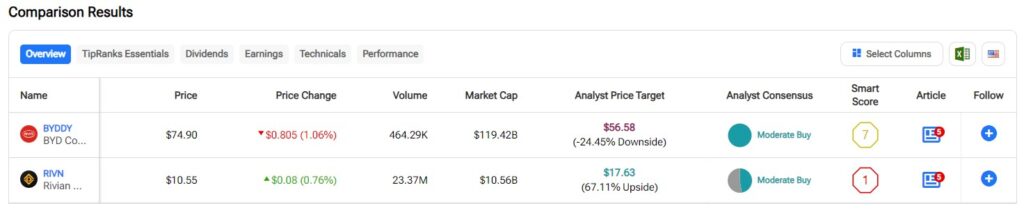

In this piece, I evaluated two electric vehicle stocks: BYD (BYDDY) (BYDDF) and Rivian Automotive (RIVN). A closer look suggests a bearish view for BYD and a neutral view for Rivian.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

China-based BYD is known for producing vehicles like the budget-friendly Atto 3 electric SUV, the Dolphin electric hatchback, and the Seal battery-electric mid-size sedan, among other vehicles. In addition to cars, BYD is also active in various industries, including the production of rechargeable batteries and mobile handset components.

Meanwhile, Rivian is known for the R1S electric SEUV, the R1T electric pickup truck, and its electric delivery van, the EDV.

American Depository Receipt (ADR) shares of BYD have surged 23% over the last three months, bringing their year-to-date return to 38% and their one-year gain to 25%. Importantly, each ADR share of BYD traded over the counter in the U.S. is worth two H shares traded on the Hong Kong Stock Exchange.

In contrast, Rivian Automotive stock has plummeted 36% over the last three months, dragging its year-to-date plunge down to 55%. The stock is off 47% over the past year.

The market’s opposite reactions to these two stocks may have some investors wondering if Rivian offers a buy-the-dip opportunity. However, there’s more to both stocks than it appears. Let’s take a look.

BYD

BYD is strongly tied to the Chinese and Hong Kong stock markets right now. As such, this stock could continue to encounter significant volatility in light of what’s happening in those stock markets. Thus, a bearish view looks appropriate.

First, an understanding of BYD’s business is helpful. As already stated, the company doesn’t just sell EVs, so there is much more to consider with the Chinese automaker. Additionally, BYD offers exposure to both battery-electric vehicles (BEVs) and plug-in hybrids, which is critical right now as most of the growth in the clean-energy vehicle space is in hybrids rather than BEVs.

Turning to the current issues with Chinese stocks, China’s stock market has gone through significant ups and downs recently. The latest news is that China’s central bank revealed a US$70 billion financing facility to fund institutional buying, which sent the Hang Seng Index up 3% at the market close on Oct. 10.

Despite some recovery, the index remains down 6.5% for the week ending Oct. 10, following an earlier drop. All eyes are now on the weekend as investors hope for even more stimulus from the People’s Bank of China. If the central bank falls short, Chinese stocks could tumble further. Conversely, if more stimulus is introduced, they could rally, potentially driving BYD’s stock higher, pushing it beyond an attractive buy price.

Either way, I would hold off on buying any BYD shares right now, given the three-month runup in the stock and the continuing volatility.

