Canadian Natural Resources Limited (CNQ), one of Canada’s largest natural gas and crude oil producers, is set to report its second quarter earnings on August 5, 2021, before markets open. The management team will host a conference call to discuss second quarter results at 10:00 a.m. ET.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Canadian Natural Resources Limited acquires, explores for, develops, produces, markets, and sells crude oil, natural gas, and natural gas liquids. The company offers synthetic crude oil, light and medium crude oil, bitumen, and primary heavy crude oil.

The global pandemic hit oil producers particularly hard at the beginning of 2020, as crude oil (WTI) spot prices collapsed below $10 per barrel in April 2020, from the $60 per barrel range at the beginning of the year. Producers also had to scale back production in the face of a demand shock as the world entered lockdowns, reducing transportation. Notably, more than two-thirds of finished petroleum products consumed in the United States such as gasoline, diesel, and jet fuel are used in the transportation sector.

CNQ was not immune to the oil price collapse. The stock tracked oil’s decline as it began the year in the C$40 range but precipitously dropped to below C$13 per share in March of 2020. The stock has had an impressive recovery since lockdowns were announced and has regained all its losses. CNQ now trades at pre-pandemic levels, up over 200% from the bottom.

Oil producers are now beginning to benefit from a recovery in the price of oil as well as a global recovery in oil demand. CNQ, being one of Canada’s largest and lowest cost producers, is at the forefront of this trend. (See Canadian Natural Stock Charts on TipRanks)

Let’s take a closer look at what analysts are expecting for the company’s Q2 print.

Earnings Preview

Analysts are expecting Canadian Natural to report a profit of $0.95 per share on revenues of approximately $6.2 billion. The company did not provide specific guidance for the quarter.

Prior Period Results

In the previous quarter, the company reported adjusted earnings of $1.03 per share, compared to a loss of $0.25 in the prior-year quarter. The result firmly beat the consensus estimate of $0.85.

Factors to Look For

The company has been on focused on cleaning up its balance sheet by reducing debt.

To that end, management has stated that they plan on allocating excess cash flow to the balance sheet in order to reduce overall debt levels. They are targeting a debt/EBITDA level of approximately 1.1x, with the anticipation of exiting 2021 with net debt of $13.8B, down from $21.3B at the end of 2020.

Management explained, “As a result our balance sheet is targeted to further strengthen throughout 2021, with debt to adjusted EBITDA targeted to improve to approximately 1.1x and debt to book capitalization targeted to improve to approximately 29%, at the mid-point of our targeted free cash flow range.”

Another focal point is the company’s free cash flow generation. Last quarter, CNQ generated $1.4B of free cash flow after capital expenditures and dividends, even in a weak environment.

BMO Capital Markets Analyst Randy Ollenberger expects this strong cash generation to continue into next year, saying, “At WTI US$70/bbl, we expect Canadian Natural will generate roughly $10.3 billion of pre-dividend free cash flow in 2022.”

Analyst Recommendations

Raymond James Analyst George Huang resumed coverage of Canadian Natural with an Outperform rating and C$55 price target. He echoes BMO’s free cash flow target of over $10 billion for 2022.

Expressing an optimistic outlook, the analyst said, “The company is poised to generate ~$10B in sustaining free cash flow next year on a maintenance capital estimate of $3.1B, mapping to an attractive DAFCF yield of 18%.”

Bottom Line

Given its industry-leading break even and free cash flow potential, further improvements in commodity prices may allow Canadian Natural to seek further measures of increasing returns to shareholders. That will happen either through increasing its dividend or reinstating its share buyback program.

Canadian Natural is well positioned to benefit from a stronger crude oil price environment over the next several years. Historically, its shares have been well correlated with crude oil prices, and that relationship will likely prevail in the future. At current commodity prices, the company could hit its debt targets this year, allowing it to accelerate cash returns to shareholders.

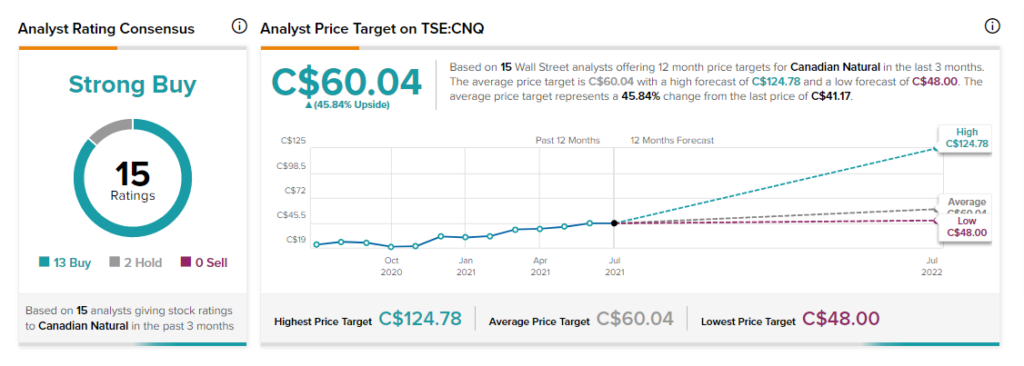

On TipRanks, CNQ has a consensus rating of Strong Buy, based on 13 Buy, 2 Hold, and 0 Sell ratings. The average CNQ price target is C$60.04, suggesting a possible 12-month upside of 45.8%. FTT is currently trading at a price of C$41.17 per share.