The stock market has been seemingly all about technology and AI recently, and it’s not hard to imagine why, with the Nasdaq 100 (NDX) up over 20% this year. Still, investors shouldn’t neglect other important sectors (like financials) once this tech-led rally begins to broaden out. The Financial Select Sector SPDR Fund (NYSEARCA:XLF) is my favorite gauge of the financial sector. It’s up a relatively lukewarm but still very respectable 9.3% year-to-date. Therefore, perhaps Strong-Buy-rated financial stocks like BRK.B, MA, and NU are worth checking out if you seek a mix of momentum and value.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

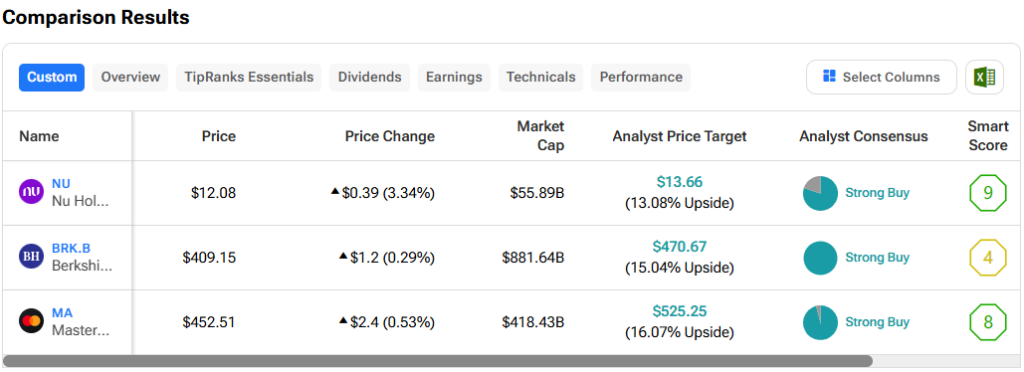

Now, let’s tune into TipRanks’ Comparison Tool to weigh which analyst-praised financial stock is the best bet for the year ahead.

Berkshire Hathaway (NYSE:BRK.B)

Berkshire Hathaway is the legendary conglomerate run by the Oracle of Omaha, Warren Buffett. At the age of 93, Buffett continues to play a pivotal role in Berkshire’s future. Though a succession plan has been in place for many years now, Buffett seems more than willing to keep heading into the office for as long as he can. With Berkshire stock consolidating in the $405-410 range for most of this year, questions linger as to which direction the next big move will be.

Even if the broad market is getting a tad lofty, thanks to technology stocks, I view Berkshire as very reasonably priced (1.54 times price-to-book, right around its five-year average of 1.4x). As Berkshire makes notable buys and sells, I continue to be bullish on the stock for the long haul during the Buffett era and after it.

The most notable of Berkshire’s recent moves was the 13% trimming of its Apple (NASDAQ:AAPL) stake. This isn’t the first time Berkshire pared gains in Apple, but it has to be one of the worst-timed exits, with AAPL stock now in breakout mode, just shy of new all-time highs. At this juncture, Apple is all aboard the AI train. And though Berkshire lightened up, it’s still very much on the Apple train that keeps chugging along.

Apart from Apple, Berkshire reduced its stake in Chinese EV maker BYD (OTCMKTS:BYDDY) by about 1.3 million shares as of June. On the buy side, Berkshire has been adding to Occidental Petroleum (NYSE:OXY), with a stake that’s reportedly grown to over $15 billion.

Clearly, Berkshire is fine taking profits in winners while buying the big dips in some of the out-of-favor plays, like OXY stock. Recent activity represents Berkshire’s stock investing strategy in a nutshell. Buy and hold value, and hold until Mr. Market realizes that value.

What Is the Price Target of BRK.B Stock?

BRK.B stock is a Strong Buy, according to analysts, with three unanimous Buys assigned in the past three months. The average BRK.B stock price target of $470.67 implies 15% upside potential.

Mastercard (NYSE:MA)

Who says you need to sacrifice growth by rotating out of tech and into financials? Credit card firm Mastercard is arguably one of the most innovative and tech-savvy financial firms on the market. There’s a reason why MA stock is a favorite among hedge funds. With shares cooling since peaking in late March, investors may have a chance to snag shares at a discount while they’re off close to 8% from highs. After a mild dip, I’m even more bullish on the name.

AI may not come to mind when you think of Mastercard or any other credit card firm. However, the credit card scene is leveraging AI to fight fraudulent transactions.

