Oracle Corporation (ORCL) has been a titan of the IT industry for some time now, but with AI becoming the buzzword on everyone’s lips, it could be poised for an even more prominent role over the coming years. With deep integration into OpenAI’s $500 billion Stargate Project, ORCL has all the resources needed to dominate the high-stakes world of AI infrastructure. Of course, there are plenty of risks along the way, but with a growing list of federal contracts, strong revenue growth, and a compelling track record, I’m confident the company can outperform the market. Therefore, I’m bullish on Oracle early in 2025.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Oracle Takes Aim at Market Peers

The company functions across three distinct areas, complementing each other as part of the growing enthusiasm for AI architecture. Cloud and Licence are the primary revenue drivers. Still, the Hardware division provides the essential computational backbone for this emerging revolution, supporting a dynamic range of AI-driven workloads and enterprise needs. Meanwhile, the Services unit ensures businesses can optimize and integrate these technologies effectively, also informing future strategic decisions for the company.

With the company’s market capitalization now over $486 billion and revenues growing double-digits for the first time in well over a decade, it seems like management has been able to recover from a period when it was simply trying to keep up and is now accelerating past the competition. Unlike Amazon’s AWS and Microsoft’s Azure, Oracle clearly focuses on AI-optimised solutions, giving it a major advantage in continuous improvements and feature development.

The Big Opportunity in the Room

Moving onto the big breaking news, ORCL can gain from the seismic $500 billion injection from SoftBank and OpenAi to launch Stargate. Many will consider this a milestone in the AI development story, but some will suggest it is a political move by the new president to capitalize on the work already underway. It represents a considerable investment in developing cutting-edge data centers over the next four years, building enormous capacity and sophistication for future work. Oracle’s Cloud Infrastructure (OCI) will be crucial in handling the immense processing needs of OpenAI’s models, leading to reliable income in a growing area.

The first of these data centers is well underway in Texas. Oracle’s strategy of optimizing smaller, regional cloud centers is significant in maintaining a cost-effective edge over competitors. I’d expect that as AI adoption continues to surge, the company’s cloud services will grow further, leading to steady revenue growth.

Price Catalysts Loom for Oracle

Oracle’s revenues soared for the cloud infrastructure area in Q2 of 2025, up 52% in a year. With this expected to exceed $25 billion next year, it’s hard to argue that the trajectory looks promising for the future.

I’m encouraged by the work announced in the private sector, but I think public sector work has just as much momentum. Oracle has secured multiple government contracts for classified data, meeting security standards many companies can only dream of. This opens up enormous opportunities for working with clients such as the U.S. Department of Defence and in other national security and healthcare areas.

Regardless of the catalysts ahead, I’ll keep my eye on the progress towards strengthening the balance sheet. Over time, management has drastically reduced the debt level compared to assets and steadily grown the company’s value.

Potential Challenges Ahead

Despite my bullishness here, there are plenty of reasons the strategy could quickly fall apart. Oracle’s cloud market share is still well behind AWS’s, making it a relatively small player in a landscape based on scale and efficiency. Building this infrastructure is enormously expensive, and despite the investment from Stargate, there is no guarantee that such vast expense will lead to improved performance in the near term. Investors will see the operating margins while these capital-intensive operations are rolled out and monitor the success of projects as they develop.

Tech giants such as Google, Microsoft, and Nvidia are clearly all rapidly vying for market leadership in the AI space. While a mix of public and private sector work puts Oracle in a strong position, such companies could easily move in on this with vastly more resources and flexibility across the range of services offered by each.

Then, there’s the fairly hefty valuation of the share price. With the P/E at 42.5, it’s no surprise to see some analysts hesitant to give the firm a buy rating. However, AI-driven growth estimates suggest there could still be plenty of potential.

Is Oracle Stock a Buy, Hold, or Sell?

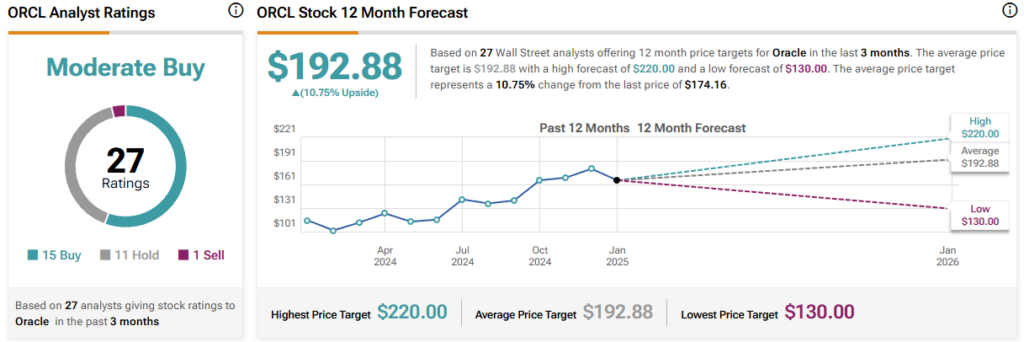

On Wall Street, ORCL stock has a Moderate Buy consensus rating based on 15 Buy, 11 Hold, and one Sell ratings over the past three months. ORCL’s average price target of $192.88 per share implies an ~11% upside potential over the next twelve months.

My proprietary discounted cash flow (DCF) calculation suggests a fair value of $126, about 27% below the current level but based on more conservative revenue growth of 13%. With shares up 62% over the past 12 months and technical indicators suggesting momentum is still strong, I think there is plenty of upside, even if it exceeds the fair valuation in the near term.

Global AI Boom Could Deliver for Oracle

Oracle has evolved far beyond its reputation as just a database provider, emerging as a major player in AI and cloud computing. With a key role in the Stargate story unfolding over the coming years, there’s plenty to be optimistic about. While risks remain after a strong rally and in an uncertain market environment, Oracle’s management has the resources to drive revenue growth, enhance efficiency, and solidify its position as a leading AI company for the long term. As a result, I’m initiating a Buy rating.