On the surface, Bumble (NASDAQ:BMBL) provided a breath of fresh air in the online romance industry. With the platform structured around women making the first move, Bumble instantly distinguished itself from the competition. Unfortunately, it failed to resonate with Wall Street. Still, recent derivatives market activity shows that options traders are swiping right on the stock. From a purely tactical and speculative view, I am bullish on BMBL stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Options Flow Data Offers Intrigue for BMBL Stock

Previously, I must admit that I did not care for BMBL stock. In June, I warned that economic pressures impacting consumer sentiment could negatively affect the dating industry. Although Bumble shares swung higher into July, the market value eventually began sliding. At the time, options data also pointed to a downward trajectory. However, a sentiment pivot warrants a reexamination.

Specifically, options flow data – which exclusively screens for big block trades likely made by institutions – reveals that in October, major traders began placing bullish wagers for options expiring late this year and early next year. Most notably, a major trader (or traders) sold 20,000 contracts of the Dec 15 ’23 10.00 put, collecting a premium of $260,000 in the process.

On the surface, the engagement of a put contract seems bearish. After all, putholders enjoy the right but not the obligation to sell the underlying security at the listed strike price. However, it’s important to realize that options contracts represent an agreement between two parties.

Regarding the $10 put, the seller has an obligation to buy BMBL stock at the strike under the exercise of the contract (i.e., if shares fall below $10). To be sure, it’s a hefty risk.

Let’s assume BMBL stock falls to $9. Subsequently, the putholder can force the seller to buy BMBL at $10. Assuming a single trader sold 20,000 puts, that entity must ultimately acquire $20 million worth of shares (since each option contract controls 100 shares), even though they’d only be worth $18 million at $9.

Given such a massive risk profile – possibly losing $2 million later in exchange for $260,000 now – the intrepid wager at least generates curiosity.

Why Bumble Might Succeed This Time

Based on a cursory look at BMBL stock, it’s difficult not to have concerns. Since the start of the year, shares have fallen by more than 36%. Since making its public market debut, the dating app hemorrhaged over 80% of its market value. Nevertheless, the rate of negative acceleration had diminished, almost egging on the knife-catchers.

While BMBL stock hardly represents a send-the-kids-to-college type of investment, broader social forces may finally favor Bumble. That’s because while every struggling company got to its doldrums because of business-related factors, BMBL legitimately suffered from poor timing.

For example, Bumble launched its initial public offering during the height of retail revenge. Subsequently, in 2022 and throughout this year, the revenge travel phenomenon dominated headlines. However, the equivalent pent-up demand for dating didn’t seem to register upside for BMBL stock.

Nevertheless, this trend might change. While consumers have been prioritizing travel-and-experience-related excursions following the lifting of global COVID-19 restrictions, this appetite may be hitting a major headwind.

Yes, people have opened their wallets for experiences – the so-called “funflation” factor – despite escalating prices and borrowing costs. However, everyone has their limits. Recently, consumer behavioral data suggests that people are winding down their travel intentions. If so, this scenario could open the door for Bumble. For one thing, dating app memberships are cheaper than flying across the world. Second, meeting someone new would check the box for social experiences.

Challenges Still Remain

For conservative investors, they may want to wait until November 7 – when Bumble releases its third-quarter earnings report – before committing capital to the idea. Fundamentally, the company still presents a risky profile. In particular, the concept that women need to make the first move may cut into the total addressable market.

Still, that’s a relatively easy fix, and with options traders apparently bullish on Bumble, it might be worth a second look.

Is BMBL Stock a Buy, According to Analysts?

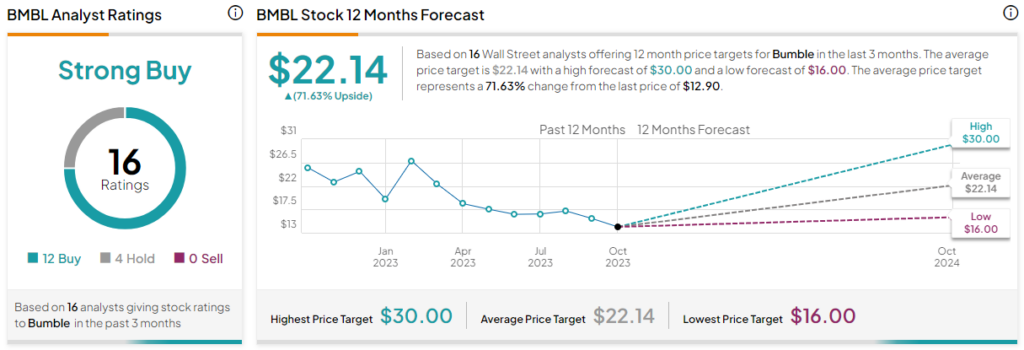

Turning to Wall Street, BMBL stock has a Strong Buy consensus rating based on 12 Buys, four Holds, and zero Sell ratings. The average BMBL stock price target is $22.14, implying 71.6% upside potential.

The Takeaway: BMBL Stock is About Following the Money

Undeniably, BMBL stock offers a high-risk, high-reward idea for speculators. For now, the smart money appears to have favorably changed its tune about the dating app. Moreover, a fundamental argument exists that supports said narrative. Therefore, if you have the nerve, Bumble might be worth checking out now.