Shares of travel companies Booking Holdings (NASDAQ:BKNG) and Expedia (NASDAQ:EXPE) have soared significantly this year, thanks to robust travel demand. With the generative AI boom, both companies are embracing AI with open arms to enhance user experiences and streamline operations, thereby boosting their revenue and profits. I believe that AI, along with a surge in travel demand, could be a huge catalyst for both, leaving me bullish on BKNG and EXPE for the long term.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

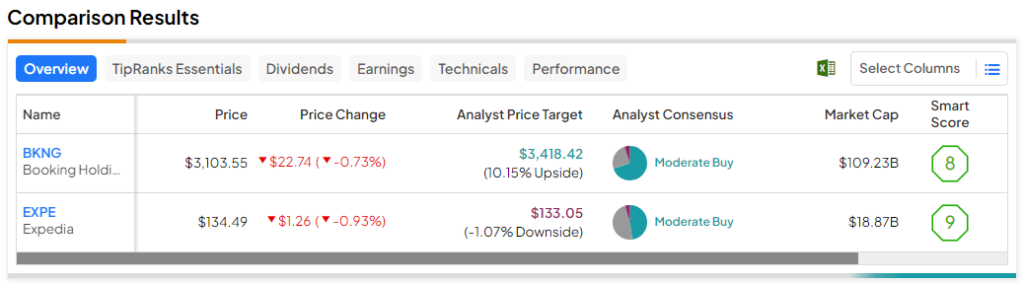

Here, we have used TipRanks’ stock comparison tool to check how Wall Street views both travel stocks. Both stocks have risen by over 50% YTD compared to the S&P 500’s (SPX) gain of 18%. Furthermore, TipRanks has assigned BKNG a Smart Score of 8 and Expedia a score of 9 out of 10, indicating a high probability of both stocks outperforming the broader market.

Booking Holdings (NASDAQ:BKNG)

Booking Holdings has always been my go-to travel platform for planning my travels. Its user-friendly interface and its extensive inventory of properties and travel-related services have made it a popular choice among travelers worldwide.

Moreover, it boasts a variety of brands, including Booking.com, Priceline, Kayak, Agoda, Rentalcars.com, and OpenTable, each catering to different facets of the travel industry.

For the third quarter, Booking reported some impressive numbers, driven by strong travel demand. Gross travel bookings were up 24% year-over-year to $39.8 billion. Total revenue jumped 21% to $7.34 billion, surpassing consensus estimates of $7.26 billion. Earnings per share (EPS) also grew 36% to $72.32, smashing the estimate of $67.96.

Going into 2024, CEO Glenn Fogel anticipates that people will continue to prioritize travel over other discretionary spending, as they did in 2023. Booking is committed to integrating generative AI into its offerings to strengthen the business over the long term.

Furthermore, management is encouraged by the early results of its new AI platforms: Priceline’s generative AI travel assistant, named Penny, and Booking.com’s AI Trip Planner.

With the hope that geopolitical tensions in the Middle East will die down, the company expects gross bookings to rise 5% year-over-year in Q4 and 20% year-over-year in 2023. Meanwhile, analysts predict a 24.5% increase in revenue to $21.3 billion in 2023 and a 10.7% rise to $23.6 billion in 2024. Also, earnings are expected to increase by 49.4% to $149.18 per share for 2023.

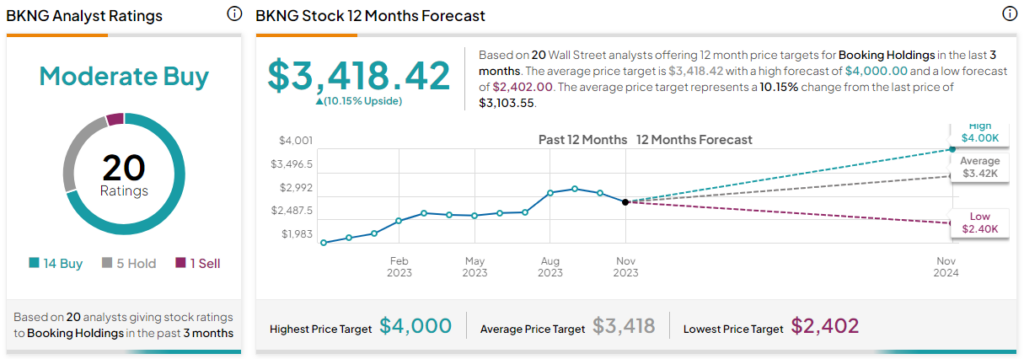

Is BKNG a Buy, According to Analysts?

