WELL Health Technologies (TSE:WELL), a digital healthcare services provider and Canada’s leading owner and manager of outpatient medical clinics, has seen its stock pull back recently. It was hovering near C$6 in May but is now trading at $4.37. This may have investors wondering whether the stock is a buy-the-dip opportunity. Analysts certainly think so, as all seven analysts covering the stock are bullish on it, with the consensus price target suggesting that the stock can double in the next 12 months.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

While we’re not sure about a double, we’re bullish on the stock as well. Therefore, let’s dive in and see what makes WELL stock attractive.

A Relatively Reliable Growth Stock

When it comes to small, high-growth stocks, conservative investors may shy away since large caps are generally more predictable. However, WELL Health stock is a relatively reliable company for its size.

For instance, in recent quarters, it has surpassed consensus EPS forecasts more often than not, and it has exceeded revenue expectations for the past 16 consecutive quarters. Therefore, it’s not a company that disappoints investors often. In fact, it recently boosted its full-year guidance (again) in its most recent earnings report.

The only issue we have with the guidance raise is that only the revenue forecast was raised, not adjusted EBITDA, meaning that EBITDA margins could fall. Nonetheless, adjusted EBITDA is still expected to grow by over 10% for the year, which is respectable.

Besides the solid track record, WELL Health stock is profitable, which is not all that common with high-growth stocks. For the trailing 12 months (TTM), WELL has generated over C$67.4 million in free cash flow. Less than two years ago, this figure stood at C$19.6 million, showcasing the company’s high growth. Similarly, TTM revenue stands at over C$642 million, more than double 2021’s revenue of C$302.3 million.

Analysts Expect WELL Stock to Double

On TipRanks, WELL Health stock comes in as a Strong Buy based on seven unanimous Buy ratings assigned in the past three months. At C$8.98, the average WELL Health stock price target implies 105.5% upside potential.

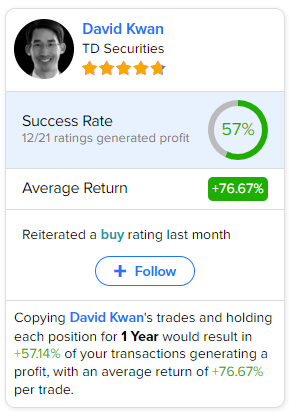

If you’re wondering which analyst you should follow if you want to buy and sell WELL stock, the most accurate analyst covering the stock (on a one-year timeframe) is David Kwan of TD Securities, with an average return of 76.67% per rating and a 57% success rate. Last month, he gave WELL stock an C$8.50 price target, implying about 95% upside potential. Click on the image below to learn more.

The Takeaway

WELL Health has returned over 600% in the past five years and was once trading at more than double its current price, so it’s entirely possible for a double to happen from here. Analysts believe it can happen, and its current valuation is very reasonable for a high-growth stock, suggesting upside potential.

At a market cap of C$1 billion, its price-to-free-cash-flow multiple is under 15x. Valuations like this are usually given to low-growth stocks or cyclical companies that are less stable. However, WELL operates in the healthcare sector, which is undoubtedly resilient, making its less-than-15x multiple even more attractive.

When considering all of these factors, including the company’s solid track record, it’s easy to see why analysts are so bullish on the stock.