Bitcoin (BTC-USD) and other top cryptocurrencies have surged in 2023. The Bitwise Crypto Industry Innovators ETF (NYSEARCA:BITQ) has benefited from this renewed crypto momentum, as the ETF has nearly tripled year-to-date. While it has given its investors great returns this year, those looking to kick the tires now after this gain should be aware of several important factors before making an investment decision.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

What Does the BITQ ETF Do?

Launched in May of 2021, BITQ is an ETF from Bitwise that invests in its underlying Bitwise Crypto Innovators 30 Index. Bitwise’s goal is to give investors direct exposure to the “picks and shovels” companies that are “building out the core infrastructure that lets crypto thrive, including Bitcoin miners, crypto brokerages, and more,” according to Bitwise. The ETF gives investors a pure-play way to invest in these crypto companies, allocating at least 85% of its funds into them and rebalancing on a quarterly basis.

Mind the High Expenses

While BITQ may indeed give investors pure-play exposure to an exciting and fast-growing sector of the economy, one thing that investors should be aware of is BITQ’s conspicuously high expense ratio, which stands out even among other crypto ETFs, which are known for high expenses. With an expense ratio of 0.85%, investors in BITQ will pay $85 in fees on a $10,000 investment.

You may be thinking that this doesn’t sound so bad — but keep in mind that these fees compound over time. After three years, assuming that the fee remains constant and that the fund gains 5% per year going forward, the same investor will have paid $271 in fees, and after five years, they will have paid $471. Over the course of 10 years, this investor will have coughed up a whopping $1,049 in fees, or more than 10% of their initial investment. It’s hard to build up a portfolio when you are sacrificing that much in fees.

Portfolio Composition

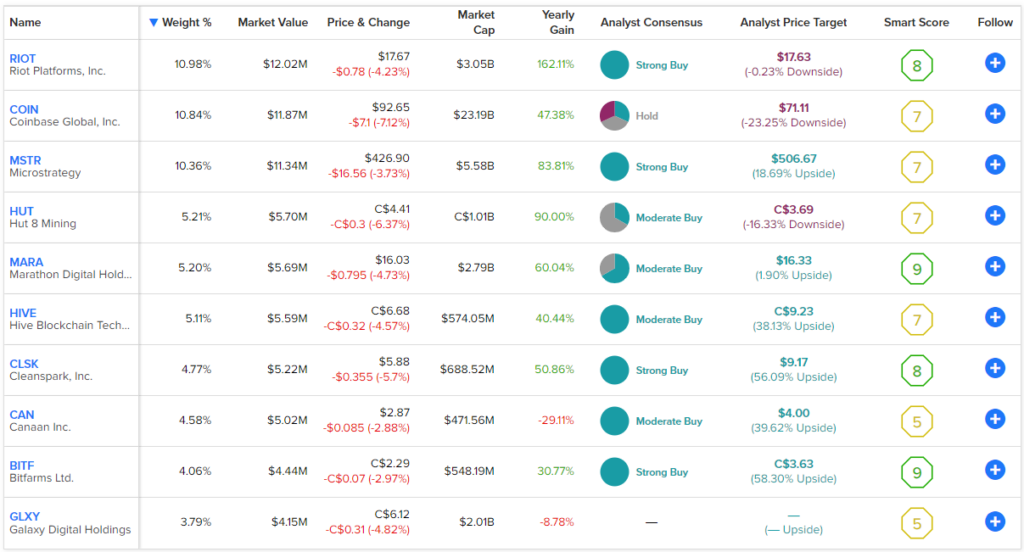

In addition to this high expense ratio, another thing that investors should be aware of is that BITQ isn’t particularly diversified. It holds just 27 stocks, and its top 10 holdings account for 65.6% of its assets. Below, you can take a look at an overview of BITQ’s top 10 holdings using TipRanks’ holdings tool.

In fairness to BITQ, it is a directional bet on the trajectory of the crypto industry, so broad diversification isn’t a top priority as it would be with a broad-market fund. However, it is very concentrated toward its top positions.

