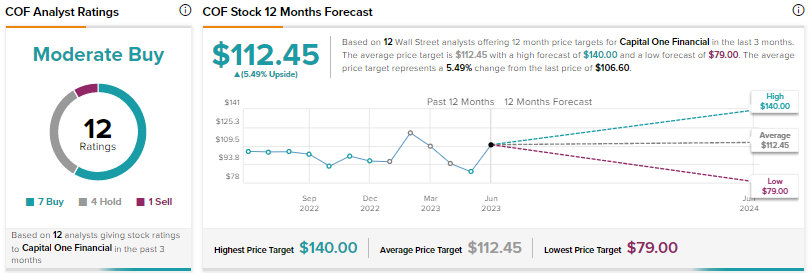

Of the 12 Wall Street analysts covering the stock, seven rate it a Buy while four have assigned a Hold and one has a Sell rating, bringing the average analysts’ consensus rating to a Moderate Buy. Further, analysts’ 12-month average price target of $112.45 implies 5.5% upside potential from current levels.

A week ago, Capital One saw a reaffirmed Sell rating from Morgan Stanley analyst Betsy Graseck with a price target of $79, implying a 26% downside potential from current levels.

Following COF’s May month report last week, Goldman Sachs analyst Ryan Nash reaffirmed a Buy rating on the stock with a price target of $114. Nash noted that COF’s May delinquency rate and net charge off reflected underperformance while loan growth continued to be strong. The rating agency believes that expected expense pressure and declining consumer credit are the two risks COF faces.

Early this month, Bank of America analyst Mihir Bhatia reiterated a Hold rating on Capital One but raised the price target to $116 from $109, citing an improving macroeconomic outlook and strong jobs data. Meanwhile, Citigroup analyst Arren Cyganovich raised the price target for COF to $121 from $119 and maintained a Buy rating due to healthy credit card issuer trends coupled with strong loan growth and stable purchase volumes.