Back in May, the company noted that its new AI-driven fraud-protection software can spot “compromised” cards even before fraudsters have a chance to swipe. Indeed, that’s a thing of science fiction and something that should give cardholders even more peace of mind.

At 35.8 times trailing price-to-earnings (P/E), MA stock is on the cheap end of its past-year historical range. For a credit card firm, Mastercard isn’t a “cheap” play in a traditional sense. With top-of-the-line AI fraud protection in place, though, it doesn’t deserve to be anything less than a premium price tag.

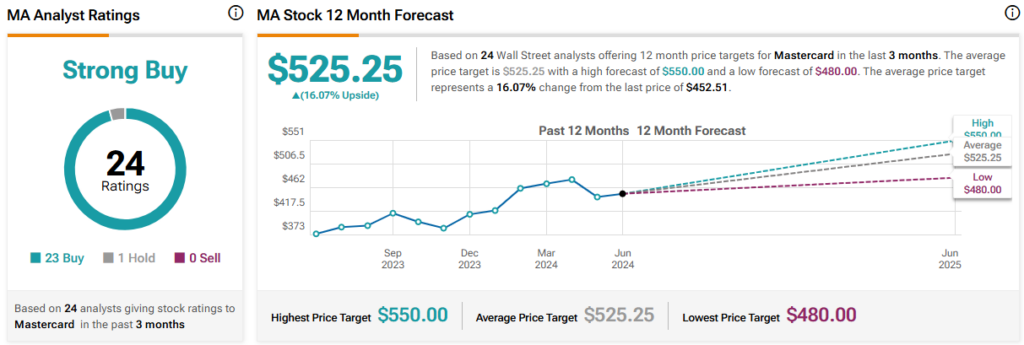

What Is the Price Target of MA Stock?

MA stock is a Strong Buy, according to analysts, with 23 Buys and one Hold assigned in the past three months. The average MA stock price target of $525.25 implies 16.1% upside potential.

Nu Holdings (NYSE:NU)

Nu Holdings is a Brazil-based fintech that Berkshire had bought in the past. The stock has been a profound winner over the past two years, blasting off more than 202% in the timespan.

With the company boasting more than 100 million customers in Latin America, the digital banking firm has huge momentum at its back. And it’s probably not going to slow anytime soon as the firm makes the most of its enviable position in a hyper-growth emerging market. Despite the hot run on the back of a strong first quarter, I have to stay bullish on NU stock going into the second half of the year.

Looking ahead, CEO David Velez is looking forward to “solving people’s needs with true innovation.” As Nu Holdings gives users quick and easy access to a wide range of financial services (banking, investing, and borrowing), it’s hard to imagine growth halting anytime soon.

At the end of the day, Nu is a market leader that’s bringing modern financial services to the masses. Indeed, 100 million may be just the start as Nu looks to capture a bigger chunk of the fast-rising Latin American market.

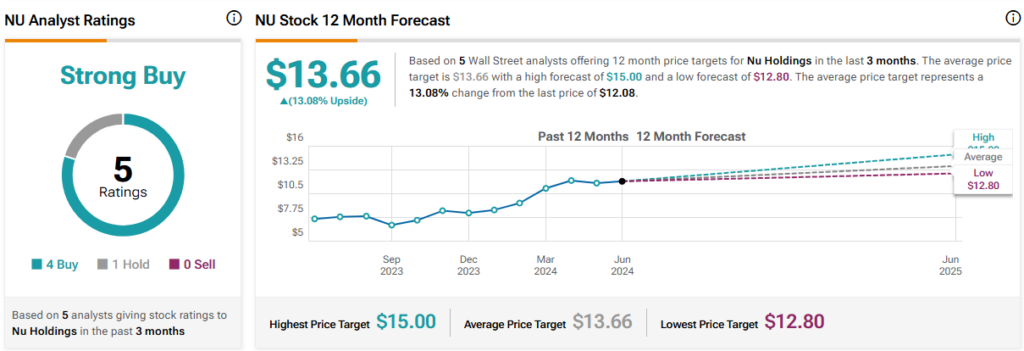

What Is the Price Target of NU Stock?

NU stock is a Strong Buy, according to analysts, with four Buys and one Hold assigned in the past three months. The average NU stock price target of $13.66 implies 13.1% upside potential.

The Takeaway

The financial sector is home to some fantastic growth plays, many of which are tapping into impressive technologies. Whether we’re talking about Mastercard’s huge strides in fraud prevention or Nu’s push to bring Latin America to the cutting edge of digital banking, some financial stocks look very intriguing.

At writing, analysts see Mastercard stock as having the most room to run from here, with 16.1% in implied upside for the year ahead.