After falling in 2022, the S&P 500 (SPX) staged an impressive comeback last year, rising over 20%. As investor optimism improved on the possibility of multiple interest rate cuts and resilient consumer spending, several stocks outpaced the S&P 500 in the past 12 months. For instance, Skechers (NYSE:SKX) stock gained close to 50% in 2023. Valued at $9.6 billion, let’s see why Skechers should continue to deliver market-beating returns in 2024.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

I am bullish on the mid-cap stock due to its cheap valuation, strong brand value, and improving profit margins.

An Overview of Skechers

Founded in 1992, Skechers designs, develops, markets, and distributes footwear for men, women, and children. It has two primary business segments, including Wholesale and Direct-to-Consumer (DTC).

Skechers sells its products through a variety of distribution channels ranging from department stores, sporting goods retailers, company-owned stores, big-box club stores, and third-party store operators.

Skechers opened its first retail store in 1994 and went public in 1999. It opened its 100th store in 2003 and touched $1 billion in annual sales in 2005. Today, it operates more than 4,900 stores, reporting $7.9 billion in sales in the last four quarters.

How Did Skechers Perform in Q3 2023?

Skechers increased sales by 7.8% year-over-year to $2 billion in Q3 2023. International sales rose by 9%, accounting for 61% of the top line, while domestic sales grew by 7%. Similar to other retail companies, Skechers has increased its DTC or online sales significantly post the COVID-19 pandemic. In the September quarter, DTC sales were up 24%, while Wholesale revenue was down 1% due to lower distributor sales.

Skechers emphasized that DTC sales stood at $850.4 million in Q3 as international online sales grew by 33% year-over-year. Skechers attributed revenue growth in Q3 to strong performance in retail stores as well as its high-margin international e-commerce platforms. However, it experienced a slowdown in online sales in the U.S. as consumers chose to shop at retail outlets.

A Focus on Partnerships

Skechers continues to expand its product portfolio, strengthening its position in the global footwear market. In Q3, it released three capsules from its new Snoop Dogg collaboration in North America and Europe, allowing it to gain traction among fans of the entertainer.

In addition to Snoop Dogg, collaborations with Martha Stewart and the Rolling Stones improved brand awareness and customer engagement.

The footwear company also launched an expansion to its Skechers performance division called Skechers Football (or soccer in the U.S.). Here, it onboarded Harry Kane, the captain of England’s national football team and a leading striker for Bayern Munich. In addition to Kane, several other athletes part of the English Premier League have tested the product prior to its launch.

Skechers expects these big-ticket partnerships to result in stellar growth for the company in the upcoming decade.

Skechers Continues to Grow

Skechers continues to target growth in international markets. In Q3, it opened 43 stores in China, five in Vietnam, four in South Korea, and three in Chile and India. Comparatively, it opened five big-box stores in the U.S.

Skechers expects to end Fiscal 2023 with sales between $7.95 billion and $8.05 billion, up from $7.44 billion in Fiscal 2022. It also forecasts adjusted earnings at $3.37 per share in 2023, up from $2.38 per share in 2022.

A Strong Balance Sheet

Skechers ended Q3 with $1.27 billion in cash, cash equivalents, and investments, an increase of $591.5 million year-over-year due to improvements in working capital and operating efficiency.

In 2022, Skechers was wrestling with capacity challenges and processing constraints at distribution centers, resulting in higher inventory. Compared to 2022, its inventory decreased by 22% to $1.38 billion, helping it boost profit margins in the near term.

Skechers lowered its inventory levels in the Americas and EMEA (Europe, Middle East, and Asia) by 33%, or more than $400 million, in the last 12 months. It claimed that current inventory levels are healthy and positioned to support demand during the key holiday season.

What is the Target Price for SKX Stock?

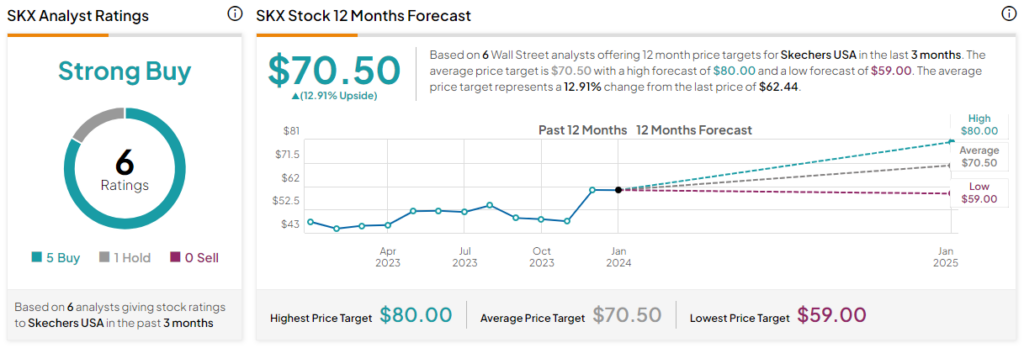

Out of the six analysts covering SKX stock, five recommend a Buy, one recommends a Hold, and none recommend a Sell, giving it a Strong Buy consensus rating. The average SKX stock price target is $70.50, 12.9% above the current price.

Analysts tracking SKX stock expect adjusted earnings to expand to $3.47 per share for Fiscal 2023 and $4.19 per share for Fiscal 2024. So, priced at 15 times forward earnings, the footwear stock is very cheap, given its stellar growth estimates. For instance, the PEG ratio for SKX stock is 0.67x, much lower than the sector median multiple of 1.68x.

The Takeaway

Skechers stock has returned over 600% to shareholders in the past decade. Despite its robust returns, the stock trades at a reasonable valuation while growing at an enviable pace. Its strong liquidity position, improving margins, and collaborations with global celebrities make SKX one of the best stocks to own right now, in my view.