As the industry leader in financial close solutions, BlackLine Inc. (BL) barely missed a step throughout the 2020 pandemic, as companies continued along their path toward digital transformation. Traditionally, companies have resorted to labor-intensive manual techniques such as accounting reconciliation by use of spreadsheets. However, BlackLine has a solution which involves the streamlining and automation of the financial controller’s duties, providing compatibility with more than 30 different ERP systems, including SAP (SAP), Workday (WDAY), and Oracle (ORCL).

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

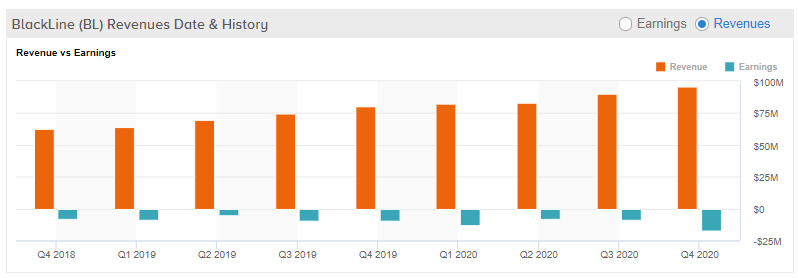

BlackLine has more than 3,400 companies and 300,000 accountants using the Software-as-a-Service (SaaS) platform, with it growing revenue by 22% in 2020 despite the challenging economic environment. The key financial metrics remain strong with the Dollar-Based Revenue Renewal Rate at 97% and Dollar-Based Net Revenue Retention Rate at 107%.

Stock Chart

While the company’s financial performance has been strong, the stock price has been declining recently, caught up in the technology sector downdraft. The stock has fallen from a high of $150 in February to around $110.

Guidance For 2021

Contributing to the drop was the conservative guidance provided for 2021 during the Q4 2020 earnings call, with annual revenue growth forecasted to be 18%, below the company’s historical growth rate. More importantly, management has warned that margins will be under pressure, to the tune of two to three points, due to increased R&D expenditure, assimilating a recent acquisition, and increased T&A during the second half of the year as the pandemic winds down.

Q4 2020 earnings fell year-over-year, but this was expected, as BlackLine made its most significant acquisition in the company’s history. BlackLine acquired Accounts Receivable Automation specialist Rimilia.

Expansion Into Adjacent Markets

The acquisition of Rimilia extends BlackLine’s product line into an adjacent market niche, Accounts Receivables Automation. Rimilia is based in the UK and has a foothold in Europe, whereas BlackLine is USA-centric. The merger will open up new markets for both companies and provide cross-selling opportunities.

In addition, BlackLine recently announced a $1 billion capital raise via a convertible debt offering. Although the company has not declared its intentions for the new capital, don’t be surprised if it is a precursor to more M&A activity. In the words of BlackLine management, “History has shown that companies who invest in a downturn are often better equipped to respond to demand when the economy recovers.”

Wall Street’s Take

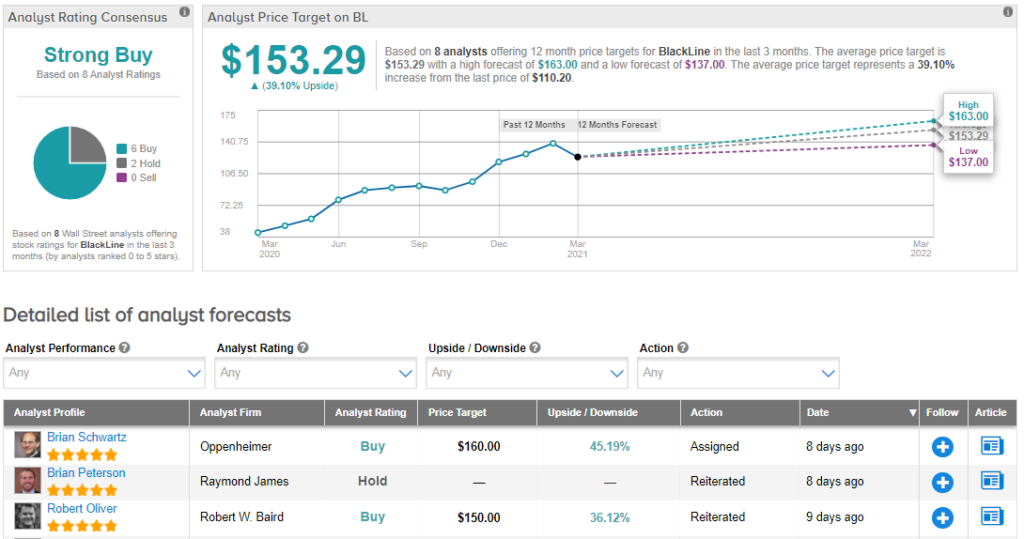

From Wall Street analysts, BlackLine earns a Strong Buy consensus rating, based on 6 Buys and 2 Holds. Additionally, the average analyst price target of $153.29 puts the upside potential at 39%. (See BlackLine stock analysis on TipRanks)

Summary And Conclusions

BlackLine is the industry leader in financial close solutions, an area that has not been significantly affected by the pandemic as companies embraced the concept of performing financial close operations remotely. The company’s financial solutions are unique and have minimal competition apart for Oracle, and the total addressable market is large, estimated at $28 billion.

The recent acquisition of Rimilia will likely be very synergistic, with new customers and cross-sell opportunities for both market niches.

It is quite likely that 2021 will be a year of strong revenue growth in spite of management’s conservative guidance, but the company will also experience compressed margins due to the integration of Rimilia, increased R&D activities, and T&A as the pandemic disappears. The currently depressed stock price may reflect an attractive entry point.

Disclosure: On the date of publication, Steve Auger did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.