ChemoCentryx Inc. (CCXI) is facing severe headwinds from current market volatility. Shares are down more than 40% this year and are likely to continue this trend for the coming weeks. Thus, I am bearish on this stock.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

About ChemoCentryx

ChemoCentryx is a U.S. biopharmaceutical developer of oral treatments for autoimmune diseases that cause inflammatory diseases and various types of cancer in adult patients in the U.S.

The company offers a product called Tavneos as a treatment for adult patients with severe, active, cytoplasmic autoantibody-associated vasculitis.

Active cytoplasmic autoantibody-associated vasculitis is an autoimmune disease that causes inflammation and damage to small blood vessels.

Tavneos is also being developed by the company to treat patients with severe hidradenitis suppurativa, and to treat patients with complement 3 glomerulopathy and lupus nephritis.

Hidradenitis suppurativa is a condition in which small, painful lumps form under the skin, usually developing in the armpits, groin, buttocks and breasts.

Complement 3 glomerulopathy is a rare kidney disease that, if left untreated, can lead to chronic kidney failure, cardiovascular problems, pulmonary edema and an increased risk of the urinary tract and kidney infections.

Lupus nephritis is a type of kidney disease that can lead to kidney failure under an autoimmune disease.

In addition, the company is currently evaluating CCX559 as a treatment for various solid tumors in a phase I dose-escalation study.

Catalysts: or Lack Thereof

In theory, the following studies could boost the stock’s price, but in this market, that’s unlikely.

Should they materialize, the positive results from the ongoing evaluation of the company’s treatments will never be strong enough to withstand the current market turmoil, which will last for months.

Some catalysts could result from:

- This year, ChemoCentryx intends to provide additional clinical data showing that CCX559 is pharmacologically active in cancer patients whose immune system shows signs of a response.

- In the second half of 2022, the company should initiate the next phase of evaluation of CCX559 to obtain more direct clinical data on antitumor properties.

- ChemoCentryx should receive additional royalties from Tavneos’ overseas market.

- Pending feedback from the U.S. Food and Drug Administration, ChemoCentryx is expected to begin clinical development of Tavneos in patients with lupus nephritis and testing of Tavneos in patients with hidradenitis suppurativa in the second half of 2022.

- In addition, the company should hold a meeting with the FDA before the end of 2022 on the clinical trial data available on Tavneos as a treatment for complement-3 glomerulopathy. The company says there is no FDA-approved therapy for this disease to date.

Any investor must know that recovery is only possible if the above events prove stronger than market resistance due to the following factors:

- High commodity inflation on fossil fuel supplies as the Ukraine crisis unfolds, and worries about the quick and effective availability of alternative sources of energy in the event of an embargo on Russian oil and gas.

- The risk of a recession for the economy if the Federal Reserve raises interest rates too much to combat inflation.

- The resurgence of infections from COVID-19 continues to cause problems hampering the regular flow of economic activity as governments must implement lockdowns and restrictions to contain the virus.

Given the importance of market turmoil triggers, the chance that the stock price will reverse the current trend is very slim.

Q1 2022 Financial Results

For the first quarter of 2022, reported revenue of $5.5 million was more than 47% lower than the corresponding period in 2021, and missed analysts’ median guidance by nearly $22 million.

On a GAAP basis, the company reported a net loss of $0.55, missing analysts’ average estimate by $0.24.

The Balance Sheet

As of March 30, the company said its balance sheet was strong.

It had $371.8 million in cash and short-term investments, including payments related to the EU approval of Tavneos.

This should cover the operational needs for research and development activities, marketing and sales activities, as well as general and administrative costs incurred in the coming years.

However, the balance sheet also includes about $24 million in long-term debt, and mentions that accumulated deficits have reached $656 million.

Wall Street’s Take

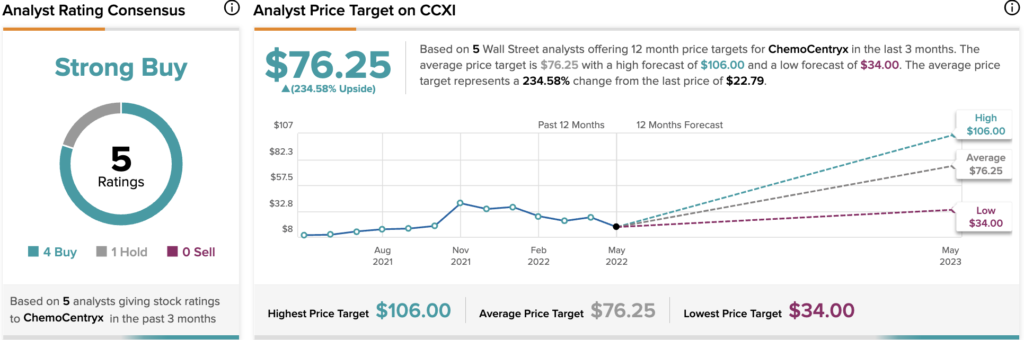

In the past three months, five Wall Street analysts have issued a 12-month price target for CCXI. The company has a Strong Buy consensus rating based on four Buy ratings, and one Hold rating.

The average ChemoCentryx price target is $76.25, implying a 234.58% upside potential.

Valuation

As of this writing, shares are changing hands at $20.86 for a market cap of $1.49 billion, and a 52-week range of $9.53 to $42.16. While shares remain somewhat above their lows, the stock could continue trending down away from its 52-week high.

Also, the stock price is about 3.6% below the 50-day moving average of $21.64 and about 21.34%, below the 200-day moving average of $26.52. This shows a long-term downtrend, one which any analyst would consider as a bearish indicator.

Conclusion

The current headwinds are too much for ChemoCentryx, whose catalysts are unlikely to weather the storm. This stock is likely to continue trading lower, thus, it may not be an opportune time to buy shares, for now.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure