We all know the story by now. A once high-flying stock presently sits at a level far below a previously attained peak. And so it is with Bionano (BNGO). The past 12 months have seen shares of the cytogenetics disruptor fall by 73%.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

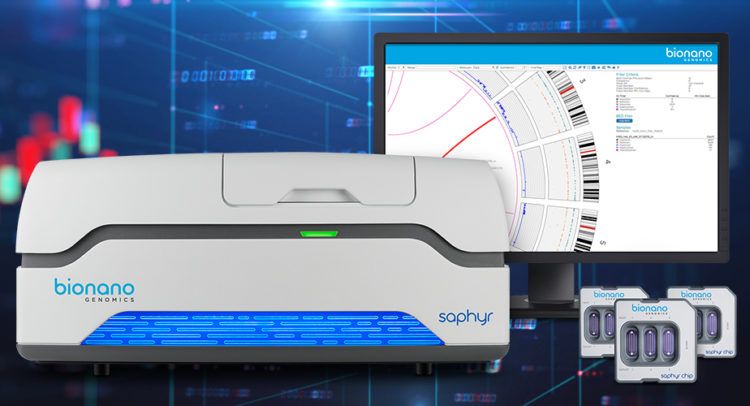

The interesting part about this name is that the rise was dramatic and short; in a little over two months between the end of 2020 and the start of 2021, shares soared by more than 3000%, as investors got excited about the company’s optical genome mapping platform (OGM) Saphyr and its potential to transform the cytogenetics space. Since then, it has been a slow, continuous bleed to the bottom.

However, a broken stock is no way a broken company and following Bionano’s 4Q21 results, Maxim analyst Jason McCarthy sees plenty to back the bull-case.

“Coming out of what we see as a ‘blocking and tackling’ year in 2021, which saw revenue begin to get some traction, 2022 is expected to be an inflection year in terms of the commercial effort for Saphyr,” the analyst said. “This includes a strategic roadmap focused on expanding commercial traction and validation of optical genome mapping (OGM), clearing the path to reimbursement (which would better position Saphyr for clinical use), and using software as a strategic driver.”

There are key events on the horizon too. The hematological malignancy study is anticipated to begin enrollment in 2Q22, while interim data from the prenatal study is expected to get a readout in Q4. That quarter should also see completion of the postnatal study.

Another catalyst could come from the next software update of NxClinical, the software solution for variant analysis which the company acquired last year along when it brought BioDiscovery under the fold. Version 7.0 should launch in 2H22 and will allow for “comprehensive integration” of OGM and NGS (next gen sequencing) in a single analysis.

“This is important as the combination of both datasets is necessary for comprehensive genome interrogation and having a single analysis streamlines the process of simultaneous interpretation of sequencing and structural data,” McCarthy noted.

All in all, McCarthy rates BNGO a Buy while his $6 price target indicates room for 224% growth in the year ahead. (To watch McCarthy’s track record, click here)

Looking at the consensus breakdown, with 2 more recent positive reviews, this stock boasts a Strong Buy consensus rating. The average price target is the same as McCarthy’s. (See Bionano stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.