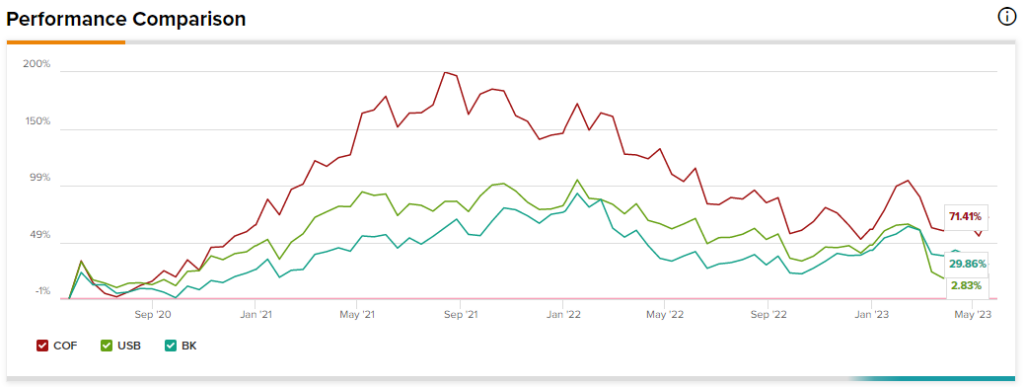

Berkshire Hathaway’s (NYSE:BRK.B) 13F filing for Q1 2023 revealed significant movements across the conglomerate’s holdings of financial stocks. Warren Buffett completely exited positions in U.S. Bancorp (NYSE:USB) and Bank of New York Mellon (NYSE:BK). At the same time, a new position in Capital One Financial (NYSE:COF) drew investors’ attention.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In this article, I will review the three companies’ Q1-2023 results and discuss whether it currently makes sense to follow in Buffett’s footsteps.

Capital One Stock — The New Purchase

Against the backdrop of failing banks and deposit outflows, Capital One had a surprisingly resilient Q1-2023 performance. The lender’s total deposits actually increased in Q1, growing by 5.1% quarter-over-quarter to $350 billion. What’s more, 78% of total deposits were insured deposits, meaning the bank finances itself predominantly with deposits below the $250,000 Federal Deposit Insurance Corporation threshold.

In contrast to the robust performance on the deposit front, profitability was down, with net income decreasing 23.6% quarter-over-quarter and 61.7% year-over-year. The main reason for the decelerating performance was elevated provisions for credit losses, which increased by 15.7% relative to Q4 and a stunning 313% year-over-year.

The silver lining is that 39.4% of the provisions for credit losses were to build reserves for future shocks to the credit portfolio rather than actual current charge-offs (a term banks utilize when they allocate provisions on credit losses to cover loans gone bad). In essence, Capital One is conservative in its provisioning and may be less affected by the expected economic downturn.

All in all, the allowance coverage ratio (which shows credit provisions relative to total loans) was 4.64% at the end of Q1, up from 4.24% at the end of 2022.

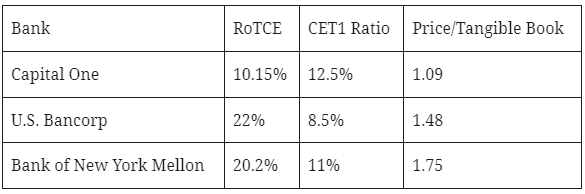

Despite the elevated provision build, the company’s return on tangible common equity (RoTCE) was still a respectable 10.15% in the quarter (compared to 14.22% in Q4 and 23.36% in Q1 2022). Thus, it is fair to say the bank earns a healthy return even when setting aside abnormally large provisions for potential future losses.

CET1 capital (a measure of capital held by the bank against its risk-weighted assets) was 12.5% at the end of the quarter, above the bank’s target of around 11%. The effect of unrealized losses on securities on the CET1 ratio was around 2%, resulting in a CET1 of 10.5% when that is included. Nonetheless, the bank estimates that about 40% of the 2% negative impact will fade by the end of 2024 as securities move closer to maturity and par value.

