Russia’s invasion of Ukraine has highlighted how fragile democracy can be, and how important it is for the U.S. (and its allies) to cultivate a strong military. This also speaks to the need for significant investments in cutting-edge technologies and solutions.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

So says Monness analyst Brian White who also thinks Palantir’s (PLTR) unique approach leaves it well-positioned to benefit from this necessity.

“We believe the recent chaos initially ushered in by the pandemic, and now the situation in Ukraine, shines a light on the critical nature of the proprietary work consummated by Palantir over the years. Increasingly, we expect more organizations will recognize the value of Palantir’s software,” said the 5-star analyst.

The fact Palantir’s offerings – what it terms its “data integration and management platform within the data management and analytics industry” – are suited for such work is no coincidence. The company was founded with the intention of developing software to “support” the U.S. intelligence community’s “counterterrorism initiatives.” Since when, Palantir has cultivated a “strong presence across a broader scope” of government organizations. Historically, then, most of the company’s revenue has been derived from this segment and it has also been one of the arguments critics have used to state the bear case. That is, that its offerings are only suitable for large government bodies and enterprises. However, while the company might have initially started off with its energies focused on government programs, it has since built a “formidable presence” in the commercial segment.

In 4Q21, 55% of revenues were generated from government customers, with the commercial segment accounting for the other 45%. Overall, the company estimates that its total market opportunity is around $119 billion, consisting of $56 billion from the commercial segment and $63 billion on the government side.

In any case, White points out that Palantir “doesn’t fit neatly into traditional software segments,” believing that its platform is “unique in the world,” no matter into what category one wishes to “pigeonhole” its software. Such is its special appeal, White states that the majority of industry commentators will find it “difficult, if not impossible, to identify an exact competitor.”

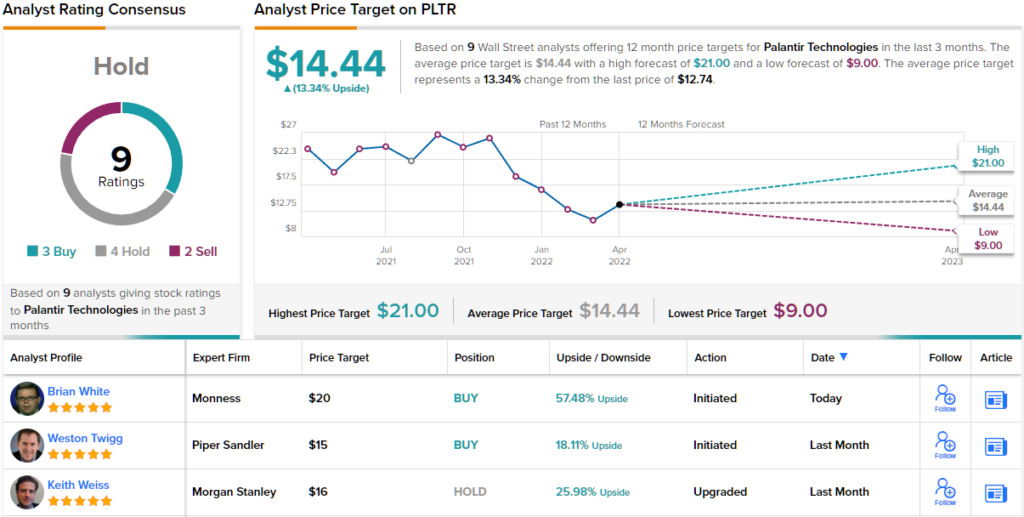

With all the above as backdrop, White initiated coverage of PLTR stock with a Buy rating and $20 price target. This figure conveys his confidence in PLTR’s ability to soar 57% in the next twelve months.(To watch White’s track record, click here)

Not everyone agrees with White’s assessment; based on 3 Buys, 4 Holds and 2 Sells, the stock claims a Hold consensus rating. The forecast calls for 12-month gains of ~13%, given the average price target clocks in at $14.44. (See Palantir stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.