British American Tobacco remains attractive to income investors, offering a strong 6.6% yield, a low valuation, and growing momentum in next-gen products, despite regulatory headwinds.

British American Tobacco (BTI) Leverages 6.1% Yield to Extend Rally

Story Highlights

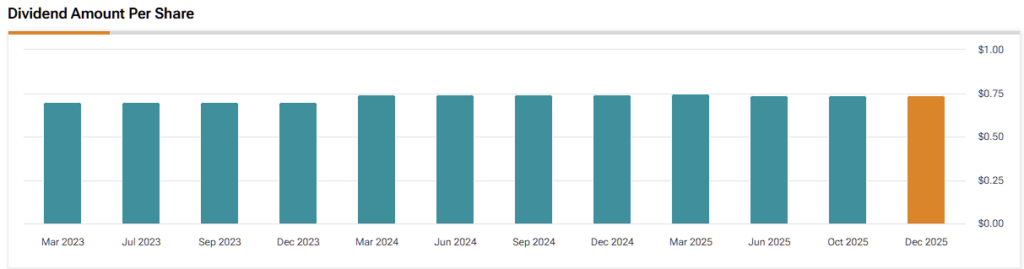

Over the past year, British American Tobacco (BTI) has gained 51%, driven in part by investor demand for reliable dividend income amid growing expectations of lower interest rates. High-quality dividend payers, such as BTI, which has boasted 29 consecutive years of dividend increases, tend to perform well in such environments.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While the yield has decreased from a peak of 10% to 6.1%, primarily due to the share price rally, BTI’s strong fundamentals suggest further upside potential. Here’s a closer look at what continues to support the company’s momentum and why I remain bullish on the tobacco giant.

Combustibles Represent Steady Cash Cow for BTI

British American Tobacco’s core combustible business, which includes brands like Camel and Lucky Strike, remains a powerhouse. In this month’s 2025 half-year pre-close trading update, management reported a return to growth in the U.S., a critical market, driven by stronger delivery in combustibles. Organic sales for combustibles nudged up 0.1% at constant rates, with a 5.3% price/mix improvement offsetting a 5.2% volume decline. This resilience is a remarkable achievement for a “struggling” tobacco major, as combustibles still account for over 80% of revenue.

Despite global smoking rates dropping at a rate of mid-single digits annually, BTI’s ability to raise prices and maintain margins showcases its pricing power. Additionally, CEO Tadeu Marroco highlighted cost savings of £402 million in 2024, which will help counter inflationary pressures, such as higher leaf prices, making the strong sales seem all the more impressive. Overall, with the U.S. market showing signs of stabilization, combustibles continue to fund BTI’s transformation while delivering steady cash flows for dividends and buybacks.

Smokeless Growth Accelerates to BTI’s Advantage

BTI’s pivot to “new categories”, including vaping, heated tobacco, and oral nicotine products, is also gaining traction. The latest trading update highlighted an 8.9% organic revenue jump in these segments, with Velo Plus nicotine pouches leading the charge in the U.S. Management noted strong customer retention for Velo, which is closing the gap with Philip Morris’s Zyn. Meanwhile, Glo Hilo, an upgraded heated tobacco device, is expanding into new markets, boosting competitiveness.

Though new categories contribute less than 15% of revenue compared to Philip Morris’s (PM) 40%, BTI’s innovation is paying off, in my view. In fact, the company raised its 2025 revenue growth guidance to 1%-2% from 1%, citing better-than-expected first-half performance in modern oral products. The CEO’s confidence in achieving 3-5% revenue growth by 2026 suggests that BTI’s smokeless portfolio is no longer a side hustle, or a bet, as many would argue, but a meaningful growth driver.

And while it is fair to criticize that vaping volumes dipped 9% in the first half, Vuse remains a U.S. market leader. BTI’s focus on premiumization and innovation, such as synthetic nicotine in Velo Plus, positions it to capture market share in a rapidly evolving nicotine market. This segment’s momentum suggests BTI is building a future beyond cigarettes.

BTI Remains a Bargain Despite Its Recent Rally

After a 57% rally, one might expect British American Tobacco (BTI) to look expensive—but it still trades at a forward P/E just under 11 while the sector median hovers at ~16, an attractive valuation even for a so-called “sin” stock. On a trailing twelve-month basis, BTI’s P/E ratio is currently 28, while the sector average is 22, indicating that although the market may view BTI as slightly overvalued today, the next twelve months appear promising.

Moreover, the company continues to generate strong cash flow and has raised its dividend for 29 consecutive years. While the yield has declined from around 10% to 6.6%, this is a result of share price appreciation, not a dividend cut. In fact, if interest rates decline as expected, BTI’s dependable yield could draw even more investor interest, potentially driving the stock higher.

The company’s $1 billion share buyback last year, while modest relative to its $108 billion market cap, enhances the total shareholder return. Factoring in the buyback, the blended yield rises to about 7.5%, offering even more appeal. Altogether, BTI’s low valuation, strong income profile, and capital return strategy provide a compelling case for continued upside—with a margin of safety—even as the stock pushes toward new 52-week highs.

What is the Price Target for BTI?

Wall Street’s stance on British American Tobacco is bearish, although with only a handful of analysts covering the stock. As things stand, BTI carries a Moderate Sell consensus based on one Sell rating in the past three months. BTI’s average 12-month price target of $35.50 implies a potential downside of about 28%, suggesting that many analysts believe the stock may have already priced in much of its recent strength.

BTI Offers Yield, Value, and Further Growth Potential

Despite its 57% rally, BTI remains a strong investment option. With a 6.1% dividend yield, a valuation of less than 11x forward earnings, and solid cash flow supporting both dividends and share buybacks, BTI stands out among income-focused opportunities.

Its core combustibles business remains resilient, while growth in smokeless products, such as Velo, signals a forward-looking pivot. While regulatory headwinds and the transition to next-gen products pose challenges, BTI’s global footprint and disciplined capital strategy position it well for investors seeking reliable yield and potential upside, especially in a rate-cutting environment.

1