Finally, COF’s tangible book value increased 5.5% quarter-over-quarter to $90.86/share.

Comparison Table

Let’s review how Capital One compares to the positions exited by Berkshire in Q1 2023:

U.S. Bancorp recorded a 3.8% quarter-over-quarter drop in deposits to $505 billion, with just 51% of all deposits being insured. U.S. Bancorp’s CET1 ratio of 8.5% is markedly lower than Capital One. Nevertheless, it is still above the 7% regulatory requirement. Profitability at U.S. Bancorp was much stronger than Capital One, with just a small prudent build-up in the allowance for credit losses.

Turning to Bank of New York Mellon, the bank again delivered strong RoTCE with relatively low risk, thanks to its trust bank business model (74.1% of all Q1 revenue is fee revenue). Deposits at Bank of New York Mellon were up by 0.8% to $281.3 billion.

Buffett’s Rationale

Looking at the table above, we see that none of the three institutions can be described as distressed, with all trading above tangible book value. Capital One has a business model more similar to U.S. Bancorp, focused on traditional lending and credit cards. In contrast, Bank of New York Mellon is a niche bank serving the investment industry.

In my opinion, Berkshire’s thinking goes along the lines that we should not see a deep recession, and as a result, profitability at Capital One will jump to levels more comparable with the other two banks. This development, coupled with the Bank’s strong capital position and valuation discount in terms of price-to-tangible-book, should result in higher returns.

Another factor in Capital One’s expected outperformance, relative to U.S. Bancorp, is that deposits have been dropping at the latter. This will force U.S. Bancorp to raise deposit rates or find new funding sources, squeezing its profitability.

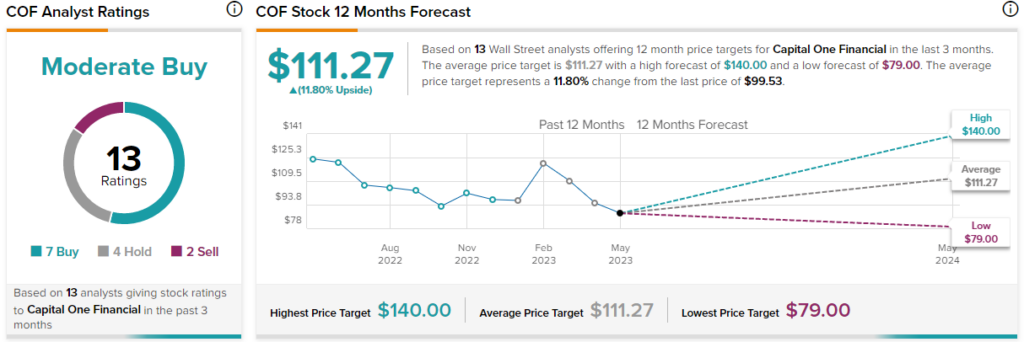

Are Analysts Bullish on COF, USB, and BK?

From Wall Street analysts, Capital One Financial earns a Moderate Buy consensus rating based on seven Buys, four Holds, and two Sell ratings. Additionally, the average Capital One Financial stock price target of $111.27 puts the upside potential at 11.8%.

U.S. Bancorp also has a Moderate Buy consensus rating based on nine Buys, eight Holds, and zero Sell ratings. The average U.S. Bancorp stock price target of $45.09 implies upside potential of 46.35%.

Lastly, Bank of New York Mellon stock earns a Moderate Buy consensus rating based on six Buys, five Holds, and one Sell rating. The average Bank of New York Mellon stock price target of $52.73 suggests upside potential of 28.13%.

Conclusion

In my opinion, as long as you hold the view that the anticipated recession will be mild, it makes sense to hold Capital One Financial relative to the other two banks, as it boasts a stronger capital position, lower valuation, and potentially similar profitability when the provision build subsides.