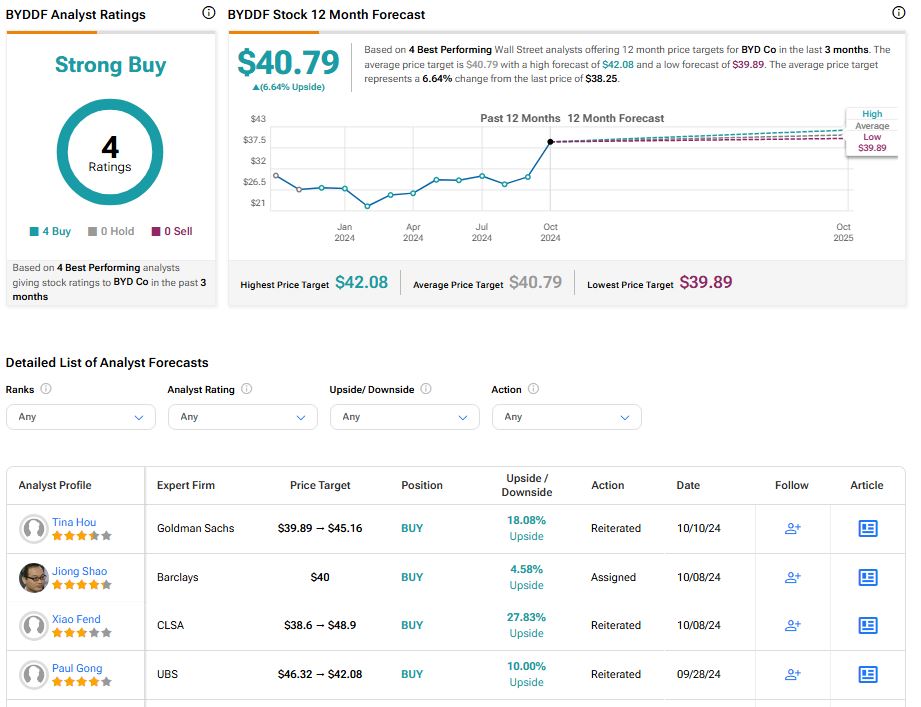

What Is the Price Target for BYDDF Stock?

BYD has a Strong Buy consensus rating based on four Buy, zero Hold, and zero Sell ratings assigned over the last three months. At $40.79, the average BYD stock price target implies an upside potential of 6.64%.

See more BYDDF analyst ratings

Rivian Automotive

Rivian faces its own issues that aren’t tied to the broader stock market. Recently, the company missed its delivery targets due to a component shortage. The component shortage caused Rivian to slash its production forecast by up to 18% to a new range of 47,000 to 49,000 vehicles for the full year. Since more disappointments could be around the corner, I would suggest a neutral view on Rivian — while keeping it on my watchlist.

Deutsche Bank analysts suggest the component shortage could weigh on Rivian’s deliveries into the first quarter of 2025. However, it’s critical to understand that this is a temporary issue creating a buy-the-dip opportunity. Nonetheless, I don’t think Rivian stock has hit bottom yet.

In addition to the component shortage, Rivian also can’t rely on hybrid sales to survive through the plateau in electric vehicle sales because it doesn’t sell any hybrids. However, the automaker’s deliveries are so low right now that this seems a minimal issue, at least temporarily.

Additionally, Rivian received 68,000 reservations for its R2 the day after it was revealed earlier this year, so indicating strong demand for its vehicles despite flattening EV sales.

Some good news about Rivian’s business model is that it involves building more expensive models first before moving toward scale with the less expensive models. The company is taking a page out of Tesla’s (TSLA) playbook with this plan, and we already know it’s a winner.

Thus, I would take a wait-and-see approach with Rivian, taking advantage of any further decline in the shares before establishing or adding to a position. Notably, company insiders are holding onto their shares as the stock plummets, awaiting a better time to take some profits because they expect the stock to bounce back.

What Is the Price Target for RIVN Stock?

Rivian Automotive has a Moderate Buy consensus rating based on four Buys, three Holds, and zero Sell ratings assigned over the last three months. At $17.33, the average Rivian Automotive stock price target implies upside potential of 68.91%.

Conclusion: Bearish on BYDDY, Neutral on RIVN

While BYD is the more established automaker, the runup in its stock and the volatility in the Chinese stock market make the shares less attractive right now. I’d like to see a drop in BYD stock or a significant downside gap in the price versus the Hong Kong shares before becoming more constructive on the stock.

As an up-and-comer, Rivian Automotive is a far riskier stock. However, after the current drop in its share price, the risk appears to be minimized. The use of Tesla’s business model of starting with higher-priced models and gradually offering cheaper ones, combined with strong demand for its vehicles, will likely outweigh the temporary component shortage. Investors may just have to bear a few more disappointments along the way, but these setbacks should make the stock even more attractive.