Bitcoin miner Riot Platforms (NASDAQ:RIOT), leading publicly-traded crypto brokerage and exchange Coinbase Global (NASDAQ:COIN), and enterprise software company MicroStrategy (NASDAQ:MSTR) — which holds a considerable amount of Bitcoin on its balance sheet — all have weightings of 10% or more.

Furthermore, the fund is dominated by crypto miners like Riot Platforms, Hut 8 Mining (NASDAQ:HUT), and Marathon Digital (NASDAQ:MARA). There is nothing wrong with investing in Bitcoin miners themselves, and these companies can be great bets on the price action of Bitcoin.

Some of these miners feature strong Smart Scores. For example, top holding Riot Platforms, plus Marathon Digital, Cleanspark (NASDAQ:CLSK), and Bitfarms (NASDAQ:BITF), all feature Outperform-equivalent Smart Scores of 8 or above.

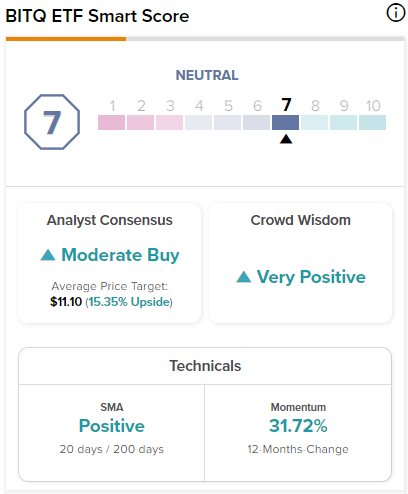

The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating. BITQ has a Neutral ETF Smart Score of 7.

However, miners make up nearly half of BITQ’s assets, and these stocks largely trade in tandem with each other, following the price action of Bitcoin (usually with more pronounced moves to the upside and downside than Bitcoin itself), so owning so many of them isn’t really adding much in the way of differentiation or diversification.

To BITQ’s credit, it does look beyond the typical crypto names like miners plus Coinbase and MicroStrategy for its portfolio. It owns payment network giants Visa (NYSE:V) and Mastercard (NYSE:MA), which have worked to invest in blockchain technology and explore integrating it into their own business models.

BITQ also owns CME Group (NASDAQ:CME) (formerly known as the Chicago Mercantile Exchange), which facilitates the trading of Bitcoin and Ethereum (ETH-USD) futures and options contracts (as well Micro Bitcoin and Micro Ethereum futures and options).

Other interesting picks include Interactive Brokers (NASDAQ:IBKR), which enables clients to buy Bitcoin, Ethereum, Bitcoin Cash (BCH-USD), and Litecoin (LTC-USD) on its platform, as well as Latin America’s e-commerce leader MercadoLibre (NASDAQ:MELI), which has experimented with its own crypto token that can be used on its platform.

Bank of New York Melon (NYSE:BK) is in the ETF as well. It’s one of America’s oldest banks and the world’s largest custodial bank, but it has recently ventured into digital asset custody services for its clientele. Lastly, fintech players like PayPal (NASDAQ:PYPL) and Block (NYSE:SQ) offer plenty of crypto exposure in their own right.

These are all interesting holdings, but unfortunately, they are all relatively minor holdings for BITQ, as all have weightings of 1-2%. I personally would have liked to see BITQ focus more on some of these multifaceted crypto participants that offer different types of exposure to the crypto industry and perhaps pare back on some of the miners.

Is BITQ Stock a Buy, According to Analysts?

Turning to Wall Street, BITQ has a Moderate Buy consensus rating, as 73.36% of analyst ratings are Buys, 21.03% are Holds, and 5.61% are Sells. At $11.10, the average BITQ stock price target implies 15.7% upside potential.

Conclusion

While I agree with BITQ that cryptocurrency is an industry that offers the potential for high growth and high profit margins, its high fees and relative lack of diversification take away from its appeal as an investment opportunity.

Furthermore, while the ETF has put up a monster 196% return year-to-date, investors should note that even after this gain, it was still down 40% since inception as of the end of the June quarter.