Turning to Wall Street, TipRanks rates BKNG as a Moderate Buy now. Out of the 20 analysts covering the stock in the past three months, 14 rate it a Buy, five say it’s a Hold, and one rates it a Sell. The average BKNG stock price target of $3,418.42 implies 10.15% upside potential.

Booking stock is priced at 17.9 times forward earnings. Based on its 2024 projected earnings growth rate of 17.6%, Booking seems like a fairly valued stock.

At this projected growth rate, BKNG is likely to reach UBS’ Street-high price target of $4,000. The firm believes Booking’s risk/reward profile is solid, assigning it a Buy rating. UBS expects Booking’s EPS to increase by 25% in 2024 and 20% in 2025, respectively.

Expedia (NASDAQ:EXPE)

A stellar third quarter is perhaps the reason why Expedia’s stock is up 55% year-to-date, having surpassed its mean price target of $133.05. Expedia’s efforts to capitalize on the increased travel demand this year despite macroeconomic headwinds are reflected in its strong Q3 performance, leaving me optimistic about Expedia’s future.

For Q3, Expedia surpassed analysts’ estimates of $4.96 on the bottom line, with earnings per share of $5.41. Earnings also jumped an impressive 33% from the prior-year quarter. The ongoing spike in travel demand helped gross bookings grow by 7% to $25.7 billion, driving year-over-year total revenue growth of 9% to $3.93 billion.

Management stated that travel demand remained solid in the quarter despite geopolitical tensions in Europe and the Middle East. Expedia remains committed to utilizing AI and machine learning capabilities to drive customer satisfaction and profits.

To tackle the competition in the travel industry, Expedia has been introducing exciting features into its existing platforms, along with new products. It has also launched generative AI-powered tools to aid in travel research.

Following the global launch of the new Vrbo app, Expedia expects an increase in market share from vacation rentals in 2024. It will be fascinating to watch how Vrbo competes with vacation rental leader Airbnb (NASDAQ:ABNB). Looking ahead, management expects double-digit top-line growth with margin expansion in 2023. Meanwhile, analysts predict a massive 41% year-over-year increase in EPS to $9.58, with a 10% increase in revenue to $12.83 billion.

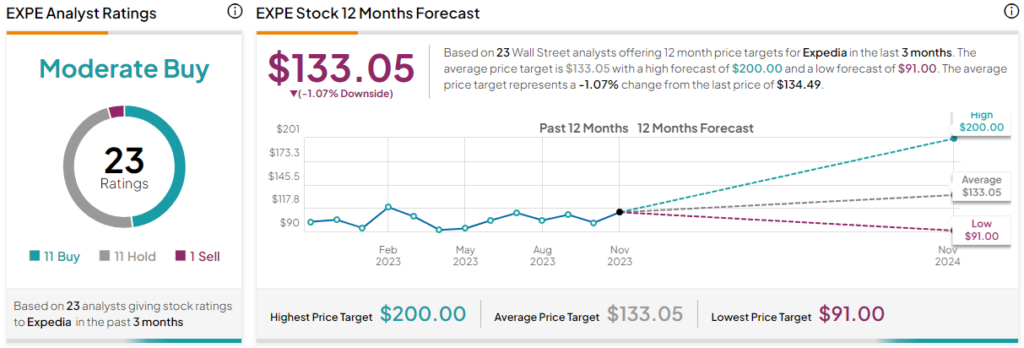

Is EXPE Stock a Buy, According to Analysts?

Overall, Wall Street rates Expedia stock as a Moderate Buy. Out of the 22 analysts covering the stock, 10 rate it a Buy, 11 rate it a Hold, and one rates it a Sell. The average EXPE stock price target is $133.05, which implies downside potential of 1.1%.

Priced at 11 times forward earnings, Expedia is a fairly reasonable travel stock, with a 27.5% projected increase in earnings from 2023 to 2024.

After EXPE’s Q3 earnings, Evercore ISI analyst Mark Mahaney increased the target price for the stock to $200 from $135 with a Buy rating, citing, “EXPE’s revenue growth acceleration is being driven by a series of sustainable company initiatives and key development.”

The Key Takeaway

In a world where travel preferences continue to evolve, both Booking Holdings and Expedia stand poised to lead the charge by leveraging AI to better understand customer preferences. According to Statista, by 2027, the global travel and tourism market could reach $1.02 trillion, growing at a compound annual growth rate of 4.4% from 2023-27.

Hence, I believe that with travel demand augmenting, both travel firms’ knack for innovation, strategic acquisitions, diverse offerings, and quests for customer satisfaction will keep strengthening their fundamentals, bringing the stocks closer to their Street-high target prices by the end of 2024.